Table of Contents

-

What is General Liability Insurance for Bounce Houses?

-

3 Key Risks Covered by Bounce House Liability Insurance

-

Insurance Costs for Bounce House Businesses

-

Additional Insurance Options for Complete Protection

-

How to Choose the Right Insurance Provider

-

Modern Solutions: Integrated Insurance Options

-

Tips for Reducing Insurance Costs

-

Temporary Insurance Options for Seasonal Businesses

-

The Cost of Not Having General Liability Insurance

Bounce houses aren’t just for birthday parties. They’re a staple at many events, from corporate picnics to school fundraisers.

But with all the fun comes a set of unique risks — both to the users and to the business providing the inflatables. From 2000 to 2021, there were 479 wind-related bounce house injuries and 28 deaths worldwide, according to research from the University of Georgia. And that’s on top of an estimated 10,000 total bounce house-related ER visits that occur in the U.S. each year.

For bounce house business owners, having the right insurance isn’t just recommended — it’s essential for your business’s survival and growth. Let’s explore everything you need to know about general liability insurance for bounce houses, including coverage options, benefits, and how to secure the right policy.

What is General Liability Insurance for Bounce Houses?

General liability insurance for bounce houses is specialized coverage designed to protect your rental business from financial losses resulting from bodily injuries, property damage, and legal claims that may arise during normal business operations.

This foundational insurance serves as your financial safety net, covering expenses related to:

- Medical costs if someone is injured while using your equipment

- Property damage that occurs during setup or use

- Legal defense costs if your business faces a lawsuit

- Settlements or judgments awarded to plaintiffs

Without proper coverage, a single incident could lead to devastating financial consequences that might force you to close your doors permanently. With the right policy in place, you can focus on growing your business while knowing you’re protected against unexpected claims.

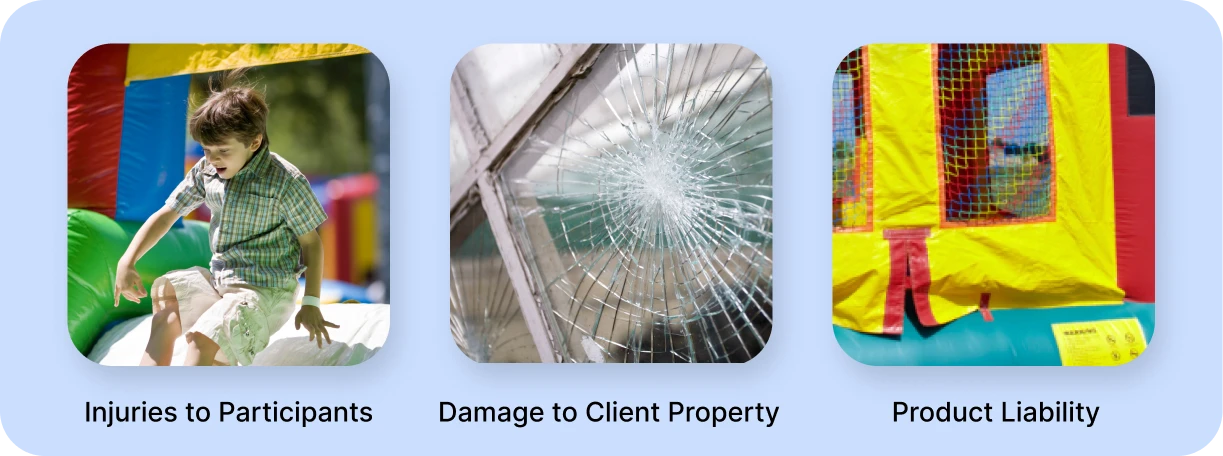

3 Key Risks Covered by Bounce House Liability Insurance

So what are those unexpected situations that general bounce house liability covers? Here are three of the most common risks:

1. Participant Injuries

Children (and adults) love the thrill of bouncing, but enthusiasm sometimes leads to accidents. From minor scrapes to more serious injuries like broken bones, your liability insurance steps in to cover medical costs when participants get hurt using your equipment.

