Event rental businesses face significant risks every day. Your valuable inventory travels to venues, gets handled by clients and their teams, and remains exposed to potential theft, damage, or accidents. Yet obtaining comprehensive insurance that truly protects your business has traditionally been incredibly difficult.

We noticed this gap in insurance coverage, and wanted to do our part to help protect your business and your clients. Enter the first-of-its-kind Event Insurance coverage.

To sum it up quickly:

- With Goodshuffle Pro’s Event Insurance integration, your clients can easily secure event host liability insurance while your business automatically receives up to $15,000 of inland marine coverage per insured event.

- Your rental company is automatically added as an “additionally insured” party on your client’s policy, providing extra protection.

- The entire integration costs nothing to implement and use — it’s a complimentary addition to your Goodshuffle Pro subscription.

Why Event Rental Businesses Need Better Insurance

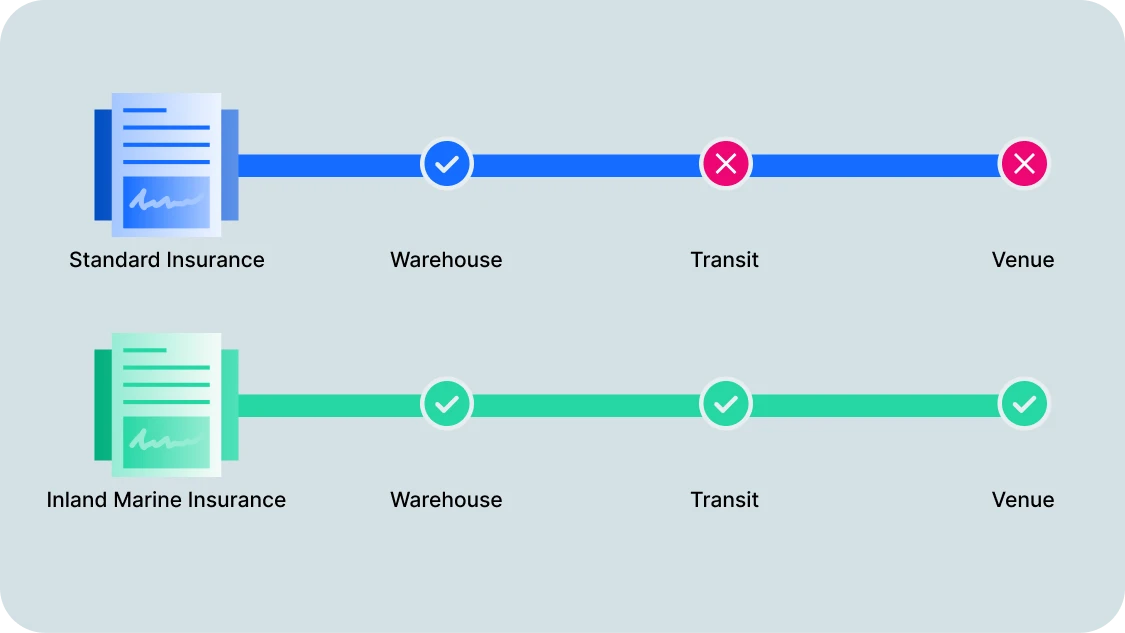

Did you know that traditional business insurance stops at your warehouse door, leaving your gear vulnerable during transport and at the venue — precisely when it’s at highest risk?

While damage waivers help protect against incidental damage by making clients responsible for minor accidents during normal use, they don’t cover more serious situations like theft, major damage, or serious negligence. And they certainly don’t protect your equipment during transport.

📋 Damage waivers vs. inland marine insurance

These protection gaps create serious financial risks:

- Theft of equipment at venues or during transit

- Major damage beyond what damage waivers cover

- Accidents involving your equipment that could leave you liable

Introducing Event Insurance

We’re thrilled to announce our groundbreaking Event Insurance integration — an industry-first solution that combines both event host liability insurance and inland marine insurance in one seamless experience within Goodshuffle Pro.

