Table of Contents

-

What Is Event Host Liability Insurance?

-

When Is Event Host Liability Insurance Required?

-

How Clients Typically Obtain Event Insurance

-

The Value of Connecting Clients with Event Insurance

-

Build Trust & Add Value to Your Rental Business

-

Should You Provide Insurance Solutions For Your Clients?

-

The Bottom Line

Providing exceptional service means anticipating your clients’ needs. This might look like suggesting bistro lighting for an outdoor dinner that runs past sunset, recommending backup tents for an event during the rainy season, or helping clients properly estimate their linen needs based on table configurations.

But there’s another often-overlooked aspect of event planning that can cause last-minute stress for your clients: Event host liability insurance. By connecting your clients with affordable, quality insurance providers, you can position your rental business as an events industry expert.

What Is Event Host Liability Insurance?

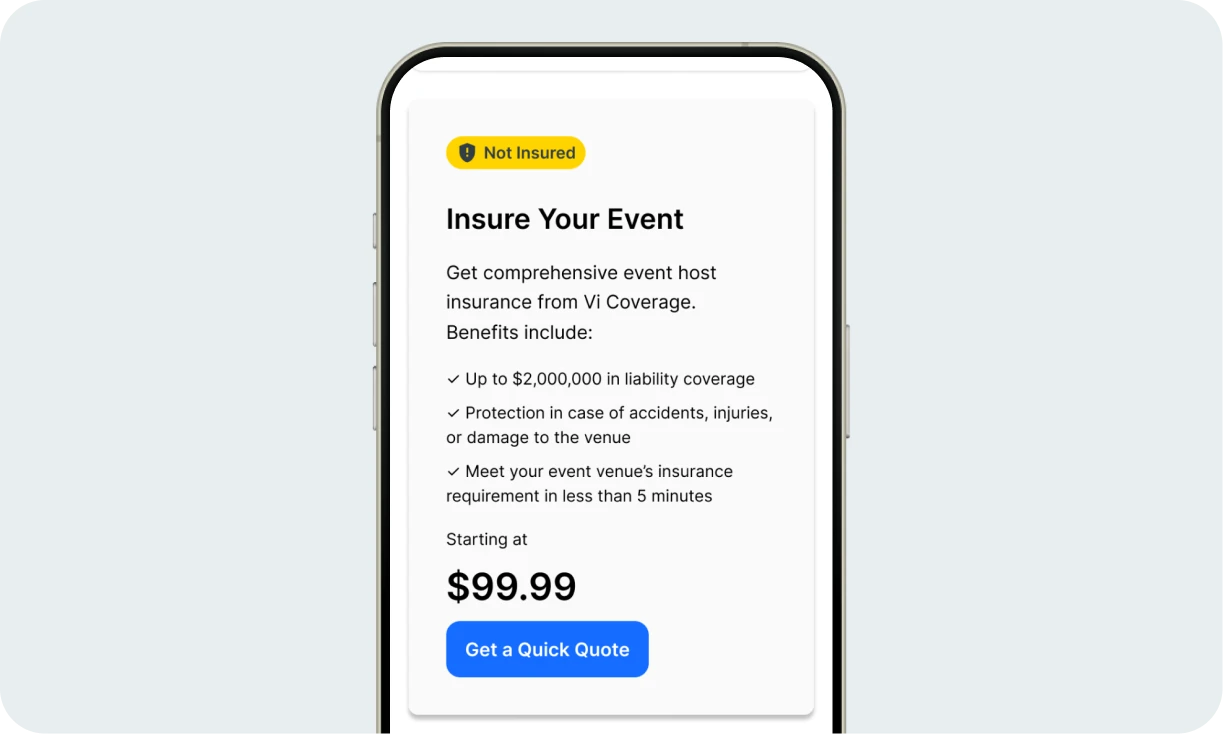

Event host liability insurance protects event hosts (your clients) if they’re held legally responsible for property damage or bodily injuries that occur during their event. Think of it as a safety net for your clients when unexpected incidents happen — from a guest slipping on a wet floor to property damage at the venue.

This insurance, provided by specialized third-party companies, typically covers bodily injury claims if a guest is injured, property damage to the venue, legal defense costs for any lawsuits, medical payments for minor injuries regardless of fault, and liquor liability if alcohol is served and results in problems.

When Is Event Host Liability Insurance Required?

As an event rental business, you’ve got your hands full with general liability insurance and inland marine insurance. But your clients may need event host liability insurance for several reasons:

- Venue requirements: Many venues make liability insurance mandatory before allowing an event to take place on their property. This protects the venue from being solely responsible for incidents during an event.

- High-value events: Weddings, corporate gatherings, and other significant celebrations often involve substantial investments that deserve protection.

- Events with special circumstances: Events serving alcohol, featuring physical activities, or hosting large crowds carry additional risks that insurance can help mitigate.

- Peace of mind: Even when not required, insurance provides security and confidence for hosts concerned about potential liabilities.

🤔 Do you need inland marine insurance?

