Accounting plays an integral role in every type of event business. Having your numbers organized, easy to comprehend, and at your fingertips provides you with the tools needed to understand your profits and losses, as well as make crucial business decisions.

QuickBooks first launched their Desktop accounting software in 1998, and their Online bookkeeping product in 2001. Ever since then, more and more event business owners have incorporated it into their bookkeeping process. Over the last two decades, there’s been a large wave of event professionals who’ve made the switch from Desktop to Online. Making this change can feel scary when you’re used to physical documents and processes, but this development has empowered companies to take their finances to the next level by increasing productivity and simplifying complicated processes.

Even with this positive step forward, many event businesses continue to operate based on the “old rules” of accounting — often losing time and money in the process. Here are three myths we’ve busted about business accounting and QuickBooks Online.

Myth #1: If You Have an Accountant, You Don’t Need Software

It may seem like you need either software or an accountant to handle your business’s finances — but in many cases, you actually need both. While accountants handle your income and expense tracking, along with your financial records, they’re limited in the additional benefits they can provide. That’s where software like QuickBooks Online comes into play:

- Save Time: Accounting software simplifies the bookkeeping process, which saves you time in the long run. You and your accountant can both access QuickBooks Online from your own devices, so you don’t need to waste time emailing documents or going back and forth. You’ll boost your time savings even more when you integrate your QuickBooks Online account with your event rental software. With Goodshuffle Pro, you can automatically sync invoices from your software into QuickBooks Online with the same ID number for easy tracking. QuickBooks Online also auto-sorts all business expenses into the right tax categories, which saves time throughout the year and during the tax season. It’s no wonder vendors report reducing the time they spend on accounting tasks by 50%.

- Save Money: Accounting is not a fixed cost. If you’re paying an accountant hourly and they’re not using software, they’re taking exponentially more hours to do work that could’ve been done in a fraction of the time. Without reliable technology, your accountant needs to spend time sifting through receipts and company expense reports. When you use QuickBooks Online, all your information is organized effectively, which stops your accountant from wasting this valuable time. While it may seem counterintuitive, paying for both an accountant and software saves you money in the long term. For the cost of the software, you’re getting hours of time back in both your and your accountant’s days, which equates to lots of saved money in your pocket.

- Add Security: It may sound contradictory, but financial documents like receipts are safer in software than they are when you handle them offline. You can lose a stack of paper — and people often do — but digital files live securely in the cloud. Large, reliable software like QuickBooks has a litany of security features to keep your data safe, secure, and accessible.

Myth #2: QuickBooks Desktop Is Better Than QuickBooks Online

If you started using QuickBooks before the growth of cloud-based software, you may use QuickBooks Desktop rather than QuickBooks Online.

You may feel a certain comfort with it, and you may also like the idea of having all your data stored on one device rather than in the cloud, which is how server-based software works.

However, QuickBooks Online provides several key benefits that make it a better solution — so much so that QuickBooks just discontinued the 2020 version of its Desktop software. Those benefits can be boiled down into three main areas:

- More Features: QuickBooks Online offers several helpful features that save business owners time and money. Unlike QuickBooks Desktop, it provides free guided setup and online support, helping users get (and stay) up to speed faster. It also eliminates the need for the annual repurchase fee to get access to new products and features, since they’re added automatically. While both QuickBooks Online and Desktop can integrate with apps, QuickBooks Online offers over 750 integrations while QuickBooks Desktop has less than 300. In Online, you can also get live bookkeeping support from actual accountants and CPAs, while also benefiting from beautiful personalized invoices and a client portal for quick and easy payments.