This integration solves multiple problems at once:

- Your clients can easily secure Event Host Insurance to satisfy venue requirements

- Your business automatically receives up to $15,000 of inland marine coverage per insured event

- You’re automatically added as an “additionally insured” party on your client’s policy

The best part? This entire integration costs you nothing to implement and use. It’s a complimentary addition to your existing Goodshuffle Pro subscription.

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.

How It Works

We’ve partnered with Vertical Insure, which uses ViCoverage to create a seamless insurance integration directly in your Goodshuffle Pro workflow. Here’s how it functions:

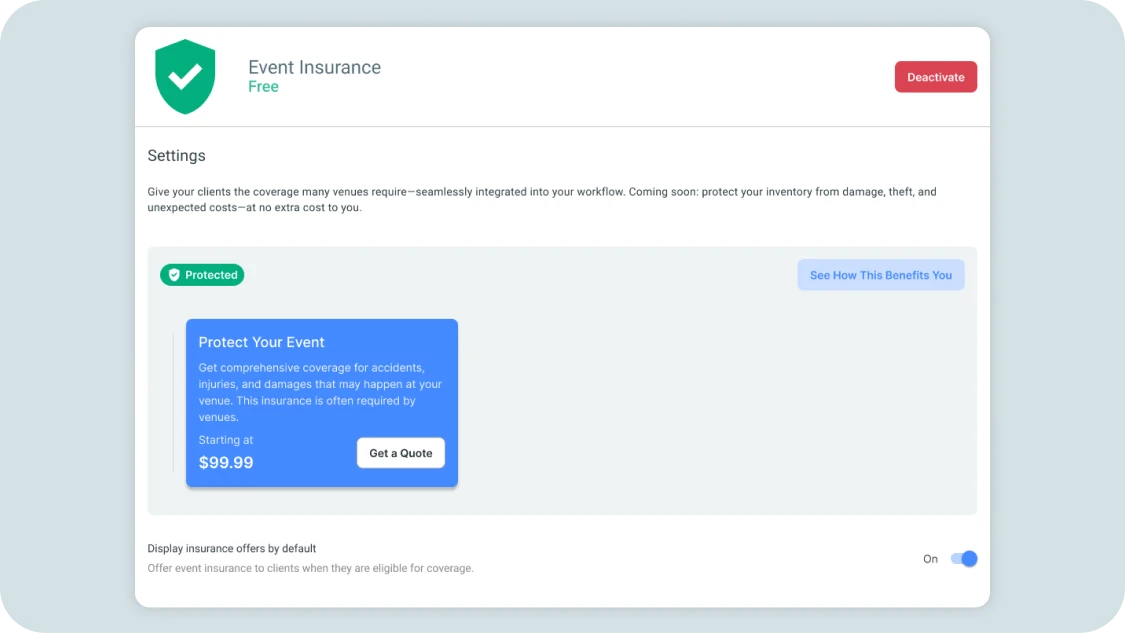

1. Confirm the integration is Enabled: This integration is on by default. When activated in your account settings, the insurance offers are available to your clients.

