Table of Contents

-

What Is Tent Rental Insurance?

-

Understanding Risks in Tent Rentals

-

Types of Insurance Coverages

-

How to Determine Your Insurance Needs

-

Cost Considerations

-

Tips for Choosing the Right Insurance Policy

-

Is Tent Rental Insurance Worth It?

-

Additional Risk Management Strategies

-

Is Tent Rental Insurance Worth It?

Being in the tent business isn’t just about delivering beautiful structures and ensuring they’re set up on time. There’s a lot at stake: your business reputation, your clients’ satisfaction, and, importantly, your financial security.

This is where tent rental insurance comes in. This guide explores the essential insurance considerations every tent rental company needs to understand. We’ll dive into why tent rental insurance is essential, what it covers, and how it can ultimately protect your business from unexpected costs and liabilities.

What Is Tent Rental Insurance?

Tent rental insurance protects your business from financial risks associated with property damage, bodily injury claims, and other liabilities. Unlike general liability insurance, tent rental insurance addresses specific protections that apply directly to equipment rentals and event installations. Without adequate coverage, a single accident or weather event could potentially bankrupt your company.

Generally, this insurance can help cover property damage, bodily injury, and even weather-related risks like wind and storms. And since tent collapses can even be deadly, it’s essential coverage for your business.

Most venue contracts also require party rental businesses to carry specific insurance types and coverage limits before allowing them on-site. Insurance serves as both protection for your assets and a necessary credential that opens doors to more business opportunities with prestigious venues and clients.

💼 Learn all about party rental insurance

Understanding Risks in Tent Rentals

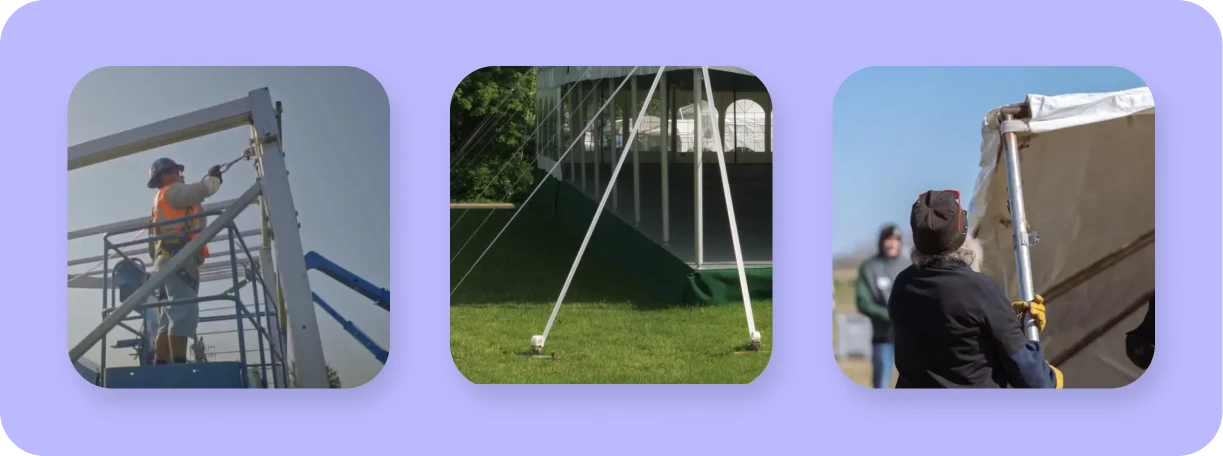

Running a tent rental business requires careful planning and coordination, from choosing the right setup location to installing each tent safely and securely.

Not following manufacturer installation guidelines to a tee can lead to property damage or injuries. Severe weather events, such as high winds or sudden rainstorms, can also damage tents, leading to potentially hefty repair or replacement costs. These are just a couple of the reasons why it’s important to properly anchor your tents, train your staff, and have an emergency exit plan in place.

But even with these precautions, not everything can be controlled. Guests could spill food or beverages, potentially staining or damaging tent fabric, or children might pull on tent structures, causing accidental wear and tear.

Tent rental insurance can mitigate these common risks, helping protect your financial resources when things don’t go as planned.