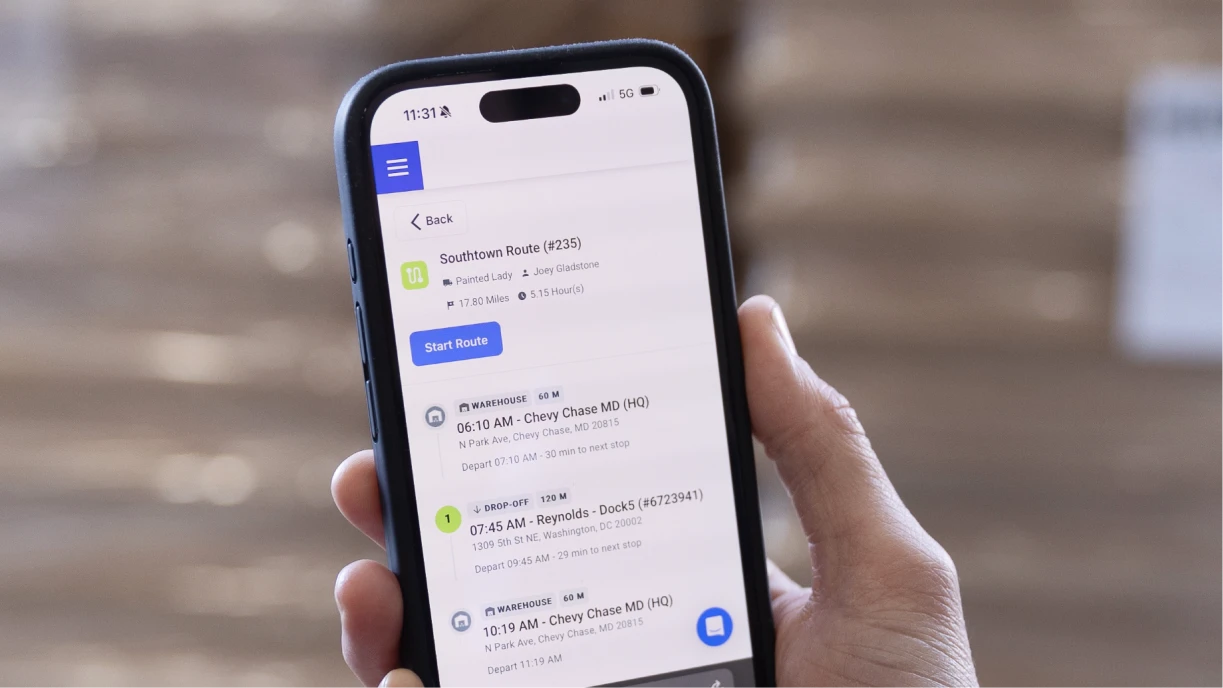

- More Flexibility: QuickBooks Desktop limits you so you have to conduct all your business from one computer. This is extremely restricting, since event professionals are always on the move. With QuickBooks Online, you can conduct business from literally anywhere, using any device, browser, or the QuickBooks Mobile App. Plus, QuickBooks Online allows for a direct line to your account so they can access invoices, revenue reports, and more from within the program.

- Stronger Security: If you’ve downloaded software onto a physical device, and that device gets compromised via a natural disaster or a cyber virus — you’re out of luck. All your files will be lost. Not only does cloud-based software act as protection from physical acts like a floor or fire, it also has high levels of security that protect your sensitive information from viruses and ransomware. QuickBooks Online automatically backs up, encrypts, and restores your data, while logging all activities to make sure you can follow every (digital) paper trail.

