Table of Contents

As an event professional, you’re an expert at managing complex logistics, communicating with multiple clients, and creating unforgettable experiences.

But when tax season arrives, even the most organized event pros can feel overwhelmed. Whether you’re considering DIY filing or hiring a professional, this comprehensive guide will help you navigate tax season with confidence so you can focus on what you do best — putting on exceptional events.

Should You DIY or Hire a Pro? 5 Key Considerations

Tax preparation isn’t one-size-fits-all, especially in the event industry. Let’s talk about what really matters when you’re deciding whether to tackle taxes yourself:

1. Volume & Complexity of Transactions

When your business is handling hundreds of transactions a year, DIY filing gets risky fast. Every rental agreement, equipment purchase, and expense receipt needs tracking, and the more you have, the easier it is to make mistakes.

Think about all those different expense categories too — from maintenance and transportation to marketing and equipment depreciation. Each category has its own tax implications, and missing out on potential deductions means leaving money on the table. And let’s be honest, when you’re juggling multiple events in a weekend, keeping those receipts organized isn’t exactly priority one.

2. Business Structure & Revenue

Your business structure makes a bigger difference than you might think. Running your photo booth side-hustle as a sole proprietor? You might be fine going solo on taxes.

But if you’ve formed an LLC or S-Corp for your full-service event production company, things get trickier. We’ve seen too many event pros miss out on serious tax advantages because they didn’t know what forms to file or deductions to claim for their specific business structure.

And if your revenue is growing — especially if you’re crossing that $100K threshold — you’ll face new tax considerations that weren’t on your radar before.

3. Asset Management & Depreciation

Now for all that gear and inventory you’ve invested in. Those tents, chairs, sound systems, and lighting equipment represent serious money. Tracking depreciation correctly means keeping detailed records of when you bought each item, what you paid, and calculating depreciation schedules.

As your inventory grows, so does this challenge — and the stakes get higher too. A tax pro can manage these critical details systematically.

4. Previous Tax Experiences & Time Constraints

Consider your tax track record and what your time is worth. If you’ve experienced IRS inquiries, unexpected tax bills, or filing errors in previous years, it might be time for professional guidance to prevent future headaches.

And let’s be honest about the opportunity cost. Your time is valuable, and those hours spent deciphering tax forms could be better invested in growing your business. Sometimes, hiring a professional is the most cost-effective decision when you consider the opportunity cost.

5. Comfort with Tax Software

Finally, be honest about your tech savvy and ability to stay current. Modern accounting software helps, but only if you know how to use it effectively.

And with tax laws changing constantly, staying up-to-date requires ongoing attention that many busy event pros simply can’t prioritize. A professional ensures you’re always up-to-date and taking advantage of every available deduction in the current tax climate.

DIY Filing: 7 Essential Preparation Tips

So you’ve decided to brave tax season solo? That’s a great cost-saving move for many event pros, but don’t wing it. Start by digging up all those receipts and statements — I know, not exactly your idea of a fun Saturday night.

Trust us, your future self will thank you for getting organized early. Here’s how to set yourself up for success:

- Gather All Records: Hunt down everything money-related — income statements, receipts, invoices, bank statements, the works. Digital organization tools like receipt scanning apps, cloud storage solutions like Google Drive, and the Financial Hub in Goodshuffle Pro are all sanity savers when you’re trying to make sense of a year’s worth of transactions.

- Categorize Expenses Carefully: Sort your spending into buckets that make sense for your business. Was that mileage for delivering tables to a wedding venue or picking up new inventory? These details matter when you’re looking to maximize deductions. Create clear categories for things like maintenance, transportation, marketing, and equipment depreciation.

- Review Previous Returns: Take a peek at last year’s taxes. You’d be surprised how many event pros repeat the same filing patterns without realizing they’re missing opportunities. That historical perspective can be gold when planning your current strategy.

- Schedule Monthly Reconciliations: A quick monthly check keeps small errors from becoming tax-time nightmares. Block an hour on your calendar each month and stick to it.