Types of Insurance Coverages

There are lots of different types of insurance, and additional protection options like damage waivers. But which ones do you actually need? Let’s take a look at them.

General Liability Insurance

This foundational coverage protects your business if someone experiences an injury during setup, the event itself, or dismantling. For example, if a guest trips over a tent stake, liability coverage helps cover medical bills and legal expenses. Most businesses need between $1-2 million in coverage limits to adequately protect their assets from lawsuits. General liability typically includes bodily injury protection, property damage liability, and sometimes advertising injury coverage to protect against claims of libel or slander related to your marketing materials.

Business Owner’s Policy (BOP)

A Business Owner’s Policy (BOP) combines several essential coverage types into one convenient package, typically at a lower cost than purchasing each policy separately. For tent rental companies, a BOP usually includes general liability insurance to protect against third-party injury claims, commercial property coverage for your warehouse and office space, and business interruption insurance to replace income if operations are temporarily halted due to a covered event. This bundled approach simplifies insurance management and often represents significant cost savings. BOPs are particularly well-suited for small to medium-sized tent rental businesses that want comprehensive protection without the complexity of managing multiple separate policies. Most insurers allow customization of BOPs to address the specific risks faced by tent rental operations.

Commercial Property Insurance

Commercial property insurance protects your physical assets — from your tent inventory to warehouse space — against damage or loss from covered perils. For tent rental businesses, this essential coverage pays for repairing or replacing damaged equipment resulting from accidents, mishandling, or severe weather events. Given the high replacement cost of quality tents and their frequent exposure to harsh conditions, this insurance prevents your business from bearing the full financial burden when damage occurs. Policies typically include specific provisions for different damage types, so understanding exactly what’s covered under various scenarios is crucial for adequate protection. The best commercial property policies not only help your business recover quickly after unexpected events but also may cover upgrades required by current building codes.

Commercial Auto Insurance

Since transporting equipment is central to your operations, commercial auto insurance protects your vehicles and employees while on business-related trips. This coverage is particularly important if an accident occurs while delivering or picking up rental equipment. Standard personal auto policies typically exclude business use, leaving you exposed to significant risk without commercial coverage. Most states require certain minimum levels of commercial auto insurance, but rental businesses often need higher limits due to the increased liability associated with transporting large equipment on public roads.

Inland Marine Insurance

This specialized coverage protects your party rental equipment while in transit between your warehouse and event locations. Inland marine insurance fills a critical gap since regular property insurance typically only covers items at your business premises.

Business Interruption Insurance

If severe weather or other covered incidents prevent you from fulfilling rental obligations, this coverage helps replace lost income and covers ongoing business expenses. This protection is particularly valuable during your busy season when cancellations could significantly impact revenue. Business interruption insurance can cover fixed costs like rent and utilities, lost profits based on previous financial records, and sometimes even temporary relocation expenses if your primary location becomes unusable. For seasonal businesses like tent rentals, this coverage can be the difference between surviving a difficult period and closing permanently.

Workers’ Compensation

For businesses with employees handling tent installation and breakdown, workers’ compensation is typically legally required in most states. It covers medical expenses and lost wages if workers are injured on the job, which is common in the physically demanding tent installation process. The heavy lifting, ladder climbing, and equipment handling involved in tent setup create numerous opportunities for workplace injuries. Beyond the legal requirement, workers’ compensation provides peace of mind that your employees will be taken care of if accidents occur, and protects your business from potential lawsuits related to workplace injuries.

Commercial Umbrella Insurance

Commercial umbrella insurance provides additional protection beyond your standard liability policy limits for catastrophic claims. For high-value events or when working with corporate clients, umbrella coverage offers an extra layer of protection above your primary policies. Umbrella insurance activates when your underlying policy limits are exhausted, extending your coverage for a fraction of what it would cost to increase the limits on all your primary policies. This cost-effective solution is ideal for tent rental businesses working with high-profile events where the financial stakes and potential liability are significantly elevated.

