Table of Contents

-

What Is Inland Marine Insurance?

-

The Coverage Gap Most Event Rental Businesses Face

-

Why Inland Marine Insurance Is So Difficult to Obtain

-

What Inland Marine Insurance Covers (That Your Standard Policy Doesn't)

-

How Inland Marine Insurance Differs from Damage Waivers

-

The Real Cost of Inland Marine Insurance

-

Embedded Event Insurance You Won’t Find Anywhere Else

-

Why This Matters Now More Than Ever

Despite its confusing name (no, it has nothing to do with boats), inland marine insurance is one of the most critical protections your event rental business needs, yet it remains one of the most challenging types of coverage to secure. If your inventory is regularly in client hands — and in the event rental business, that’s practically every day — you could be exposing yourself to significant financial risk without proper inland marine coverage.

In this guide to inland marine insurance, we’ll explain what it covers, why it’s so difficult for event businesses to get, and how you can get it for free.

What Is Inland Marine Insurance?

Inland marine insurance is specialized coverage that protects your business property and inventory while it’s in transit or temporarily stored at an off-site location. For event rental businesses, this means your tables, chairs, tents, linens, AV equipment, and other rental items are protected when they’re on the move or set up at a venue.

The confusing name dates back to when shipping companies needed protection for goods transported over water (“marine insurance”). As transportation evolved to include movements over land, the coverage adapted, and “inland marine” insurance was born.

Today, it refers to coverage that protects valuable property, equipment, and inventory when it’s not at your primary business location. For event rental companies, this is essential since your business model depends on your inventory constantly moving between your warehouse and various event venues.

🤔 Do you need party rental insurance?

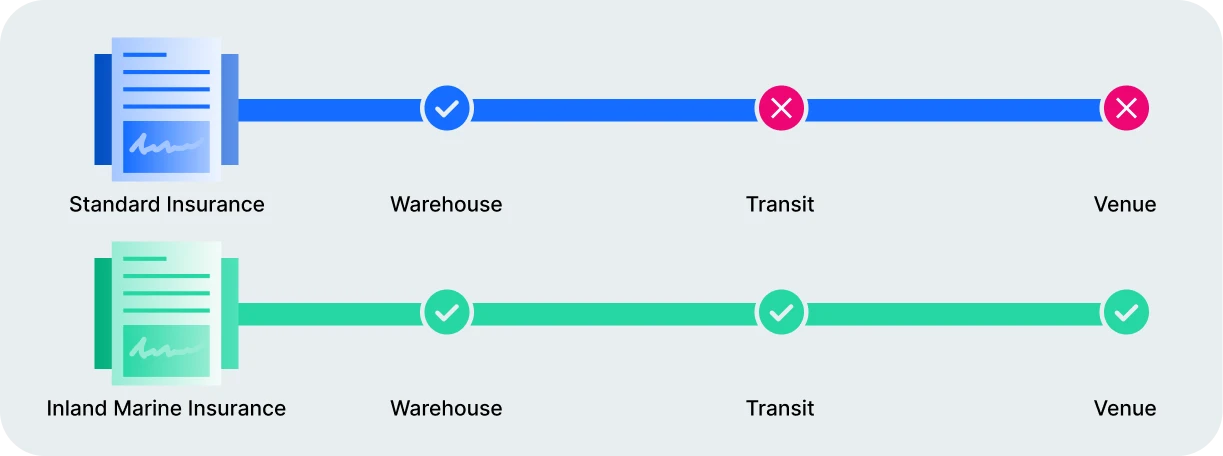

The Coverage Gap Most Event Rental Businesses Face

Most event rental companies have some form of business insurance, but many don’t realize that standard business insurance typically only covers inventory while it’s physically inside your warehouse. Once your items enter your clients’ hands, that coverage ends — creating a dangerous gap in protection.

Think about how much time your rental assets spend outside of your control:

- In transit to and from venues

- Set up at event locations

- Stored temporarily at venues before or after events

Without inland marine insurance, your inventory is completely unprotected during these periods. In an industry where your entire business model revolves around your inventory traveling to different locations, this presents a serious vulnerability.

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.

Why Inland Marine Insurance Is So Difficult to Obtain

Have you ever gotten a quote for inland marine insurance only to be shocked by the astronomical premium? Or maybe you’ve had difficulty even getting a quote in the first place? You’re not alone.

One event rental business owner reported receiving a quote of over $12,000 annually for inland marine coverage — a prohibitive cost for many small to mid-sized businesses. Yet without this protection, a single incident could result in tens of thousands of dollars in losses.

Unfortunately, event rental businesses face significant challenges when seeking inland marine coverage:

- High-risk industry designation: Insurance companies view event rental businesses as high-risk due to the constant movement of valuable inventory and the unpredictable nature of events.

- Limited provider options: Few insurance companies offer inland marine policies specifically tailored to event rental businesses.

- Costly premiums: When policies are available, they often come with steep pricing that can strain operational budgets.

