Money doesn’t grow on trees. But a lack of cash doesn’t have to keep you from growing your event business. That’s why we’ve partnered with Stripe Capital — to give you access to funds that can give your business a boost.

To sum it up quickly:

- Stripe Capital financing allows certain Goodshuffle Pro users access to interest-free financing options at flexible amounts.

- Your personal credit won’t be impacted if you take financing.

To learn more about how it works and eligibility, keep reading.

How Stripe Capital Financing Works

Here’s how the Stripe Capital process goes:

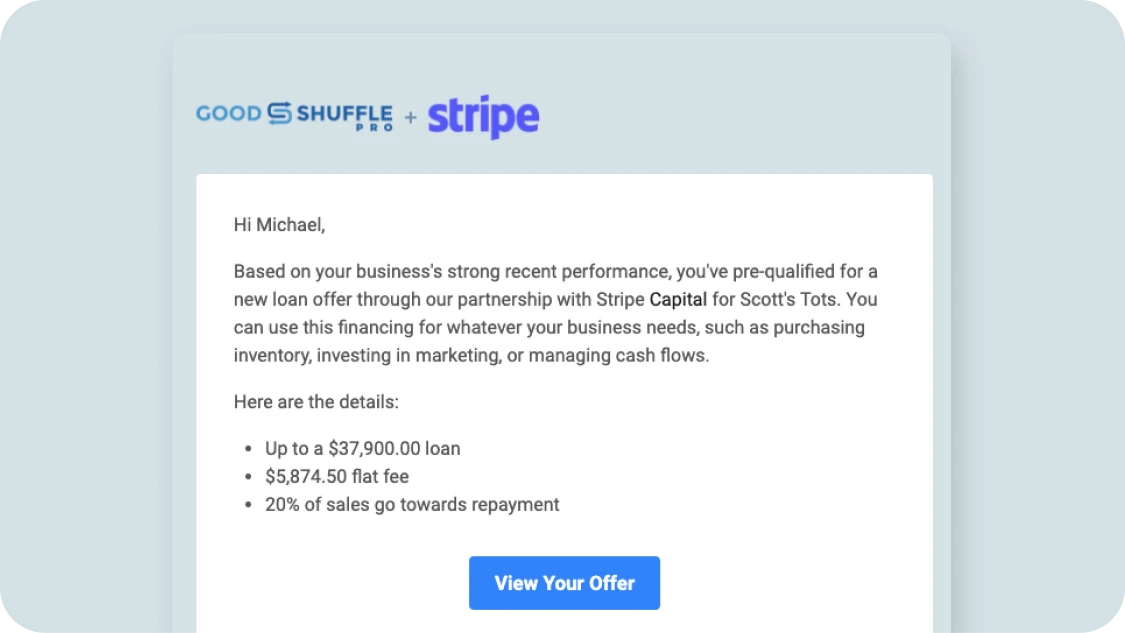

1. You Receive an Offer

If you are eligible, you should have already received an email from Stripe Capital and Goodshuffle Pro.

Eligibility depends on a variety of factors, like business location, amount of time processing payments with Stripe, processing volume, and standing with Stripe Capital.

There are also other factors that Stripe Capital considers, like if your business is growing or if you have a low dispute rate. To stay up to date on the latest eligibility requirements, visit Stripe’s eligibility page.