Special Event Cancellation Insurance

While typically purchased by event hosts, some tent rental companies offer this as an add-on service. It protects against cancellations due to adverse weather or other unforeseen circumstances. Providing access to cancellation insurance can be a valuable differentiator for your business, demonstrating your commitment to clients’ success and potentially creating an additional revenue stream. This type of insurance becomes increasingly important as climate change makes weather patterns less predictable, causing more event disruptions than in previous decades.

How to Determine Your Insurance Needs

When evaluating insurance needs for your tent rental business, take a comprehensive approach that examines multiple factors. Start by analyzing your operation’s size, including inventory value, number of employees, and typical event scale. Consider your geographic location, as businesses in areas prone to severe weather may need additional coverage. Review your client contracts to identify insurance requirements that venues and customers typically demand. Finally, assess your risk tolerance and financial capacity for deductibles versus premium costs. This holistic evaluation ensures you secure coverage that truly aligns with your specific business situation.

Assess Business Operations

Take a detailed inventory of your assets, including the replacement value of all tents, accessories, and equipment. Document your typical setup and breakdown procedures, identifying potential risk points where injuries or damages commonly occur. Consider your annual revenue and cash flow, as these will help determine appropriate coverage limits and what deductible levels your business can comfortably manage.

Also evaluate your staffing model — whether you use employees or contractors will impact your workers’ compensation requirements. This operational assessment provides the foundation for building an insurance program that addresses your specific business vulnerabilities.

Evaluate Risk Factors

Every tent rental business faces unique risks based on their particular operations. Consider the types of events you typically service — corporate functions often carry different liability concerns than weddings or festivals. Examine your installation practices, as more complex structures generally involve higher risk potential. Weather exposure in your service area significantly impacts risk profiles, with coastal or storm-prone regions facing greater threats.

Your client demographics also matter — high-net-worth clients may be more litigation-prone than others. By systematically assessing these risk factors, you can prioritize coverage types that address your most significant vulnerabilities.

Coverage Limits & Deductibles

Finding the right balance between coverage limits and deductibles is crucial for effective insurance planning. Higher coverage limits provide better protection but increase premium costs. Most tent rental businesses should carry at least $1 million in general liability coverage, with larger operations or those serving corporate clients often requiring $2 million or more. When setting deductibles, consider your financial ability to cover out-of-pocket expenses following a claim. While higher deductibles lower your premiums, they should never exceed what your business can comfortably absorb without disrupting operations. Your insurance agent can help model different scenarios to find the optimal balance for your specific situation.

Cost Considerations

There are a ton of cost considerations associated with choosing insurance, too. Let’s get into them.

