Protecting your valuable inventory is crucial to your long-term success. The moment your equipment leaves your hands, it’s exposed to numerous risks — from minor scratches to theft and major damage. But how should you protect yourself? Two common options are damage waivers and inland marine insurance, but understanding the difference between them can be confusing.

In this guide, we’ll break down what each option covers, when you might need one versus the other, and how they can work together to provide comprehensive protection for your business.

What Are Damage Waivers?

A damage waiver is an agreement between you (the rental company) and your client that outlines who’s responsible for damage to rented equipment. Essentially, it’s a fee clients pay to limit their liability if something happens to your equipment during their rental period.

Many rental businesses offer damage waivers, though it’s important to note that making them mandatory may not be legal in every state (including New York and California). Check with your legal counsel to ensure compliance with local laws before implementing your damage waiver policy.

Damage waivers serve as your first line of defense against the everyday wear and tear that comes with renting out equipment.

What Do Damage Waivers Typically Cover?

Damage waivers generally cover incidental and accidental damage — minor scratches, dents, stains, or breakage that occurs during normal use. They also address incidental damage, like a chair leg breaking or a tablecloth getting torn. The primary purpose is to reduce the client’s financial responsibility if accidents occur during normal use of your equipment.

Think of damage waivers as protection against the inevitable small mishaps that happen at events. The wedding guest who spills red wine on your white linen. The corporate event where someone accidentally scratches your dance floor. These minor incidents are exactly what damage waivers are designed to address.

Limitations of Damage Waivers

While damage waivers provide essential protection, they have important limitations that every rental business owner should understand.

Damage waivers only cover client-caused damage — not theft, loss, or damage when your clients have your items in transit. They’re agreement-based, not insurance policies, meaning they don’t provide reimbursement from an insurance company. Most importantly, they exclude coverage for negligence, improper use, or intentional damage.

This means if someone steals your equipment from the event site, your damage waiver won’t help. For these larger risks, you need something more comprehensive.

What Is Inland Marine Insurance?

Inland marine insurance specifically protects your property and equipment while it’s in transit or temporarily located somewhere other than your permanent location. For event rental businesses, this means protection for your inventory when it’s on the move or at event venues.

Originally, this type of insurance covered goods transported over water (“marine insurance”). As transportation evolved to include trains, trucks, and other land-based methods, the coverage expanded to include property in transit over land — hence “inland marine.”

🔒 #1 way to protect inventory: Inland marine insurance

What Does Inland Marine Insurance Cover?

Inland marine insurance is designed to address significant risks beyond what damage waivers cover, such as theft, serious negligence, and major damage. While damage waivers handle incidental and accidental damage during normal use, inland marine coverage steps in for more serious situations. It provides a safety net for potentially business-threatening incidents.

For example, when a client’s guest intentionally damages your high-end audio equipment, inland marine insurance can help cover the replacement cost.

These policies typically protect against theft, major damage from accidents, and loss while your inventory is away from your warehouse. It’s specifically designed for businesses like yours, where equipment constantly moves between locations.

Traditional inland marine policies typically come with deductibles — amounts you must pay out-of-pocket before insurance coverage kicks in. These deductibles can range from hundreds to thousands of dollars depending on your policy. However, the inland marine coverage provided through Goodshuffle Pro’s Event Insurance integration has no deductible cost to vendors, making it an even more valuable protection.

The Power of Inland Marine Insurance for Event Rental Businesses

For event rental companies, inland marine insurance fills critical gaps that damage waivers don’t address. Consider this real-world scenario:

You’re providing equipment for a large corporate event. After the client takes possession of your specialty lighting décor, lounge furniture, and pipe & drape, worth $30,000, a guest accidentally knocks over part of the stage setup, causing significant damage to multiple pieces. This goes well beyond minor wear and tear and is considered gross negligence.

Fortunately, because these items are covered under the inland marine policy offered through Goodshuffle Pro’s Event Insurance integration, a substantial portion of the loss may be reimbursed — helping protect your business and ensuring your high-value rentals are backed by added peace of mind.

While the damage waiver your client signed wouldn’t cover this level of damage, inland marine insurance would step in to protect your business from this significant financial hit once the client has possession of your equipment.

Why Inland Marine Insurance Is Hard to Get

Despite its critical importance, securing inland marine insurance presents significant challenges for event rental businesses. Insurance providers often view event rental companies as high-risk clients due to several factors:

- High-risk classification: Event rental businesses frequently transport valuable equipment to different locations and operate in environments with numerous unpredictable variables. This mobility and exposure to various environments makes them inherently riskier in the eyes of insurers.