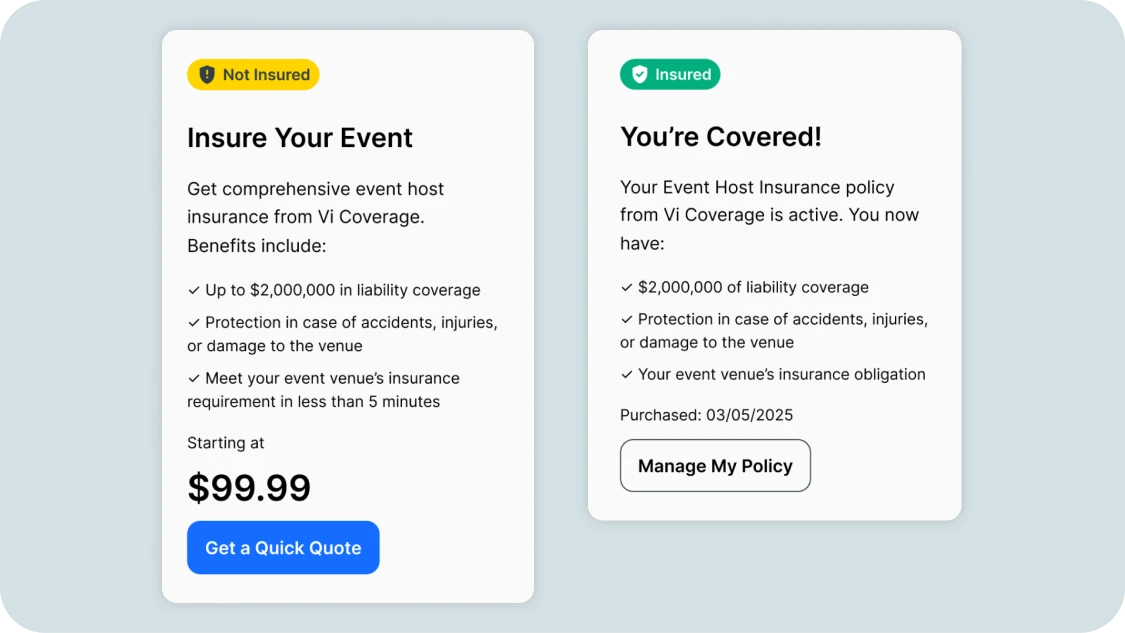

2. Clients walk through the checkout process: When your client goes to pay their invoice, they’ll see a prominent option to protect their event with insurance.

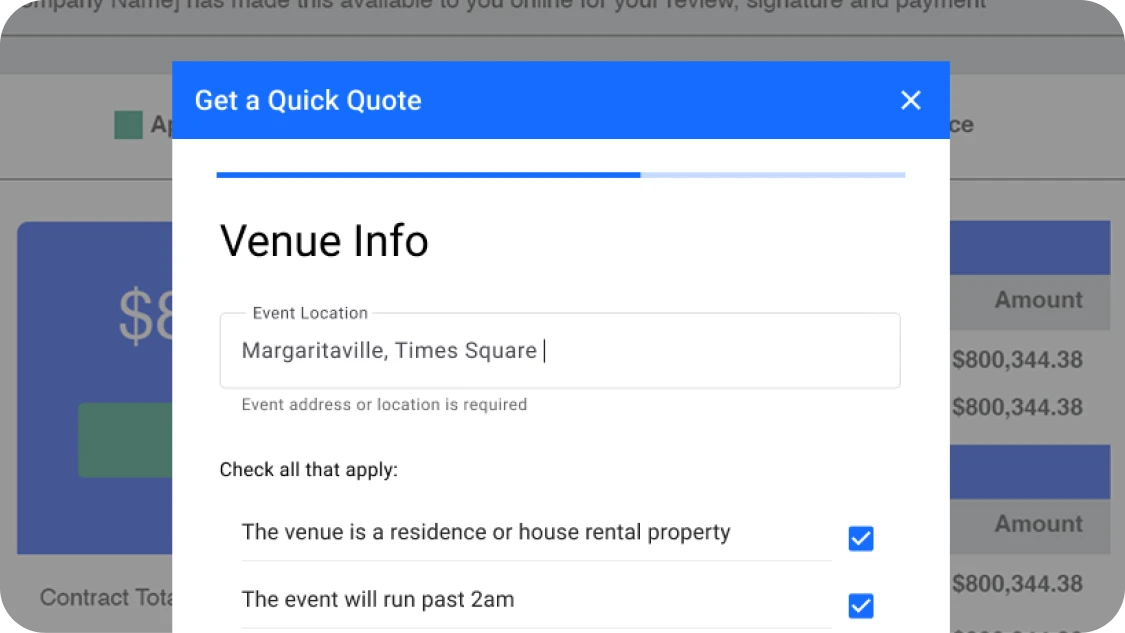

3. Clients answer a few questions: Clients answer a few questions about their event and receive an instant quote (typically more affordable than other providers on the market).