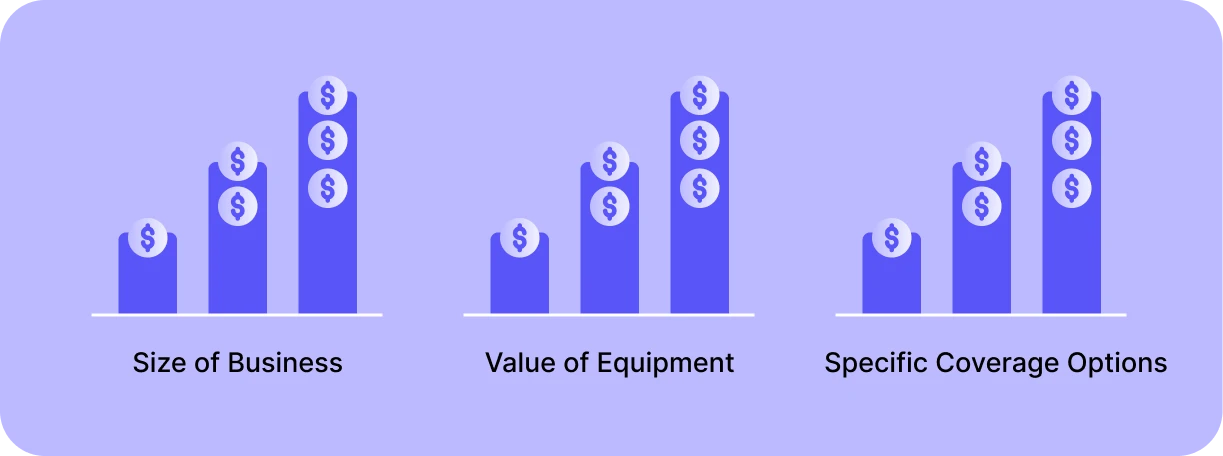

Factors Influencing Insurance Costs

Insurance premiums for tent rental businesses vary based on several key factors. Your claims history significantly impacts rates — businesses with previous claims typically face higher premiums than those with clean records. The value and type of equipment you rent affects costs, with higher-value inventories or specialty structures requiring greater coverage. Your business location plays a major role, as areas prone to severe weather or high crime rates generally face higher premiums. The size of your operation, measured by revenue and employee count, directly correlates with premium costs. Understanding these factors helps you anticipate costs and potentially implement measures to improve your risk profile and secure better rates.

Understanding Premium Calculations

Insurance companies use complex formulas to calculate premiums for tent rental businesses. They start by assessing your base risk level using industry data about similar operations. This baseline is then adjusted according to your specific business characteristics, including years in operation, safety record, and implementation of risk management protocols. Carriers also consider market conditions, with premiums often rising industry-wide after significant claim events affect the insurance market. Deductible choices and coverage limits directly impact your final premium, with higher deductibles typically resulting in lower premiums. Understanding these calculations helps you make informed decisions when comparing quotes from different providers.

Strategies for Cost Optimization

While comprehensive insurance is essential, several approaches can help control costs without sacrificing protection. Implementing robust safety protocols and staff training programs can qualify your business for premium discounts while simultaneously reducing accident risks.

Consider bundling multiple policies with the same provider to access package discounts, often saving 10-15% compared to purchasing separate coverages. Many insurers offer premium reductions for businesses that maintain clean claims records over time, so prioritizing safety can deliver long-term savings. Paying premiums annually rather than monthly typically reduces overall costs. Finally, regularly review your coverage with your insurance agent to ensure you’re not carrying unnecessary protections or outdated limits as your business evolves.

Tips for Choosing the Right Insurance Policy

When selecting a tent rental insurance policy, think about the specific risks your business commonly encounters, from equipment handling to regional weather patterns.

If you’re in Florida, for example, you might need additional coverage for hurricanes and severe storms. But if you’re in Kansas, you might prioritize insurance that covers tornado damage or high winds.

Evaluating these specifics can help you determine which coverages are most important. And always make sure to carefully review the policy details, including exclusions and limits, to prevent surprises when you file a claim.

Working with a reputable provider experienced with event rental businesses can also be beneficial. These providers understand your industry’s nuances and can offer tailored advice. This is a great chance to tap into your local network for recommendations.

Is Tent Rental Insurance Worth It?

Now, you should have an idea of what kind of coverage you need. But who will you get it from?

Research Credible Providers

Finding the right insurance provider begins with identifying companies that specialize in event rental businesses. Look for insurers with specific experience covering tent rental operations, as they’ll better understand your unique risks and coverage needs. Check each provider’s financial strength ratings from independent agencies like A.M. Best, Standard & Poor’s, or Moody’s — these ratings indicate the company’s ability to pay claims, especially after widespread disasters when many claims occur simultaneously.

Industry associations like the American Rental Association maintain lists of recommended insurance providers that understand the rental business. Taking time to research potential providers thoroughly ensures you’ll partner with a company that can properly protect your business when you need it most.

Compare Policy Offerings

When evaluating insurance providers, look beyond just premium costs to compare the actual coverage details. Examine covered perils, policy exclusions, and special conditions that might impact claim eligibility. Pay particular attention to how each policy addresses common tent rental scenarios like wind damage, water accumulation, or injuries during installation. Some policies include valuable additions like equipment replacement at full value rather than depreciated value, or coverage for rented equipment.

Request sample policy documents from each provider to compare specific language, definitions, and claim procedures. This detailed comparison helps ensure you’re making accurate like-for-like comparisons rather than just focusing on headline numbers.