- Premium costs: When event rental businesses do find an insurer willing to provide inland marine coverage, the premiums can be prohibitively expensive, especially for small to mid-sized operations. These costs often force business owners into difficult decisions about their protection strategy.

- Limited provider options: Many standard insurance carriers simply don’t offer specialized inland marine policies tailored to the unique needs of event rental businesses. The few that do may impose strict limitations or exclusions that reduce the policy’s effectiveness.

- Complex application process: Securing inland marine insurance typically involves detailed inventory documentation, equipment valuation, and extensive paperwork. This administrative burden can be overwhelming for busy rental operations.

These obstacles explain why relatively few event rental businesses have comprehensive inland marine insurance in place. Instead, many rely solely on their damage waivers and general liability insurance — a combination that leaves significant gaps in protection, particularly for theft, transit damage, or major incidents outside of your warehouse.

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.

Key Differences Between Damage Waivers and Inland Marine Insurance

Understanding the fundamental differences between these two protection methods helps you implement them effectively:

- Coverage focus: Damage waivers address accidental, incidental damage during normal use, while inland marine insurance covers theft, major damage, and transit incidents.

- Provider: You offer damage waivers to your clients, but you purchase inland marine insurance from an insurance company for your own protection (you can also get it for free when your clients purchase event host insurance through the Goodshuffle Pro checkout flow).

- Payment structure: Clients pay a one-time damage waiver fee per rental, while you pay regular premium payments for inland marine insurance (premiums aren’t applicable for insurance obtained through Goodshuffle Pro’s checkout flow).

- Deductibles: Traditional inland marine insurance policies include deductibles that you as the event company must pay, while the coverage through Goodshuffle Pro’s Event Insurance has no vendor-paid deductible. Damage waivers don’t involve deductibles.

- Coverage location: Damage waivers only apply at the event site during the rental period, but inland marine insurance protects your equipment in transit by the client and at temporary locations.

- Claim process: Damage waivers reduce client liability, while inland marine insurance provides direct reimbursement to your business after a covered loss.

- Protection level: Damage waivers offer limited protection focused on minor damage, but inland marine insurance provides comprehensive coverage for major losses.

Why You Need Both Types of Protection

The most comprehensive approach is to implement both damage waivers and inland marine insurance. Here’s why:

Damage waivers handle the day-to-day wear and tear of your rental business — the small accidents that inevitably happen when clients use your equipment. They help maintain positive client relationships by removing the anxiety clients might feel about being responsible for minor damage.

Inland marine insurance provides the safety net for major incidents that could otherwise be financially devastating to your business. It can cover the gaps that damage waivers simply weren’t designed to address.

Together, they create a comprehensive protection strategy that addresses risks to your inventory. Think of damage waivers as your first line of defense, handling the small stuff so you can focus on providing excellent service. Inland marine insurance is your backup plan — there when you need it for those rare but potentially catastrophic situations.

Practical Tips for Full Event Coverage

Here are some of our best tips for getting your events fully covered:

Implement Effective Damage Waivers

Creating clear, transparent language in your damage waivers helps ensure clients understand what is and isn’t covered. Consider standardizing your waiver fees as a percentage of rental value (typically 3-10%) for consistency and simplicity. Damage waivers are typical for covering a small percentage of the total order.

