We’ve talked quite a bit about our partnership with Stripe, but who and what is Plaid? And why do we partner with them? As you may already know, Stripe is our trusted payment processor for credit card transactions. To provide a secure connection for ACH payments, however, Goodshuffle Pro and our partners at Stripe trust Plaid to keep financial data secure. We’re not alone; Venmo, American Express, and Coinbase all trust Plaid to create secure digital pathways so their clients can safely link their bank accounts to apps and services. These companies are just a few examples; over 4,000 apps currently use Plaid, and Plaid connects to over 11,000 US financial institutions.

How Plaid Works

Plaid simplifies ACH payments, bank-to-bank payments, and other non-card related transactions for businesses by handling the high-level security processes for you. Plaid confirms account numbers, verifies that client information matches what the bank has on file, and confirms that funds are available to make the payment automatically. Just set up your account (which is super easy in Goodshuffle Pro), and Plaid handles the rest. No more handling client bank account numbers or losing sleep over data security!

Security

Security is a big deal here at Goodshuffle Pro. That’s why we choose partners who maintain high-level security protections for our clients. Plaid utilizes multi-factor authentication, high-tech encryption standards (Advanced Encryption Standard (AES 256) and Transport Layer Security (TLS) measures), 24/7 security monitoring, and even offers a third-party bug bounty program to make sure there are no weaknesses in their security protections. They pay hackers who manage to break through their security, so they can fix any vulnerabilities that may be found.

Multi-factor authentication verifies information on multiple fronts to help avoid fraud and tampering. If information doesn’t line up, transactions are flagged and typically do not go through. Multiple layers of encryption helps prevent hackers from taking information in transit; essentially, the transmitted information is encoded, or translated, into an unrecognizable language, and only the sending and receiving parties have the key to translate that language back into readable information. All of these security layers mean that Plaid puts your information in a digital, guarded vault every time it’s transmitted. It doesn’t get much safer!

Plaid also has a strict data-sharing policy: they don’t do it without your permission. Plaid doesn’t sell your information, and you choose which apps you connect with Plaid.

But why do I have to enter my bank information?

Plaid works by creating a secure tunnel to transfer your banking information to and from another app— but to do so, it must have access to your bank and some personal information. This information will be used to verify your identity and the identity of the other person involved in the transaction. Plus, Plaid was built securely from the ground up to do this; the alternative is to enter your banking information directly into an app or website that may not be equipped to handle that level of sensitive information, which will result in your data being vulnerable to theft. Authorizing Plaid to access your accounts ensures that data is passed directly through Plaid and only Plaid— Goodshuffle Pro won’t even have access to your financial information.

Not only will the information collected be used to keep your financial data safe, collecting certain personal information from you is required by law. In 2001, the US enacted part of the Patriot Act (section 326) that requires all financial institutions to collect specific personal details in an effort to prevent malicious financial activities and identity theft. This law took effect in 2003, and any company that participates in financial transactions— such as credit card processors, banks, and credit unions — are required, by law, to participate. Stripe and Plaid call their versions of this program the “Know Your Customer” obligations and are fulfilling their legal requirements by collecting this information from their customers.