4. Automatic coverage for your event rental business: Once your client purchases their policy, your business automatically receives up to $15,000 of inland marine insurance covering your equipment during client transit and at the venue, plus “additionally insured” status on your client’s Event Host Liability policy.

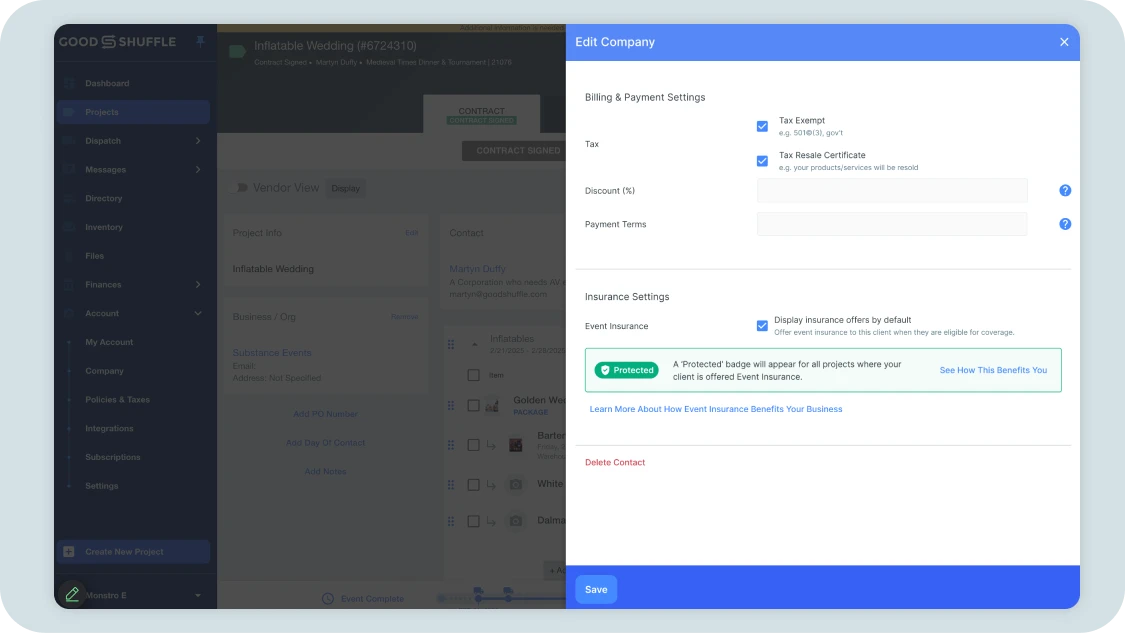

5. Complete control over when it appears: You maintain full control over when the insurance option is displayed to clients. Event Insurance will be automatically enabled on all of your projects within Goodshuffle Pro, but if you’d like to toggle it off for specific situations (like corporate accounts or peer sub-rentals), you can easily do so.

Benefits for Event Rental Businesses

Our Event Insurance integration connects your clients directly with qualified insurance providers while keeping you completely removed from the insurance advisory process. You get all the business benefits without the liability or extra work of managing insurance directly.

In short, the integration makes your checkout process as a one-stop shop for your clients and makes you stand out even more as a knowledgeable, helpful resource.

It has lots of other benefits too:

Comprehensive Protection

Fill the critical coverage gap when your equipment gets handed off to clients. Inland marine insurance covers theft, serious damage, and negligent handling of your equipment — protecting your investment across the entire rental cycle.