Consider this scenario: A child falls in your bounce house and breaks their arm. Without insurance, your business could be responsible for thousands in medical bills, plus potential legal costs if the parents decide to sue. With general liability coverage, these expenses are typically covered up to your policy limits.

Note: While general liability insurance generally isn’t designed for weather-related damages, a business owner’s policy (BOP) may cover potential liabilities from bad weather. You can learn more about different insurance types here.

2. Property Damage

Inflatables are heavy and powerful equipment. During setup, operation, or breakdown, they can potentially cause damage to clients’ property — from lawn damage to broken fixtures or even structural harm to buildings.

For instance, if your bounce house tears up a client’s carefully maintained lawn or damages landscaping features during a rainy event, general liability insurance would cover the cost of repairs, helping you maintain positive relationships with your clients.

3. Legal Defense and Settlements

Perhaps the most significant benefit of general liability insurance is protection against potential lawsuits. If someone sues your business — even if the claim is without merit — your insurance typically covers attorney fees, court costs, and any resulting settlements.

The average liability claim for a small business can range from $10,000 to well over $100,000, depending on the severity of the incident and resulting injuries. These costs can be financially devastating without proper insurance protection.

Insurance Costs for Bounce House Businesses

The cost of general liability insurance varies based on multiple factors. A small, part-time operation might pay around $1,800 to $2,500 annually for basic general liability coverage. However, several elements influence your premium:

- Location: Businesses in areas with higher legal claims or stricter regulations may face steeper premiums

- Operating schedule: Seasonal businesses may find temporary insurance more cost-effective

- Claims history: Companies with previous accidents or claims will likely pay more

- Business size and rental frequency: Larger operations with frequent rentals typically pay higher rates

- Coverage limits: Higher coverage limits mean higher premiums

Most small to medium-sized bounce house rental businesses opt for policies with $1-2 million in coverage per occurrence, with an aggregate limit of $2-3 million. This level of coverage balances protection with affordability for most operations.

Additional Insurance Options for Complete Protection

While general liability insurance forms the foundation of your risk management strategy, a comprehensive approach often includes additional coverage types:

Product Liability Insurance

Even with regular maintenance and inspections, your bounce houses may have defects from the manufacturer that aren’t immediately visible. If a product defect causes an injury, your business could be held liable. Product liability insurance covers these incidents, providing protection if equipment malfunction leads to injury or property damage.

Commercial Property Insurance

This protects your bounce houses and related equipment while in storage or transit. Given the significant investment in high-quality inflatables, property insurance ensures you won’t face a total loss if your equipment is damaged, stolen, or destroyed.

Commercial Auto Insurance

If you transport inflatables to event sites, commercial auto coverage is essential. Your personal auto policy likely won’t cover accidents that occur while conducting business activities.

Workers’ Compensation Insurance

If you have employees, workers’ compensation is typically required by law in most states. This coverage pays for medical expenses and lost wages if employees suffer job-related injuries or illnesses.

Umbrella Insurance

For additional peace of mind, umbrella policies provide extra liability coverage beyond your standard policy limits. This can be particularly valuable for businesses servicing large events or operating in high-risk environments.

Inland Marine Insurance

Because in-transit items may not be covered under other insurance policies, inland marine insurance exists to cover eligible rental items while they’re in transit or once they’re at the venue. Note that specialized equipment like inflatables often require dedicated coverage options, so be sure to check with your insurance provider about specific coverage for bounce houses.

How to Choose the Right Insurance Provider

Not all insurance companies offer the same level of protection or industry understanding. When selecting a provider for bounce house insurance, consider these factors:

Industry Expertise

Look for companies with specific experience insuring bounce house and event rental businesses. These providers better understand the unique risks you face and often offer more appropriate coverage options.

As Luna Tolunay, CSEP of Fun Planners advises: “Shop around for a good broker you trust who works with a lot of businesses and markets so they can find the best price for you.”