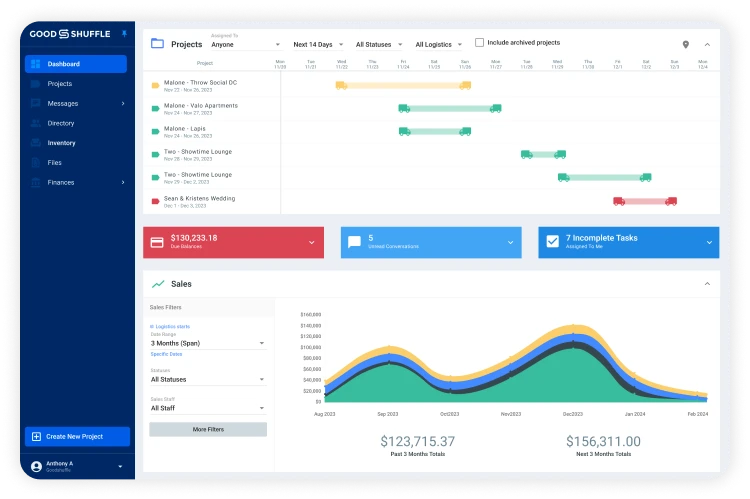

While traditional insurance shopping requires extensive research and comparison, Goodshuffle Pro users benefit from pre-vetted coverage options integrated directly into their business software. This curated approach ensures quality coverage tailored specifically to the event rental industry’s unique needs.

Read Customer Reviews & Testimonials

Beyond examining policy details, investigate how insurance companies actually perform when claims are filed. Seek reviews and testimonials specifically from other event rental businesses to understand how responsive providers are during the claims process. Industry forums and social media groups can provide insights into other tent rental operators’ experiences with different insurers. Pay particular attention to comments about claim processing speed, adjuster knowledge of the tent rental business, and overall satisfaction with settlements. The true value of insurance becomes apparent only when you need to file a claim, so understanding how companies handle this critical moment can be as important as the policy details themselves.

Additional Risk Management Strategies

Being thoroughly covered is great. But there’s plenty you can do to reduce your risk of having to file a claim as well — that’s your first line of defense, after all.

Implement Safety Protocols

Robust safety protocols serve dual purposes — they reduce accident risks while potentially qualifying your business for insurance discounts. Develop comprehensive checklists for tent installation and removal procedures that address common hazards. Create clear guidelines for equipment inspection before and after each use to catch potential problems early. Establish weather monitoring practices with specific action plans for high wind, lightning, or severe storm scenarios. Document all safety procedures in writing and maintain records of their implementation. Well-designed safety protocols not only protect your business financially but also demonstrate professionalism to clients and venues, potentially opening doors to more prestigious events and partnerships.

📝 Why & how to document your processes

Regular Equipment Maintenance

Proactive equipment maintenance significantly reduces both breakdown risks and potential liability claims. Establish a scheduled inspection routine for all tent components, including fabric, poles, stakes, and anchoring systems. Document all maintenance activities, repairs, and part replacements in a centralized system. Train staff to identify early warning signs of equipment wear or damage during normal operations. Consider implementing a rotation system that limits how long particular pieces remain in service before replacement. Beyond preventing accidents and extending equipment life, thorough maintenance records can prove invaluable during claim investigations by demonstrating your commitment to proper equipment care.

Employee Training & Certifications

Investing in comprehensive employee training pays dividends through reduced accidents and improved client satisfaction. Develop structured onboarding programs that thoroughly cover safe installation techniques, equipment handling, and customer interaction protocols. Consider pursuing industry certifications from organizations like Manufacturers and Tent Rental Association (MATRA) or the American Rental Association (ARA). Regular safety drills and refresher training sessions keep best practices top-of-mind for all staff members. Document all training activities and maintain records of employee certifications. Well-trained staff not only reduce your liability exposure but also enhance your company’s reputation for professionalism, potentially commanding premium rates for your services.

Is Tent Rental Insurance Worth It?

Not only does tent rental insurance protect your business financially, but it also allows you to focus on providing stand-out service to your clients. Whether you’re handling a small family gathering or a large corporate event, the right insurance ensures you’re prepared for anything.

Goodshuffle Pro users who enable the Event Insurance integration enjoy added benefits: when clients purchase event insurance through the platform, they are automatically added as “Additional Insured” on the policy.

So now that you’ve read through everything, are you properly insured?