The modern event client values flexibility — in what they rent, where they rent from, and how they pay for it. The more flexibility your business offers, the more clients tend to say “Yes.”

Our newest feature — Buy Now, Pay Later — was specifically designed to help event businesses offer more flexibility.

To sum it up quickly:

- Instead of paying invoices in one lump sum, certain clients can now pay invoices in multiple, smaller installments.

- No matter how your clients choose to pay, you as the vendor still get paid immediately.

Read on to learn more about this powerful new financial feature.

What is Buy Now, Pay Later?

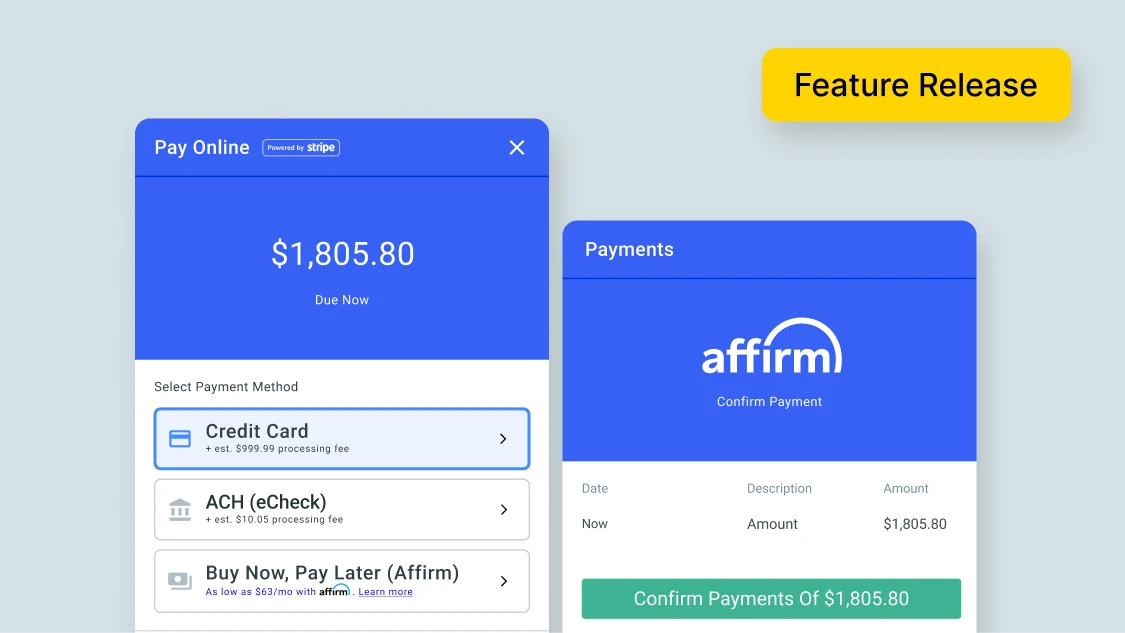

Traditionally, when consumers make purchases, they have to pay the total cost up front. With Buy Now, Pay Later, your clients have the option to pay their invoice in either four installments (without interest) or in up to 36 monthly payments (with interest).

From the client’s perspective, the option typically looks like this — which you may have come across while doing your own online shopping:

Buy Now, Pay Later is popular with businesses such as Amazon and online retailers because it turns “maybe” buyers into “yes” buyers, which increases checkout rates.

Goodshuffle Pro is bringing the same concept to event professionals, who can now enjoy the same benefits of offering flexible financing.

Only individuals, not businesses, can take out loans with Affirm — but when you work with non-corporate clients, this is an exciting new tool in your toolkit.

How Does This Feature Help Event Rental Companies?

Buy Now, Pay Later has the potential to help event rental companies in many ways, but the benefits fall into three major categories.

1. Win More Business

Sticker shock is the feeling consumers get when the price for something is unexpectedly high. If you’ve ever lost a client because the quote you sent was higher than they wanted, there’s a good chance you’ve seen this.

And if you work in the event industry, there’s a good chance you’ve seen it a lot.

Buy Now, Pay Later won’t solve every case of sticker shock — but it will solve some of them. When a client really wants to sign a contract, but they lack the commitment or cash flow to incur a large charge, the ability to spread payments over multiple small amounts sounds appealing.

It’s another tool in your arsenal to overcome objections from potential clients.

2. Increase Profitability

By overcoming sticker shock, Buy Now, Pay Later helps you close more contracts. But it also goes one step further, helping you increase the value of each contract you close.

After all, it’s not the small quotes that make clients nervous to pay. It’s the big quotes. The ability to spread large payments over the course of up to 36 months, rather than needing to pay a large sum immediately, makes the cost of big events easier for clients to stomach.

3. Get Paid Up Front, Risk-Free

If a client chooses to use Buy Now, Pay Later, they can pay less money up front — but that does not mean your business receives less money up front.

You’ll be paid in full immediately, and Affirm — one of the nation’s largest financial technology companies — will front the money, assume the risk, and collect due balances from the client. Affirm’s fee is 6% + $0.30 per transaction, and it does not charge integration fees, annual fees, or monthly fees.

🤝 Learn more about our partnership with Stripe & Affirm

What Does It Look Like For Clients?