Coverage Specifics

Review policy details carefully, paying attention to:

- Coverage limits and deductibles

- Exclusions and limitations

- Additional coverage options

- Claims process and response times

Reputation and Financial Stability

Research potential insurance carriers’ financial ratings (from organizations like A.M. Best or Standard & Poor’s) and read reviews from other bounce house rental businesses in Facebook communities like Party Rental Knowledge Group and Bounce House Business Success Group. When in doubt, you can always make your own post to ask advice on what other people use and if they like it. Current users can offer detailed info on service quality, claims process, and overall reliability.

An insurer’s financial stability is crucial — you need confidence they’ll be able to pay claims when needed.

Cost vs. Value

While it’s tempting to choose the cheapest option, remember that insurance is an investment in your business’s future. Balance cost considerations with the breadth and depth of coverage provided.

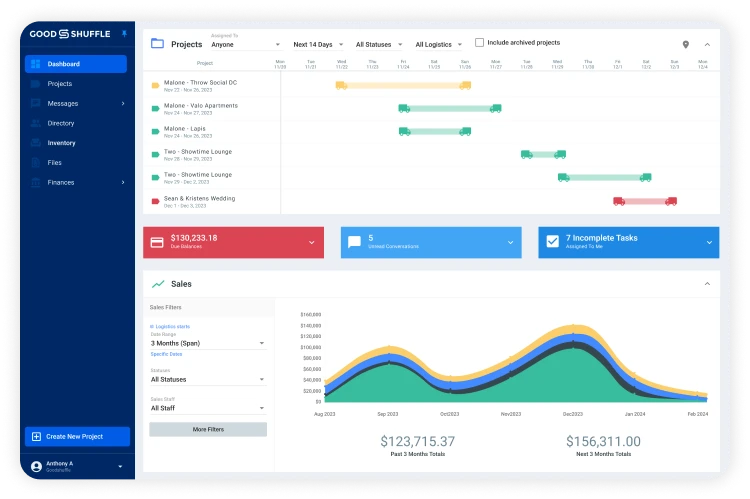

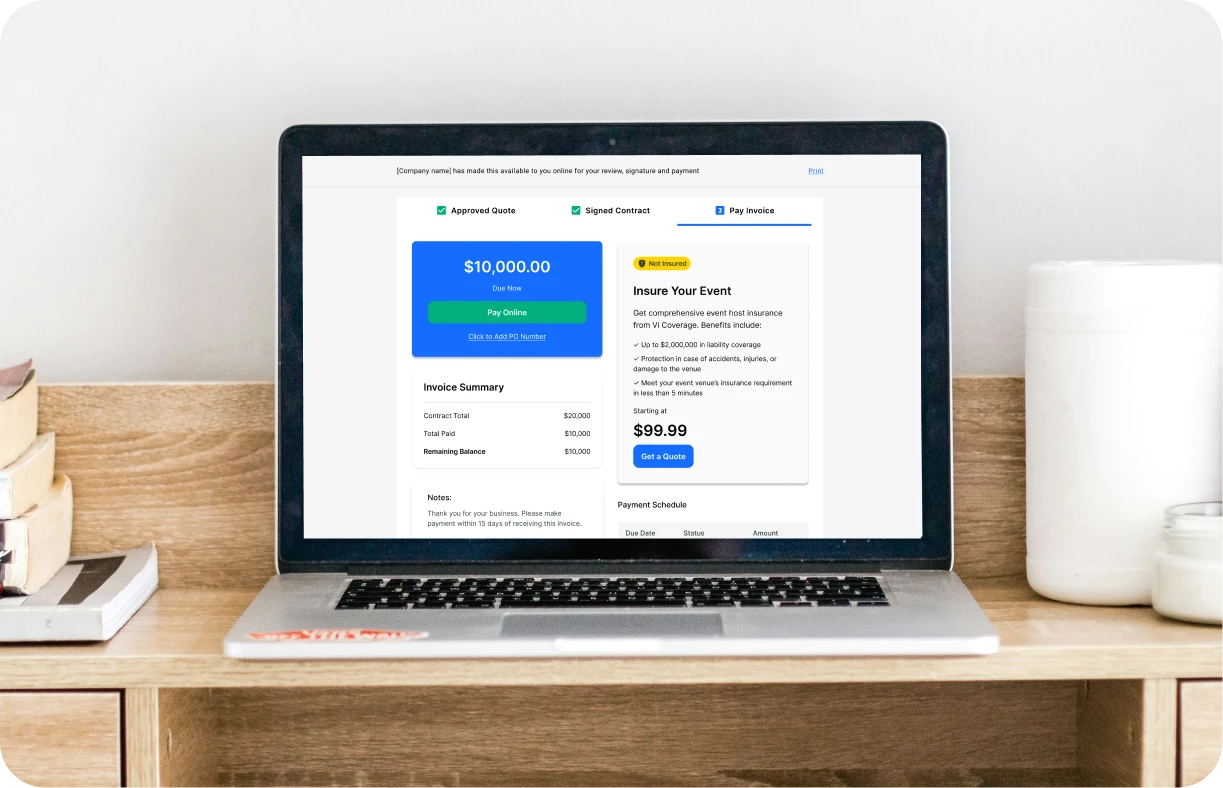

Modern Solutions: Integrated Insurance Options

Today’s event rental businesses need streamlined solutions that integrate seamlessly with their operations. Modern rental management platforms like Goodshuffle Pro are recognizing this need by incorporating event insurance options directly into their business management software.

With integrated insurance solutions, both rental companies and their clients benefit from a simplified process:

- Clients can secure event host insurance during the booking process with a simple online application

- Rental companies can ensure clients meet venue insurance requirements

- Both parties have documentation and coverage information in one place

- The rental company can be added as an additional insured party automatically

This integration eliminates the traditional hassle of paperwork, back-and-forth emails, and last-minute scrambling to secure proper coverage, making the entire rental process more efficient for everyone involved.

Tips for Reducing Insurance Costs

On average, party rental businesses in the U.S. spend between $500 and $1,100 annually for $1 million in general liability coverage.

But insurance costs can quickly add up, especially for a small business. Here are some strategies to help keep your premiums more affordable:

- Staff training: By investing in training for your team, you reduce the likelihood of accidents and lower your insurance risk profile, which may qualify you for lower premiums.

- Routine equipment inspections: Regular checks can help prevent issues before they arise, reducing the risk of equipment-related injuries or damage.

- Bundle coverage: Many providers offer discounted rates if you combine multiple types of insurance (like general liability and commercial auto), helping you save while getting comprehensive protection.

- Effective waivers and contracts: While damage waivers don’t eliminate liability entirely, they demonstrate that customers were informed of the risks. Have clients sign comprehensive liability waivers before using your equipment, especially for unsupervised rentals.

Temporary Insurance Options for Seasonal Businesses

For businesses operating on a part-time or seasonal basis, temporary insurance policies may offer a more affordable alternative to year-round coverage. Temporary insurance allows you to purchase coverage only for the periods you need, such as weekends, summers, or other peak rental seasons.

This flexibility can save money and ensure you’re protected when it matters most. However, if your business operates consistently throughout the year, a full-year policy might be more cost-effective in the long run.

The Cost of Not Having General Liability Insurance

For those just starting out, skipping insurance may seem like an easy way to cut costs. However, the risks of not having liability insurance can be financially devastating. Medical bills, legal fees, and damages can quickly add up to tens of thousands of dollars, especially in injury cases involving children. Businesses without insurance may face financial ruin from a single incident.

Beyond the financial costs, the absence of insurance could harm your reputation. Clients who experience issues may feel that your business isn’t taking safety seriously, which can impact word-of-mouth referrals and repeat bookings. Liability insurance is an investment in both the financial security and long-term reputation of your business.

With comprehensive coverage in place, you can focus on creating safe, enjoyable experiences for your clients, knowing that your business is protected from the unexpected. Get sufficient coverage, and let the fun continue — worry-free!