Your inventory should earn its keep — here’s how to make sure it does.

Hi y’all,

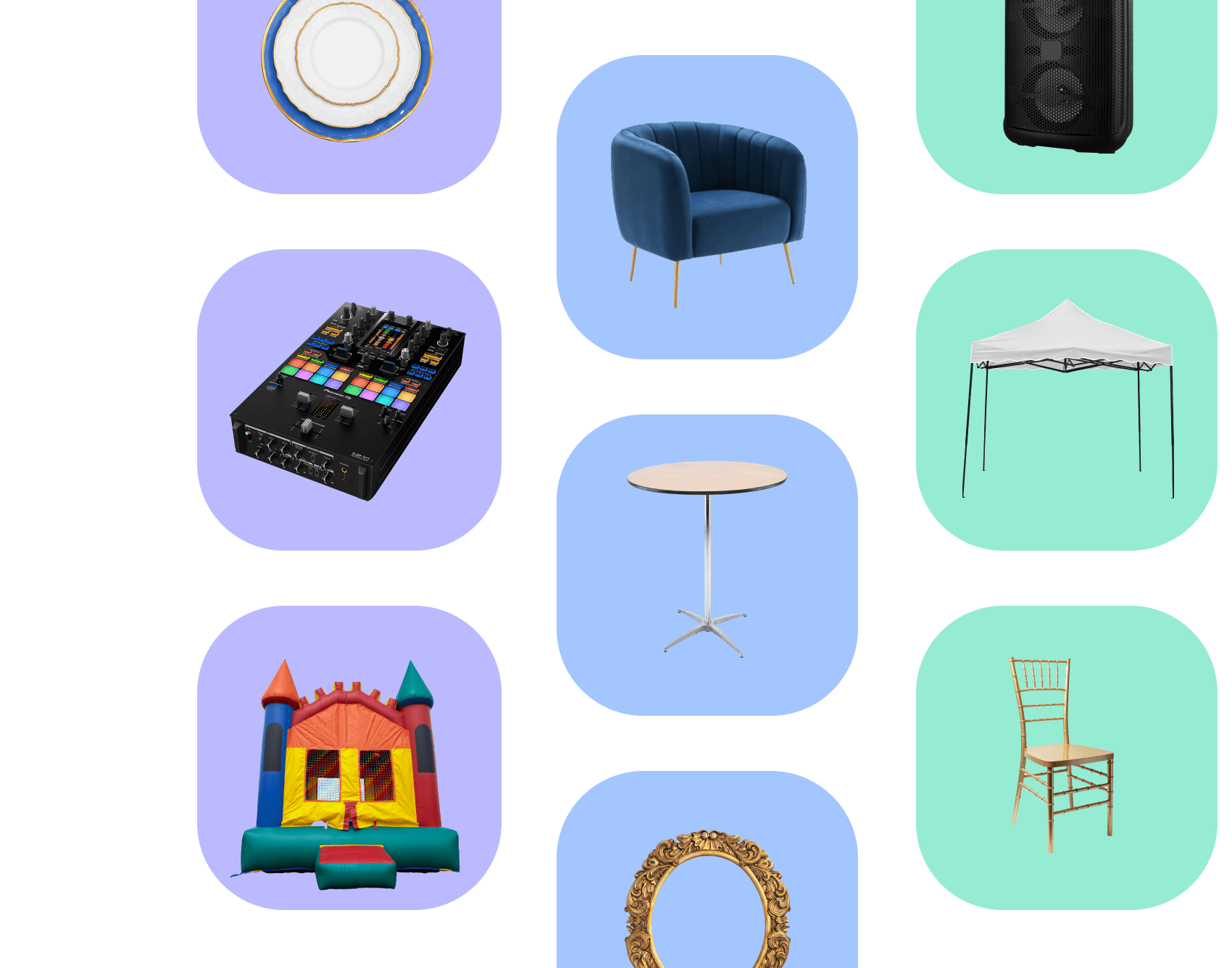

Your inventory items are like tenants in an apartment building, and they should be earning their keep. Both on your shelves and what it takes to maintain those pieces.

You might have that gorgeous lounge set that speaks to your soul but hasn’t rented in six months. Or those circular bars that fly off the shelves but cost a fortune in refinishing between events. But if you don’t have a clear picture of what it actually costs to house and maintain your inventory, you’re flying blind.

This busy season, get serious about tracking the real numbers. The goal isn’t to become an accounting wizard overnight. Walk, jog, run with this stuff. If you’ve never tracked these costs before, start general this busy season. Get maybe 20% clearer on your numbers than you were last year. Don’t try to solve everything at once — you’re already going to be busy enough without making your life unnecessarily complicated.

But before we roll up our sleeves and talk about how to do this, know that in the 6+ years I’ve been at Goodshuffle, I’ve seen approximately 5,324 different ways companies go about tracking their expenses.

It all depends on the size of your business, how long you’ve been in business, and how granular the information you track is.

I know that Goodshuffle Pro users reading this will be like, “how come this isn’t just built right into Goodshuffle Pro,” and the short answer is “it’s complex and if we set it up the way you think ‘just makes sense’, I guarantee 47 other business owners will have different feedback.”

What I do recommend is leveraging our QuickBooks integration since it will enable you to track expenses in the accounting software per job or by inventory category, which is awesome for about 99% of the businesses we work with. The other 1%, y’all do things very particularly.

Start with the most direct costs and then work your way out from there. If you restain your wood folding chairs, for example, then attribute the cost of the stain and other supplies against your revenue for chairs. From there, you can broaden your expenses: track the labor hours for those items. And even broader would be attributing a certain portion of your overhead to storing those chairs (if you want to get VERY precise with the formula, consider the % of warehouse space chairs take up in your storage facility and attribute % of your leasing/taxes/overhead cost toward that category of rental item).

Even with that advice, I’m sure readers are doing it a different way, so the even better advice is to network with other vendors in your market or at your stage of growth and exchange advice. I’ve also been kicking around the idea of coordinating ‘braindates’ between rental pros so if that is something you’re interested in, reply to this email and I can start connecting folks.

If you’re a Goodshuffle Pro user (or interested in using Goodshuffle Pro to track your expenses), reach out to our team of experts to see what kind of data you can leverage in our platform and through our QuickBooks integration to give you visibility into your numbers. The flexibility is there to track expenses in a multitude of ways, and our team is always happy to help you figure it out.

If you create a plan today, by the end of busy season, you’ll know which pieces are actually generating real revenue for you and which ones are just taking up valuable real estate. Yes, even that piece you’re emotionally attached to.

Your inventory should work as hard as you do. If it’s not earning its keep, it’s time for some tough conversations about what stays and what goes. Because at the end of the day, your warehouse isn’t a museum — it’s a business.

See you next Monday,

Mallory Mullen

Goodshuffle