Zero-Deductible Coverage

Unlike traditional inland marine policies that require you to pay significant deductibles before coverage applies, the inland marine insurance you receive through our integration has no deductible cost to you as the event company.

Financial Security

With up to $15,000 coverage per insured event, a business handling 100 events per year could gain access to $1,000,000 worth of potential coverage annually.

Client Convenience

Provide a valuable service to your clients by offering a streamlined way to satisfy venue insurance requirements without leaving your booking system.

Competitive Advantage

Stand out from competitors by offering an integrated insurance solution that makes planning easier for your clients while protecting your business.

Peace of Mind

Reduce the mental load of worrying about equipment loss or damage. Focus on growing your business instead of stressing about potential losses.

Frequently Asked Questions

Q: Is there a cost to enable this integration?

A: No, the integration is completely free for Goodshuffle Pro users. Your clients pay for their insurance policy if they choose to purchase one, but you incur no costs.

Q: How much coverage do I receive per event?

A: Each event with an insurance policy provides your business with up to $15,000 of Inland Marine coverage.

Q: Are there deductibles with the inland marine coverage obtained through Goodshuffle Pro’s Event Insurance?

A: Unlike traditional inland marine policies that often come with high deductibles that event companies must pay before coverage kicks in, the up to $15,000 of inland marine coverage your business receives through our Event Insurance integration has no deductible cost to you as the vendor. This means you don’t pay out of pocket when filing a claim, making this coverage even more valuable.

Q: I already have my own insurance policies and charge damage waivers. Won’t this make my damage waiver fees seem redundant?

A: Event Insurance and damage waivers serve complementary purposes. Damage waivers typically cover incidental and accidental damage during normal use, while inland marine insurance covers larger issues like theft, serious negligence, or major damage. We recommend explaining to clients that your damage waiver covers minor incidents, while the optional Event Insurance provides broader protection for major incidents. The up to $15,000 of free inland marine coverage you receive also gives you an additional layer of protection beyond your existing policies, potentially reducing your need to file claims against your own insurance.

Q: Will offering insurance affect my conversion rates?

A: Our data shows that offering integrated insurance options typically does not impact conversion rates negatively. In fact, many clients appreciate the added convenience and protection.

Q: I’m worried clients will see this as an upsell or additional cost. How should I address this?

A: Be transparent with clients that Event Insurance is entirely optional and offered as a convenience. Many clients appreciate the ability to handle their venue insurance requirements in the same system they’re already using for rentals. You can emphasize that this integration helps simplify their event planning process and provides additional protection that benefits both parties. Remember that you can also disable the insurance offer for specific clients if you prefer to handle insurance differently with certain customers.

Q: Can I choose when to offer insurance to clients?

A: Yes, you have full control. You can toggle insurance offers on and off at the account, company, or project level.

Q: Why is Event Insurance enabled by default? Can I disable it?

A: Event Insurance is enabled by default to ensure you don’t miss out on the up to $15,000 inland marine coverage for your business. However, we understand some businesses prefer to handle insurance differently. You can easily disable this feature at the account level in your Insurance Settings, or toggle it off for specific clients or projects. The chatbot can also guide you through the process if you need assistance finding these settings.

Q: What happens if my client’s event isn’t eligible for instant coverage?

A: If an event doesn’t qualify for an instant quote, our insurance provider will either inform the client directly or follow up with additional questions to determine if coverage is still possible.

How to Get Started

Getting started with Event Insurance is simple. It’ll be automatically enabled on all of your projects within Goodshuffle Pro — and presto, you’re getting free insurance.

Event Insurance is part of our ongoing commitment to developing innovative solutions for event rental professionals. This launch follows our recent release of Dispatch, which includes AI-powered route optimization, and comes alongside our new Barcoding feature, which lets you process inventory 2x faster using just your smartphone.

We’re constantly working to make your business operations smoother, more efficient, and more protected. Stay tuned for more exciting updates in the coming months.

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.