- Complex application process: Underwriters typically require detailed inventory lists, valuation documentation, and extensive business history.

- Stringent requirements: Many policies come with strict conditions about security measures, transportation methods, and storage practices.

Despite these obstacles, protecting your inventory when it leaves your hands is essential to your business’s long-term stability.

What Inland Marine Insurance Covers (That Your Standard Policy Doesn't)

Inland marine insurance fills critical protection gaps that your standard business insurance policy typically doesn’t address. Let’s explore the key coverages:

Theft

When you hand your equipment off to your clients, it becomes more vulnerable to theft. Inland marine insurance protects you if, under your client’s watch, your entire truck of rental equipment is stolen from a venue parking lot, or if items disappear during an event. Without this coverage, the cost of replacing stolen inventory falls entirely on your business.

Transit Damage

Your inventory is at significant risk during transportation. Items can shift, fall, or collide while your truck is on the road. Inland marine insurance covers damages that occur while your rental equipment is being transported to or from event locations, protecting you from losses that standard business insurance won’t touch.

Off-Site Damage

Once your equipment is set up at a venue, it’s exposed to numerous risks outside your control. Inland marine insurance covers major damage that occurs while your items are at the venue location, giving you peace of mind that your assets are protected even when they’re not under your direct supervision.

Natural Disasters

Weather is unpredictable, but coverage doesn’t have to be. From hurricanes in Florida to tornadoes in Oklahoma, inland marine insurance provides protection against floods, fires, or severe weather that damages your equipment at off-site locations. This coverage is especially valuable for outdoor events where weather-related risks are higher.

Serious Neglect

Despite your best efforts to educate clients on proper equipment handling, sometimes rental items are treated with extreme carelessness. Inland marine insurance covers damages resulting from serious neglect by clients or venue staff, offering protection beyond what typical damage waivers provide.

Without inland marine coverage, you would bear the full financial burden of replacing or repairing these items out of pocket — potentially devastating costs that could threaten the survival of your business after just one significant incident.

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.

How Inland Marine Insurance Differs from Damage Waivers

Many rental businesses rely on damage waivers as their primary protection. While valuable, damage waivers have limitations:

- Damage waivers: Cover incidental and accidental damage caused by clients during normal use.

- Inland marine insurance: Covers theft, transit damage, natural disasters, and serious neglect.

Think of damage waivers as your first line of defense for minor issues, while inland marine insurance protects against major catastrophes that could otherwise devastate your business.

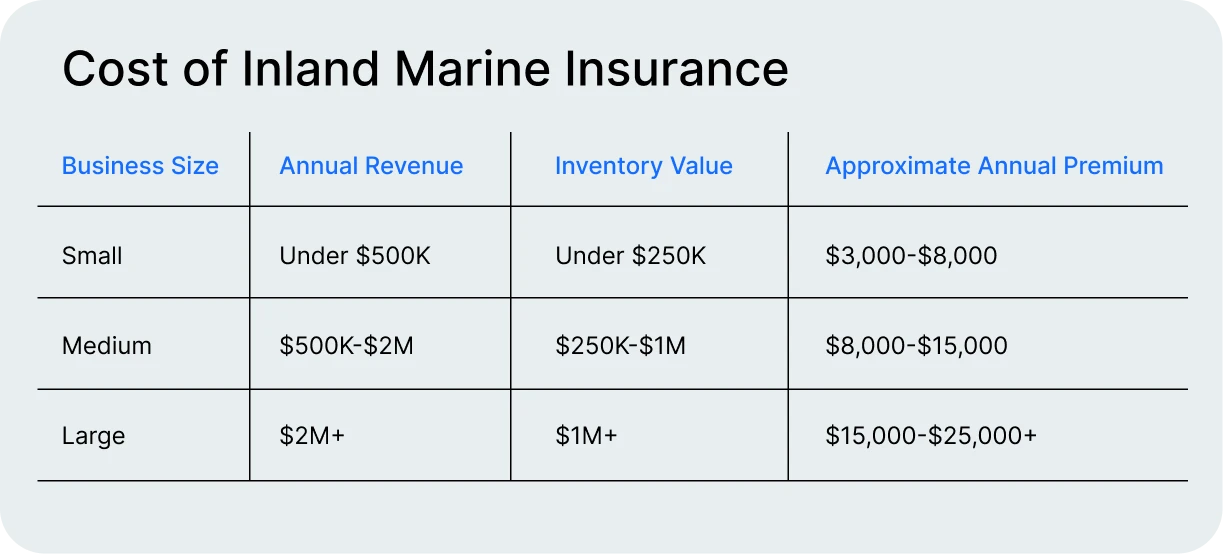

The Real Cost of Inland Marine Insurance

Traditional inland marine insurance costs vary widely based on:

- Total value of inventory

- Types of equipment rented

- Annual revenue

- Claims history

- Geographic service area

According to industry reports and conversations with event rental business owners, approximate annual premiums typically fall within these ranges*:

*Note: These figures represent industry averages based on our research and conversations with insurance providers. Your actual quotes may vary depending on your specific business circumstances.