- Update Your Tax Software: That notification to update your accounting software? Don’t ignore it. Those updates often include new features that could make your filing easier or reflect tax changes you need to know about.

- Stay Informed About Tax Changes: The tax world doesn’t stand still. Subscribe to updates from the IRS or your local tax authorities. Boring? Maybe. Essential? Absolutely, especially when those changes could mean money in (or out of) your pocket.

- Plan for Estimated Payments: If you’re making quarterly tax payments, be meticulous about setting those funds aside and keeping records. Nothing worse than scrambling for cash when that estimated payment is due. (And if your state and city have taxes, don’t forget to submit those as well.)

Get the Most Out of Working With a Tax Professional

If you’ve decided to partner with a tax pro, don’t just drop off a shoebox of receipts once a year and hope for the best. Think of your accountant as a year-round financial ally, not just a tax-season hero.

Build a Real Relationship, Not Just a Transaction

If you and your accountant only talk once a year in April, you’re doing it wrong. Schedule regular check-ins throughout the year. If you’ve just booked your biggest wedding ever or are adding photo booth services to your offerings, give them a heads-up.

These conversations aren’t just small talk — they’re chances for your accountant to spot opportunities before tax time rolls around. The more they understand your business rhythms and how your event services are evolving, the better advice they can give you.

Make Their Job Easier (and Save Yourself Money)

Your accountant can’t help you if they’re spending half their billable hours sorting through your jumbled receipts. The more organized you are, the more time they can spend finding you tax breaks instead of just making sense of your paperwork.

Digital is the way to go here. If you’re using Goodshuffle Pro with QuickBooks Online, make sure everything’s syncing properly. Your accountant will thank you, and your bill might actually be lower when you’re not paying them to be your personal file clerk.

Ask For More Than Just Tax Filing

A good accountant does way more than just file your taxes. They can help you figure out whether leasing that new lighting rig makes more financial sense than buying it outright. They can tell you when it’s time to adjust your pricing because your margins are getting squeezed.

When you meet, bring your big-picture questions: How can I improve my cash flow during slow seasons? Is it time to hire my first employee? What financial metrics should I be watching as my business grows? Their answers might be worth far more than what you’re paying them for tax prep.

Who Is the Ideal Tax Professional for Your Business?

Not all accountants are created equal. You need someone who gets what makes event businesses unique — like how your inventory investments work or why your cash flow looks like a roller coaster (hello, wedding season!).

What to Look For in Your Financial Wingman

- Industry Experience Matters: Find someone who’s worked with other event pros before. They’ll already understand why you bought those gold Chiavari chairs in bulk or how to categorize labor for setup crews versus creative design time.

- Credentials Count: Sure, your cousin’s roommate might “know taxes,” but a real CPA has the training and ethical obligations to back up their advice. This isn’t the place to cut corners.

- More Than Just a Tax Filer: The best pros offer year-round support — bookkeeping help when you’re slammed with summer events, financial planning for your slow season, and strategies to reduce your tax burden before December 31st rolls around.

- Tech-Savvy Partners Win: Your ideal accountant should be comfortable with whatever system you’re using. If they’re still pushing paper ledgers while you’re running Goodshuffle Pro and QuickBooks, you’ve got a mismatch.

- Clear Communication is Non-Negotiable: You need someone who can translate tax-speak into plain English. If they can’t explain why you should (or shouldn’t) write off that company vehicle in terms you actually understand, keep looking.

- Transparent Pricing: Nobody likes surprise bills. Find out upfront if they charge by the hour, by the task, or offer package pricing. Ask what happens if you need a quick question answered mid-year — does the meter start running immediately?

Essential Questions for Your Interview

When meeting potential tax professionals, don’t be shy. Ask them straight up:

- “Have you worked with event rental businesses before? What tax challenges did they face?”

- “Beyond tax filing, what other financial services do you offer that might help my business?”

- “Can you work with my existing systems, or will I need to change how I track things?”