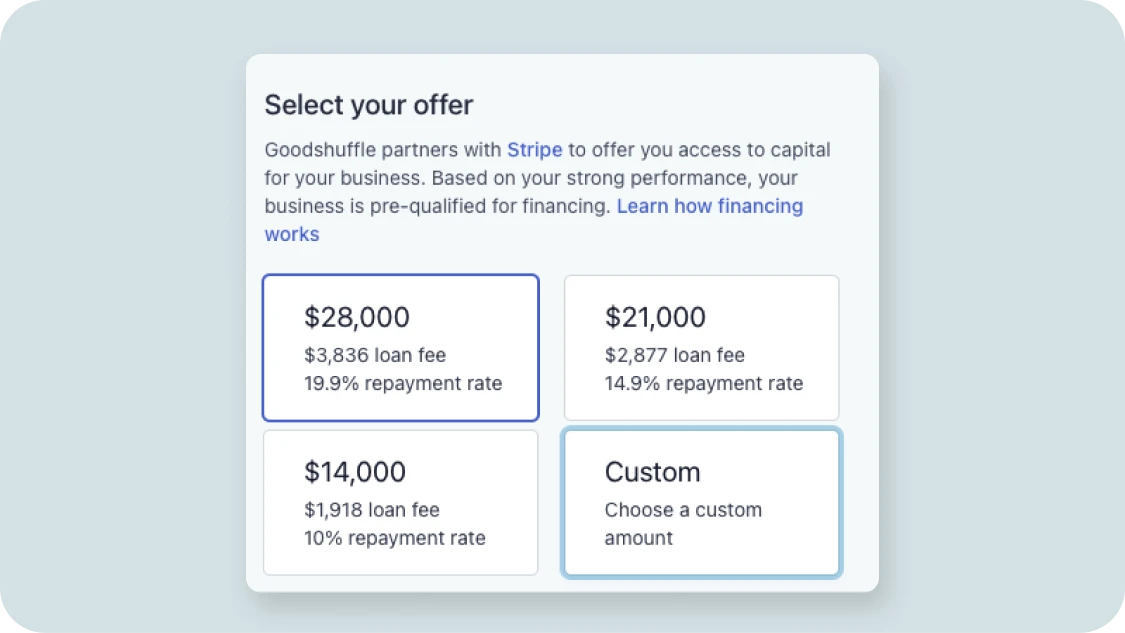

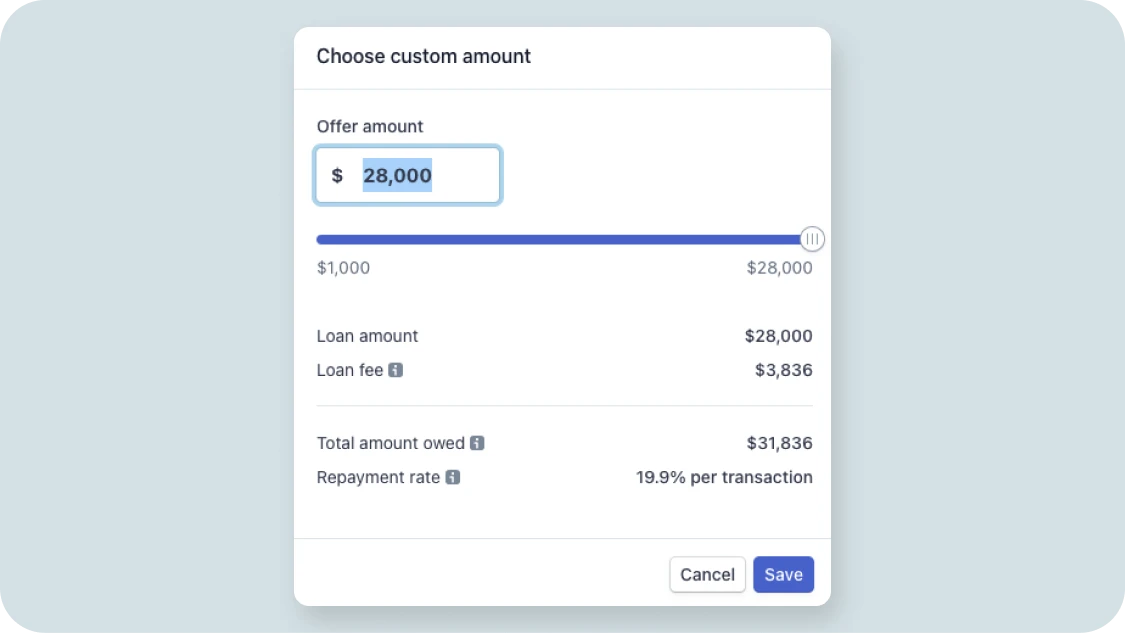

2. You Select Your Amount

If you’re eligible for Stripe Capital financing, you’ll be presented with various offer amounts, along with their respective fees and payment toward financing rates. These amounts are based on your transaction history. You can also choose a custom amount if you wish.