Myth #3: You Don’t Need To Integrate QuickBooks With Other Software

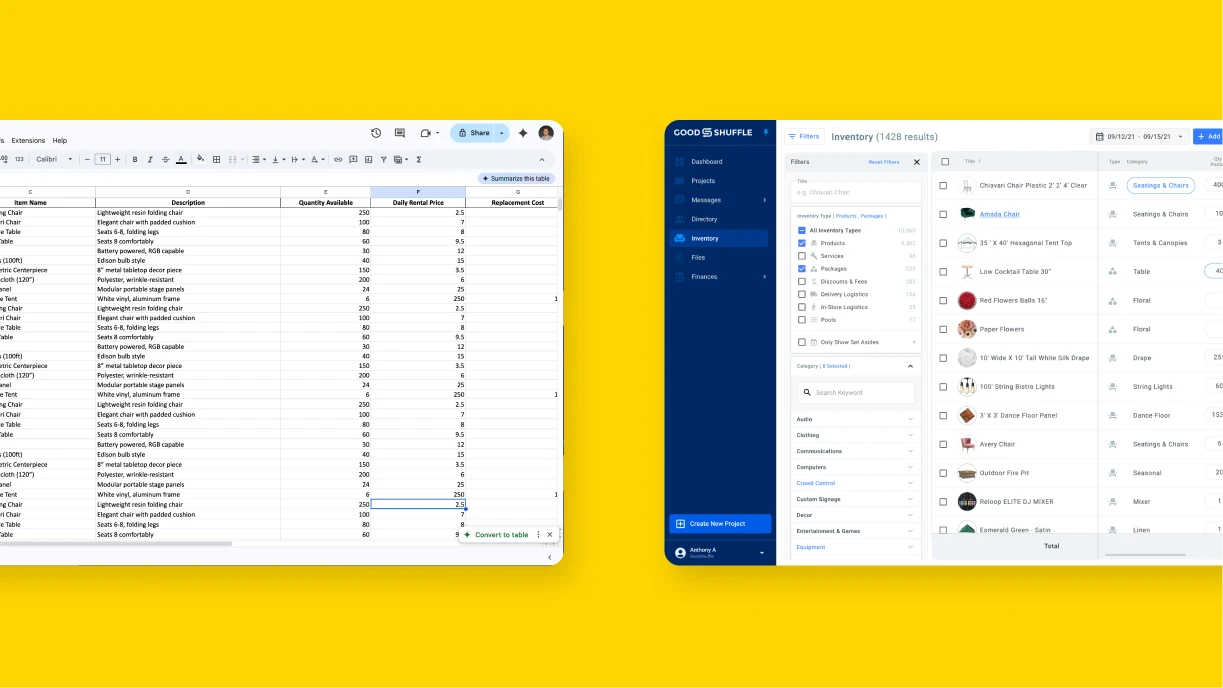

While QuickBooks was built to empower small businesses with their bookkeeping, it wasn’t designed specifically for the events industry. This means that other aspects of event professionals’ success, like quote creation, contract signatures, and inventory management, aren’t automated within the platform. This is where event rental software like Goodshuffle Pro comes in. With Goodshuffle Pro, you can customize what you show or hide on the client quote, create a seamless payment process, and more.

Some of the benefits of integrating include:

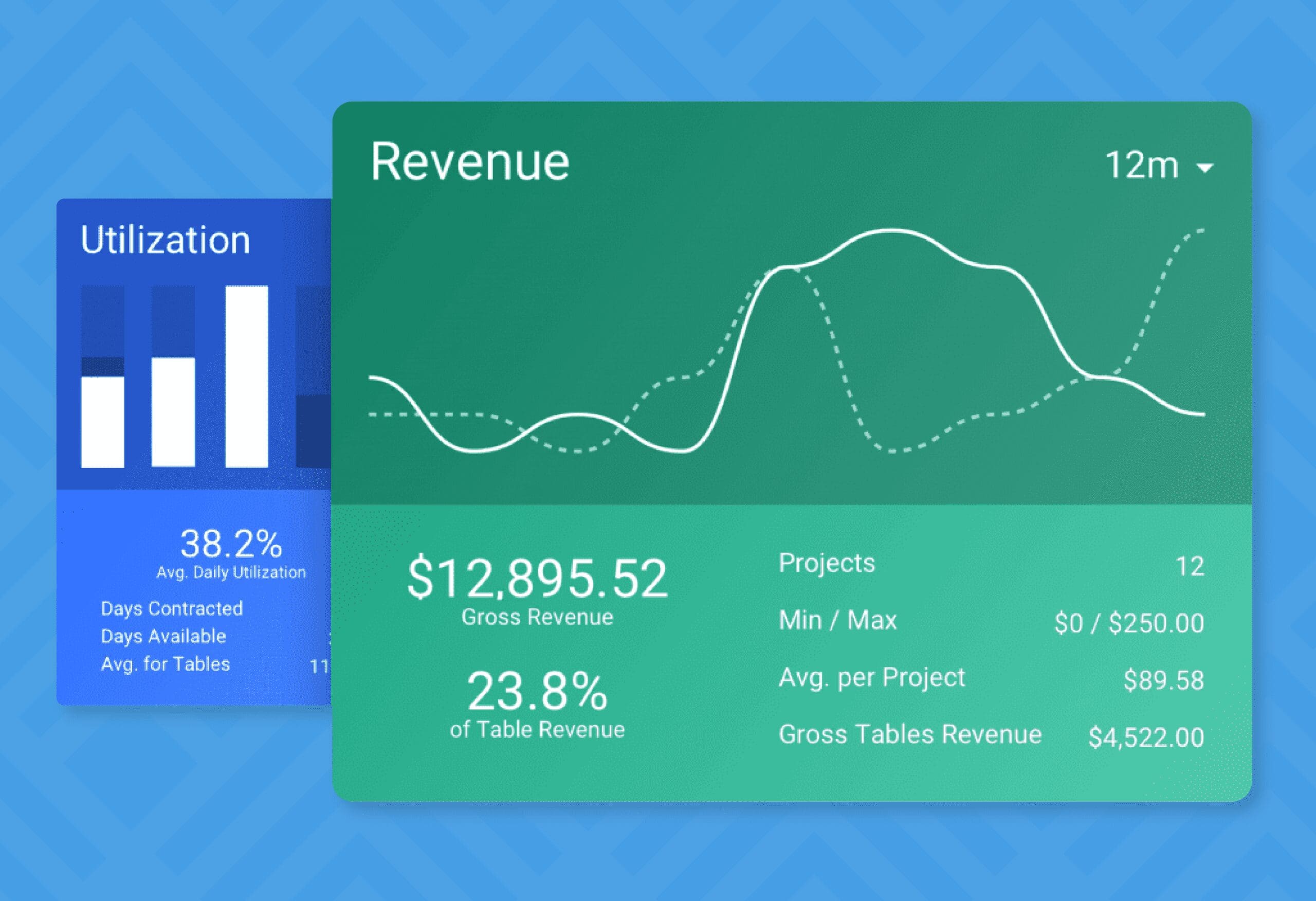

- More Flexibility: Rather than navigating through multiple pages or spreadsheets to keep track of your finances, Goodshuffle Pro’s powerful Financial Hub empowers you to view the information you need in a clear, organized view. Want to drill down into specifics? Customize your reports with flexible filters to answer all your questions.

- More Security: Goodshuffle Pro’s QuickBooks Integration is certified by Intuit, QuickBooks Online’s parent company. We undergo a rigorous security audit and always keep our systems updated to ensure you get top-level security. Additionally, Goodshuffle Pro does not store any data that’s not required to run QuickBooks Online. It is a one-way sync, making it the most secure integration possible.

- Helping Accountants: Goodshuffle Pro’s direct connection to QuickBooks Online means accountants have access to all the documents, financial records, and reports needed to help your company function efficiently. Revenue accounts can be organized by sales, services, fees, and more, providing the seamless organization necessary for accountants to be successful. With important financial information organized and easy to access, your accountant will save time and bill you for fewer hours.

Key Takeaways

Accounting is a dynamic field, which is exactly why software like QuickBooks Online and Goodshuffle Pro are worthwhile steps for continuing your company’s journey. With any new product, various reservations and myths can arise, which is why it’s important to always do your research, compare, and get second opinions. To recap:

Event professionals need both an accountant and software. Despite what you may think, an accountant is not the end-all be-all. Software is an important tool that can help bookkeeping be the most successful it can be. Software also results in less money spent overall, with your accountant spending less time (therefore less of your money) organizing the finances that QuickBooks Online could easily present.

QuickBooks Online has more benefits for business owners than QuickBooks Desktop does. While it is tempting to think that the Desktop version is more secure and efficient, we have learned that cloud-based software and QuickBooks Online is not only more secure but provides flexibility and countless features that the Desktop version lacks.

While QuickBooks Online powers your bookkeeping, the rest of your business needs automation, too. If you want to provide a more seamless connection between your finances, your website, and your actual business, it is highly recommended that you integrate with software like Goodshuffle Pro. This ensures that you are organizing your business in the most productive way possible.