- “How do you stay on top of tax changes that might affect my business?”

- “Walk me through your pricing structure. What am I getting for my money?”

- “What happens if I get audited? Will you represent me, and is that included in your fee?”

- “Can I talk to other event pros you’ve worked with?”

Take the Headache Out of Tax Season With Technology

Let’s face it: nobody starts an event rental business because they love doing taxes. But with the right tech setup, you can stop dreading tax season and actually get back to what matters.

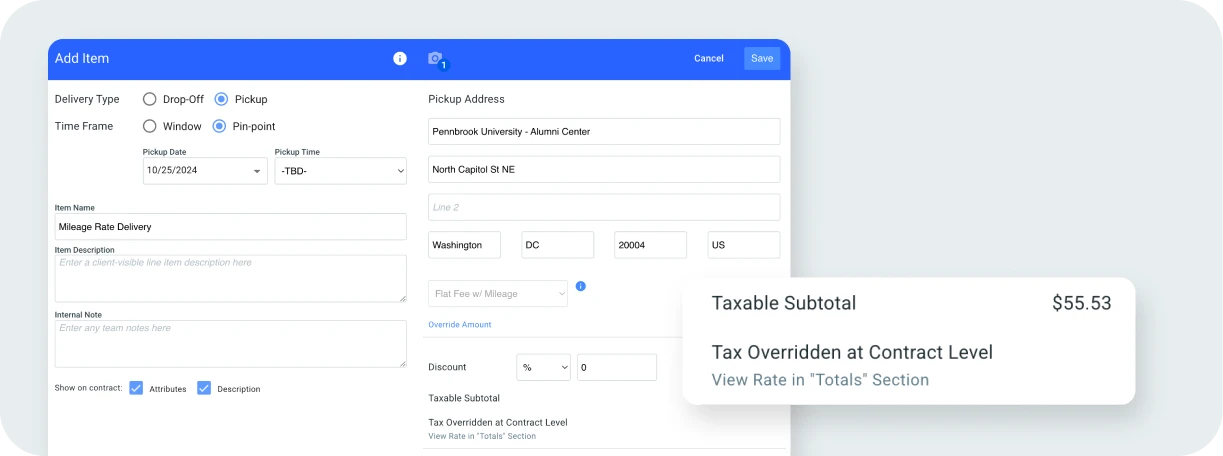

When you connect Goodshuffle Pro with your accounting system, magic happens. Your transactions get recorded automatically and sorted into categories that actually make sense for our industry — like transportation costs, maintenance, and equipment depreciation. No more sorting through piles of receipts or wondering which expenses belong where.

Then, there’s the ability to track your inventory and depreciation properly. Your tents, speakers, and lighting gear are major investments. Goodshuffle helps you log when you bought them, what you paid, and how they’re being used — so you can claim every dollar of depreciation you deserve.

Hook this up to QuickBooks Online and you’ve got a seriously powerful combo:

- Your rental data flows straight into your books — no double-entry headaches

- You can check your financial pulse anytime with real-time reports

- If you ever face an audit (knock on wood), your records are organized and ready

- You get hours of your life back each month to actually run your business

Smart technology doesn’t just make tax time easier — it gives you the financial clarity to make better decisions year-round. Meanwhile, you can focus on creating those unforgettable events that keep clients coming back.

Face Tax Season Without Breaking a Sweat

Whether you’re tackling taxes yourself or calling in the pros, being prepared is your secret weapon. Get your paperwork in order, understand what your business actually needs, use tech that makes sense for you, and don’t be afraid to ask for help when things get complicated.

Here’s the thing about taxes and your event business: they’ll grow up together. What works for you this year might not cut it next year when you’re handling bigger clients or adding new services. So keep checking in with yourself (and maybe your accountant) to make sure your approach still makes sense.

The goal isn’t just to survive tax season — it’s to actually use it to your advantage. Every deduction you claim, every expense you track correctly, that’s money staying in your business. And isn’t that the point?

So take a deep breath. You’ve got this.