Stripe Capital loans and merchant cash advances are interest-free, and you’ll only pay the flat fee you accept during this stage.

3. If You’re Approved, You Receive Your Funds

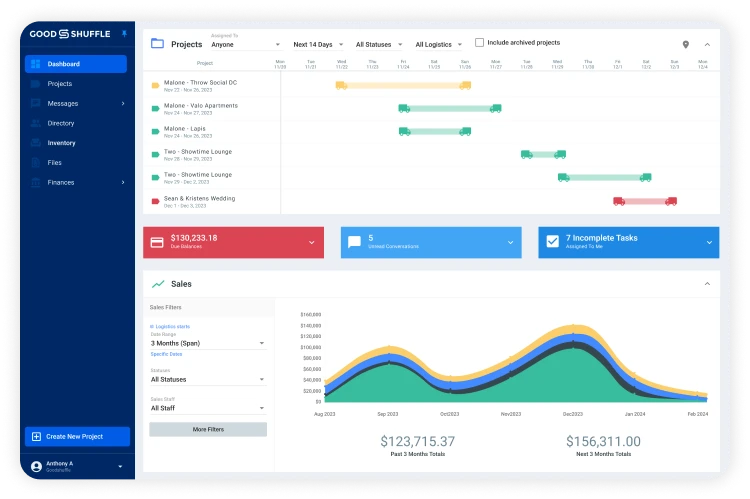

Congrats, you’ve now got your funds in hand! You can use them however you best see fit to grow your business, whether that’s buying new equipment or hiring a new team member. In the next section, we’ll go over some of our favorite ways Goodshuffle Pro users have used their Stripe Capital funds.

4. Repay Your Funds

When you accepted your loan or merchant cash advance, you were given a “payment toward financing fee” as a percentage. This represents the amount that will be deducted from each payment you receive through Stripe.

Because it’s a percentage rate, it gives you flexibility to pay back more during your busy seasons and less during your slow seasons.

You’ll have a minimum amount due each period, and if the total amount that you repay through sales doesn’t meet the minimum, your account will be automatically debited the remaining amount at the end of the period.

When to Use Stripe Capital Financing

We’ve seen event pros use Stripe Capital financing for all kinds of reasons, whether that’s recovering from a natural disaster or improving their website. Here are just a couple of our favorite Stripe Capital stories:

- Kristen Bender Daaboul of Kadeema Rentals used her loan to take on an event for a big-name celebrity. Stripe Capital allowed her to secure the labor and new inventory she needed to take on a VIP client. Read about Kristen’s experience here.

- Igor Vlasenko of Rent for Event used his loan to ramp up marketing efforts during Covid-19 — that included SEO, email marketing, and blogging. Read more about Igor’s journey here.

You can also use your funds to combat the slow season, capitalize on going-out-of-business sales, and more. It’s really up to you and your business needs.

💡 Learn more about how to get Stripe Capital funds

What’s Next?

If your curiosity still isn’t satisfied, check out our Stripe Capital financing FAQ here.

As we continue to roll out more flexible financing options for you and your clients, we’re excited to have you along for the ride. To be the first to know about Goodshuffle Pro’s latest features, be sure to subscribe to our newsletter.

And if you’re itching to see what else Goodshuffle Pro can do for your business, why not book a demo?

Stripe Capital offers financing types that include loans and merchant cash advances. All financing applications are subject to review prior to approval. In the US, Stripe Capital loans are issued by Celtic Bank, and YouLend provides Stripe Capital merchant cash advances. See your Dashboard for the terms of your offer.