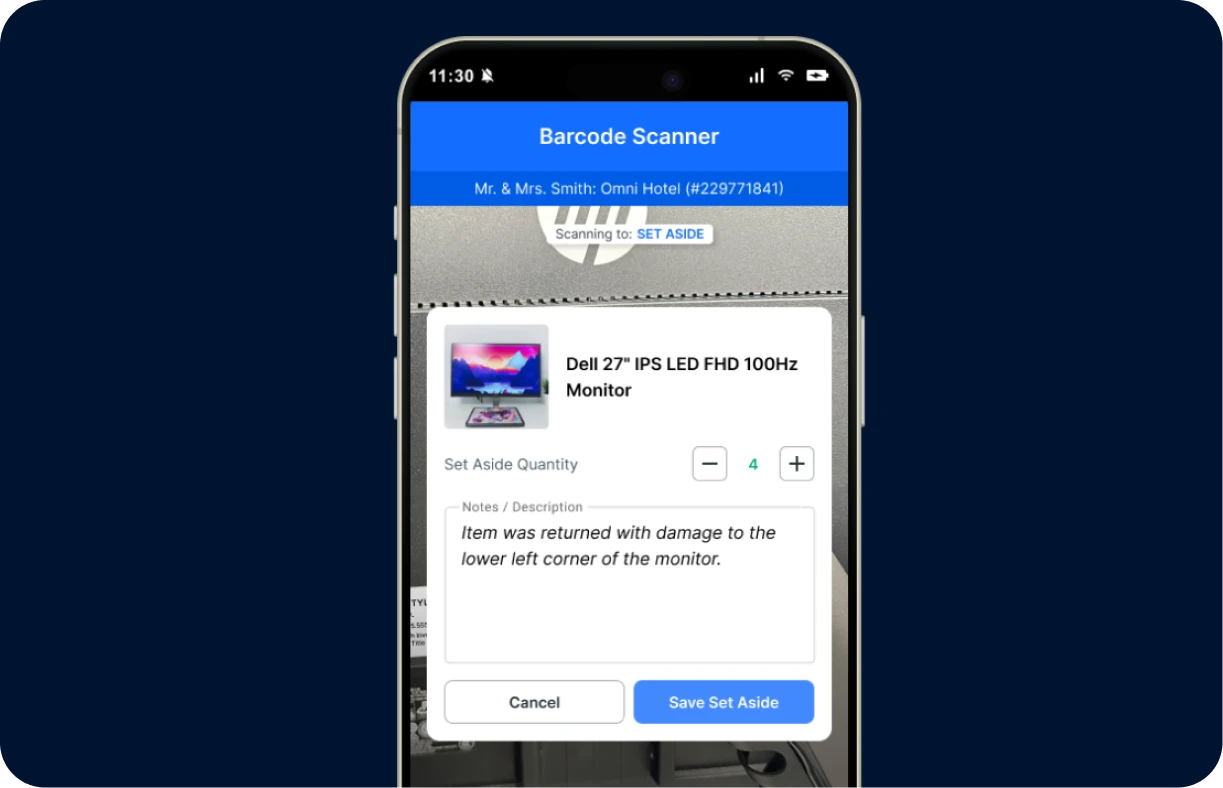

Document equipment condition with photos or video before and after each rental to avoid disputes. This visual evidence is invaluable if you need to demonstrate that damage occurred during a client’s rental period.

Many successful rental businesses make damage waivers part of their standard contracts, though they must be offered as optional in some states. If you are able to add damage waivers to all your contracts, it ensures all rentals have at least basic protection. When clients ask why, explain that this policy helps you maintain your inventory in excellent condition while keeping rental prices competitive.

✅ How to deal with inventory damages

Communication Best Practices

Explaining both protection types to clients helps them understand the value of damage waivers and why they’re necessary. When clients understand that damage waivers only cover minor incidents, they gain perspective on the risks you assume as a rental business owner.

Train your team thoroughly on the differences between damage waivers and inland marine insurance so everyone can explain your policies correctly. This knowledge builds credibility with clients and helps prevent miscommunications.

Document everything related to equipment condition and incidents. Detailed records make insurance claims smoother and help resolve any disagreements about damage. Consider implementing a standardized check-in/check-out process that all team members follow consistently.

Secure the Right Inland Marine Coverage

Finding the right inland marine coverage starts with working with insurers who understand the event rental industry. These specialized providers will understand the unique risks your business faces and can tailor coverage accordingly.

When setting up your policy, be meticulous about accurately valuing your inventory to ensure you’re not under-insured. Take time to review exclusions carefully so you understand what perils might not be covered. Some policies may exclude certain types of equipment or specific scenarios relevant to your business.

For particularly expensive items like high-end audio equipment or specialty lighting, consider whether you need additional coverage limits. As your inventory grows and changes, regularly update your policy to reflect these changes.

The Future of Rental Protection

For the first time, the event rental industry has an option for integrated protection solutions that combine event host insurance for clients with inland marine coverage for event businesses. It’s all wrapped up into Goodshuffle Pro’s Event Insurance integration.

This streamlined approach provides dual protection that benefits both parties while reducing administrative overhead. By thoughtfully implementing both damage waivers (for everyday accidents) and inland marine insurance (for major threats like theft during client transit), rental businesses create a comprehensive safety net that protects their investment and maintains positive client relationships.

Ready to get protected?

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.