How Clients Typically Obtain Event Insurance

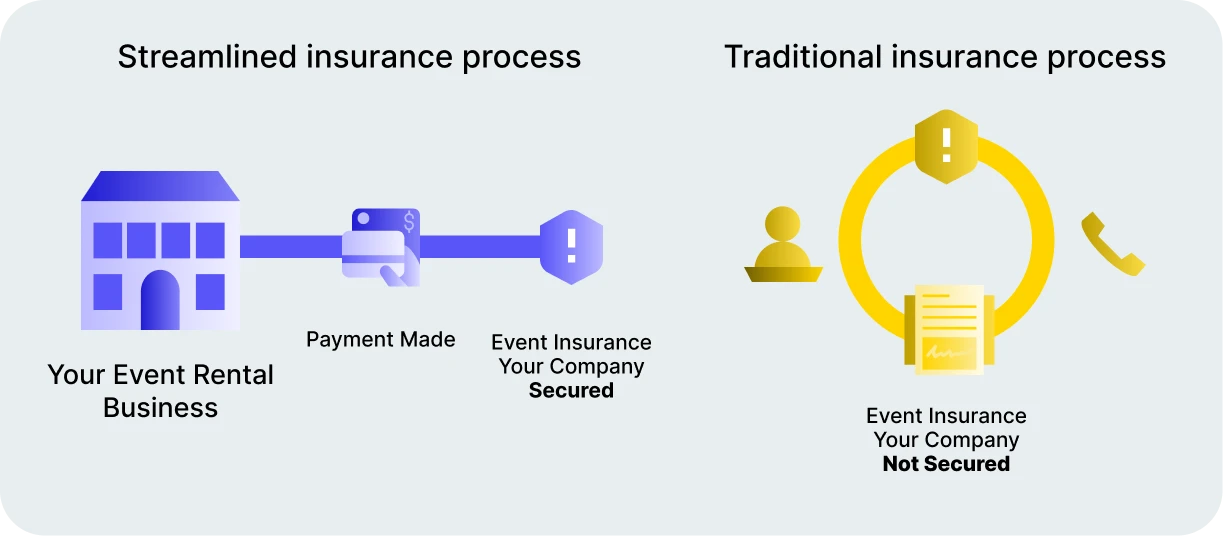

Historically, your clients have had to navigate the insurance marketplace on their own, which often looks like:

- Research phase: Spending hours researching third-party insurance providers, many of which feel outdated or unfamiliar

- Comparison shopping: Attempting to compare policies from different companies without fully understanding coverage terms

- Application process: Filling out repetitive forms with complex insurance terminology

- Last-minute scramble: Often leaving this task until just before the event, creating unnecessary stress

- Verification headaches: Ensuring the policy meets specific venue requirements and submitting proof

This fragmented experience can be frustrating for clients who are already juggling countless other event details.

The Value of Connecting Clients with Event Insurance

When you help clients connect with reputable third-party insurance providers, you’re offering them several key benefits:

Time Savings

Event planning is demanding enough without adding insurance research to the to-do list. By providing a streamlined path to quality insurance providers, you’re giving clients back precious time they can spend focusing on other aspects of their event.

Confidence and Security

Insurance provides peace of mind. Your clients can proceed with event planning knowing they’re protected against unforeseen circumstances. This confidence extends to their interactions with event rental businesses and venues, knowing they’ve covered all their bases.

Professionalism

Having appropriate insurance demonstrates to venues and other event rental businesses that your client takes their event seriously and understands industry best practices. This professional approach can open doors to premium venues that require insurance.

Financial Protection

The cost of liability insurance from third-party providers is minimal compared to the potential financial impact of an incident. For a fraction of the overall event budget, clients gain protection against potentially devastating expenses.

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.

Build Trust & Add Value to Your Rental Business

Facilitating connections to event insurance for your clients doesn’t just benefit them — it strengthens your business as well.

Establishing Expert Status

By educating clients about insurance needs and connecting them with reliable third-party providers before they even ask, you position yourself as a knowledgeable industry expert who understands all aspects of event execution. This expertise builds credibility and trust.

Creating a Seamless Experience

The most memorable business relationships are those that remove obstacles rather than creating them. By helping clients find the right insurance solutions, you’re streamlining the client experience and eliminating a common pain point.

Increasing Client Loyalty

Clients remember businesses that go above and beyond. When you help them navigate complex aspects of event planning like insurance, you create a positive impression that encourages repeat business and referrals.

Differentiating Your Services

In a competitive rental market, added services like facilitating connections to quality insurance providers can set your business apart. This value-add can be a deciding factor for clients choosing between similar rental providers.

Should You Provide Insurance Solutions For Your Clients?

Handling insurance matters requires expertise and carries potential liability risks when done incorrectly. That’s why trying to become an insurance expert or taking on insurance responsibilities yourself isn’t the right approach. Instead, leverage technology partnerships that do the heavy lifting for you.

Goodshuffle Pro’s Event Insurance integration, powered by our partner Vertical Insure, offers a streamlined solution that connects your clients directly to a qualified third-party insurance provider without requiring you to become an insurance expert. The integration appears right within your client’s checkout flow, making it simple to offer this valuable service without creating additional work for your team.

With this integration, your clients can access event host liability insurance with just a few clicks after completing their rental booking. There’s no need for you to research providers, maintain insurance relationships, or take on additional liability by providing insurance advice. The system handles everything from qualification questions to policy generation.

This approach gives you all the business benefits of connecting clients with insurance solutions while eliminating the risks and extra work of managing insurance matters directly. Your clients get the protection they need, and you enhance your service offering without expanding your responsibilities into potentially complicated territory.

The Bottom Line

While you don’t provide event host liability insurance directly, helping clients connect with quality third-party coverage isn’t just a box to check — it’s an opportunity to demonstrate your commitment to comprehensive client service. By guiding clients toward appropriate coverage options, you’re protecting their interests while elevating your business above competitors who leave clients to figure it out on their own.

The result is that you position your rental business as an indispensable resource in the event planning journey.

Remember, clients may forget exactly what you did or what you said, but they’ll always remember how you made their lives easier during the stressful process of planning an event. Making event host liability insurance accessible is one more way you can create that lasting positive impression.

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.