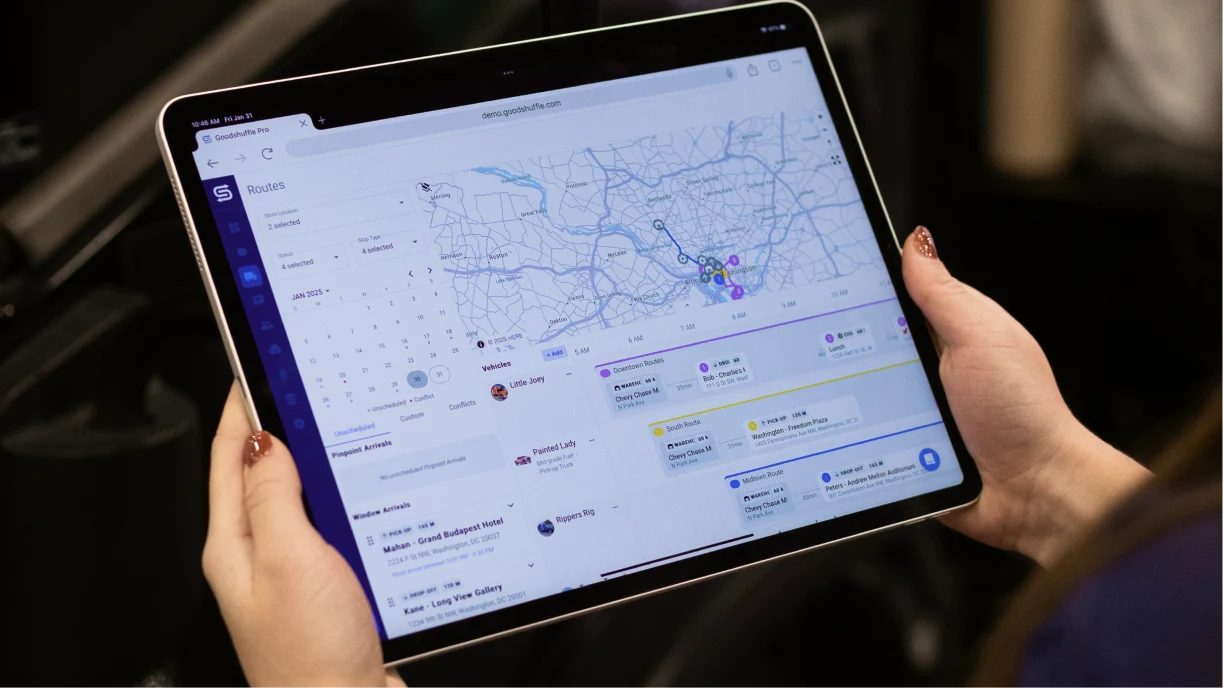

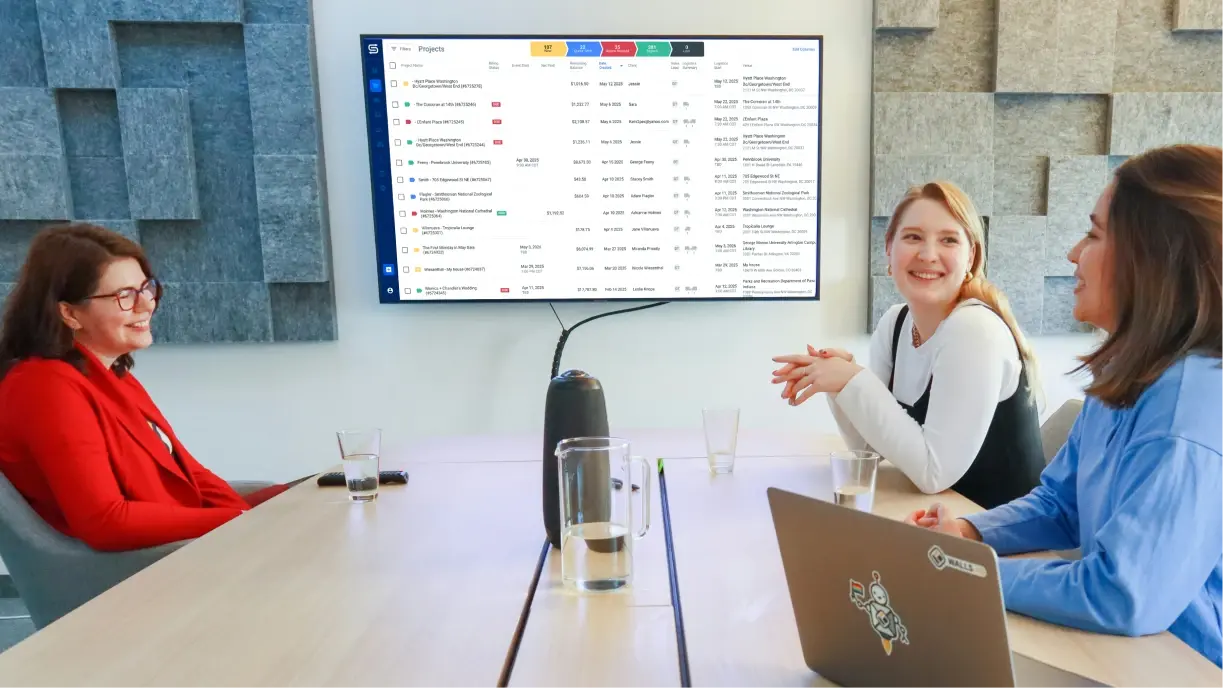

At Goodshuffle Pro, we know that securing financial data is a huge responsibility. That’s why we’ve chosen Stripe and Plaid as our financial processing partners. They have great reputations for keeping financial transactions safe, plus meet third-party and government certification requirements for data security. Stripe and Plaid are also user-friendly and integrate seamlessly into the Goodshuffle Pro experience, without an additional subscription fee. To learn more about the Stripe and Plaid experience within Goodshuffle Pro, book a free demo today!