For many businesses, especially those just starting out or operating with tight margins, these costs represent a significant obstacle to obtaining proper protection.

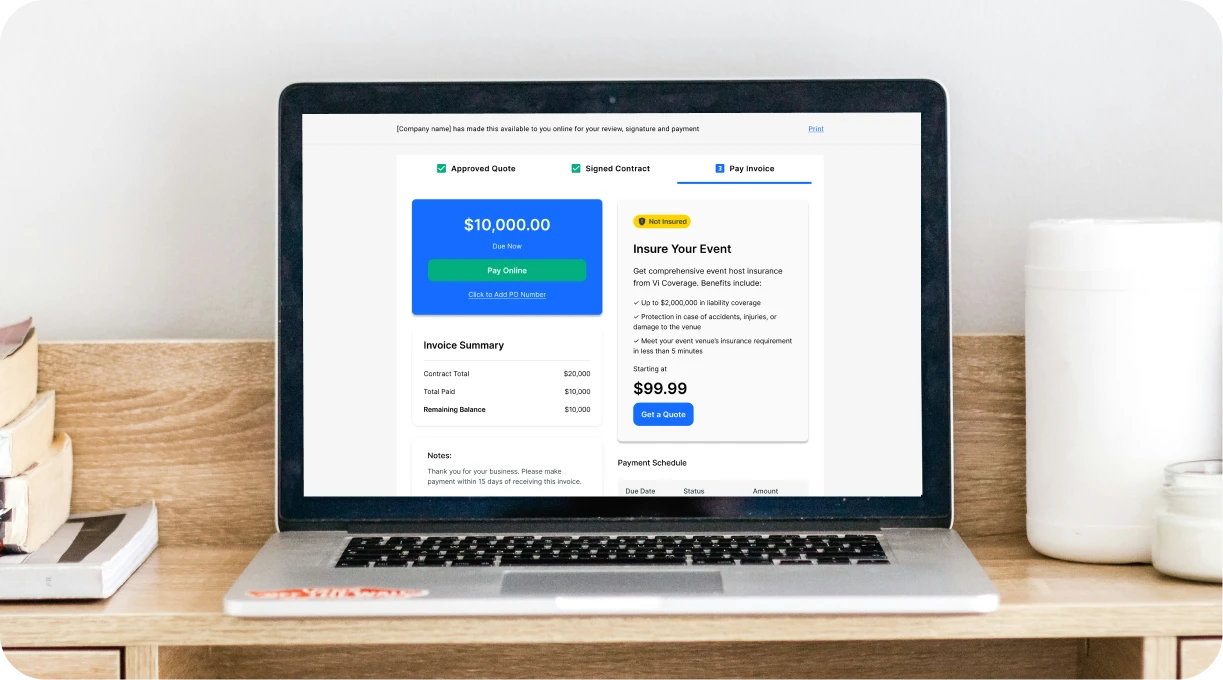

Embedded Event Insurance You Won’t Find Anywhere Else

This is where Goodshuffle Pro’s groundbreaking new Event Insurance integration becomes a game-changer for event rental businesses. We’ve partnered with ViCoverage to create the industry’s first embedded insurance solution that bundles both Event Host Liability and Inland Marine coverage.

What makes this truly revolutionary:

- Up to $10,000 coverage for each event: Event rental businesses receive up to $10,000 of inland marine insurance coverage for each project where clients purchase event host insurance through the integration — at absolutely no cost to you as an event rental business. This covers your inventory while it’s in transit or on site with clients.

- Additional insured status: You’re automatically added as an “Additionally Insured” party on your client’s Event Host Insurance policy.

- Seamless integration: Everything happens directly within the Goodshuffle Pro interface — no separate applications, no additional paperwork, and one-click setup. It’s easy for your clients to get access to trusted, affordable insurance within their checkout flow, too, which builds trust.

- No cost to event businesses: This integration costs you $0 to implement and maintain.

When you consider the potential value, the numbers are staggering. If your business handles 100 events per year, that’s potentially $1,000,000 worth of free inland marine coverage — protection that would otherwise cost tens of thousands of dollars annually.

Why This Matters Now More Than Ever

Supply chain issues and rising material costs have increased the value and replacement costs of many rental items, making adequate insurance coverage even more crucial.

Additionally, with rising labor costs and tight margins, event rental businesses simply cannot afford unexpected financial losses from uninsured inventory damage or theft.

This makes inland marine insurance essential protection for the lifeblood of your event rental business: your inventory. With Goodshuffle Pro’s innovative Event Insurance integration, we’re removing the historical barriers that have prevented many rental businesses from securing this vital coverage.

We’re proud to offer this first-of-its-kind solution that gives peace of mind to both you and your clients — and one less thing to keep you up at night as a business owner.

Want to learn more about how Goodshuffle Pro can protect and grow your business?

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.