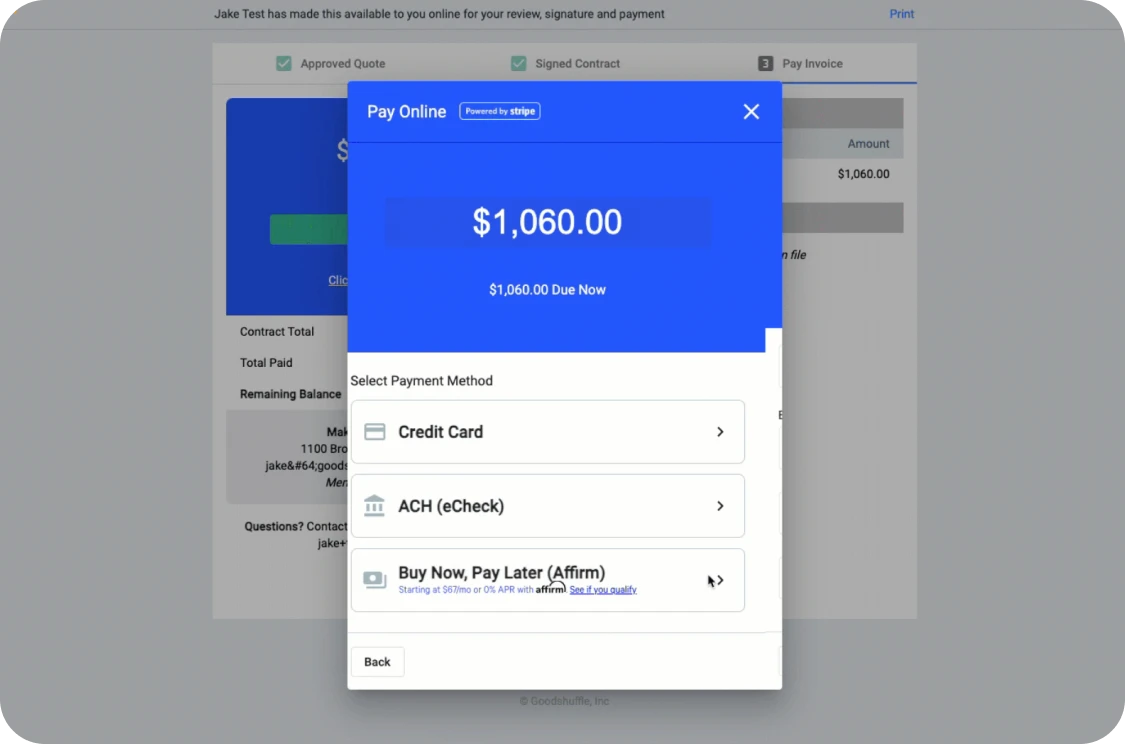

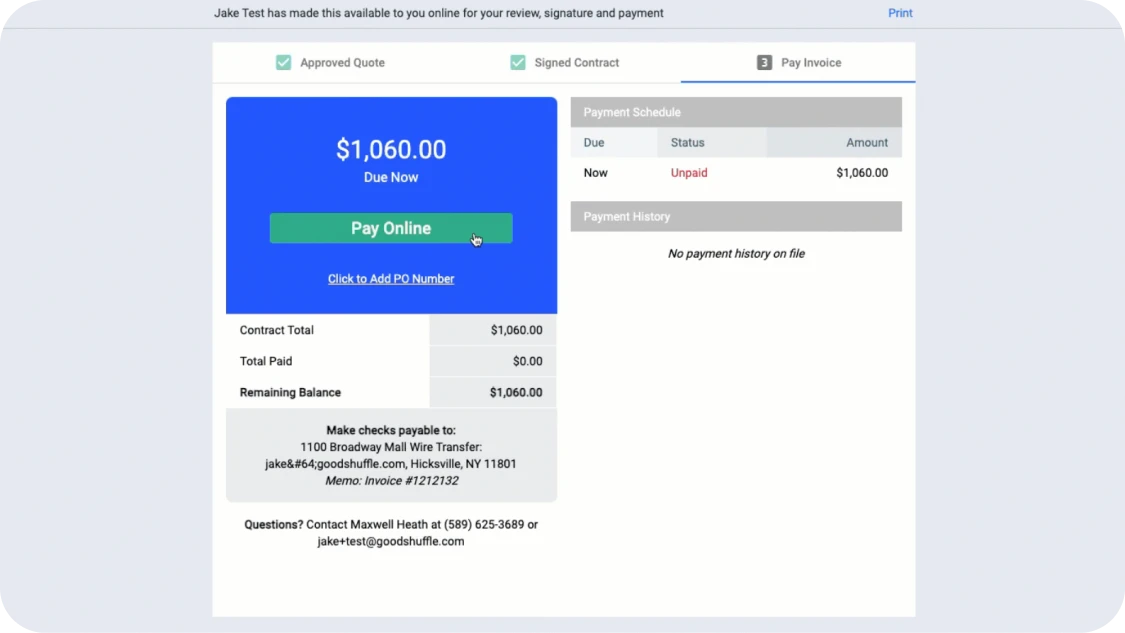

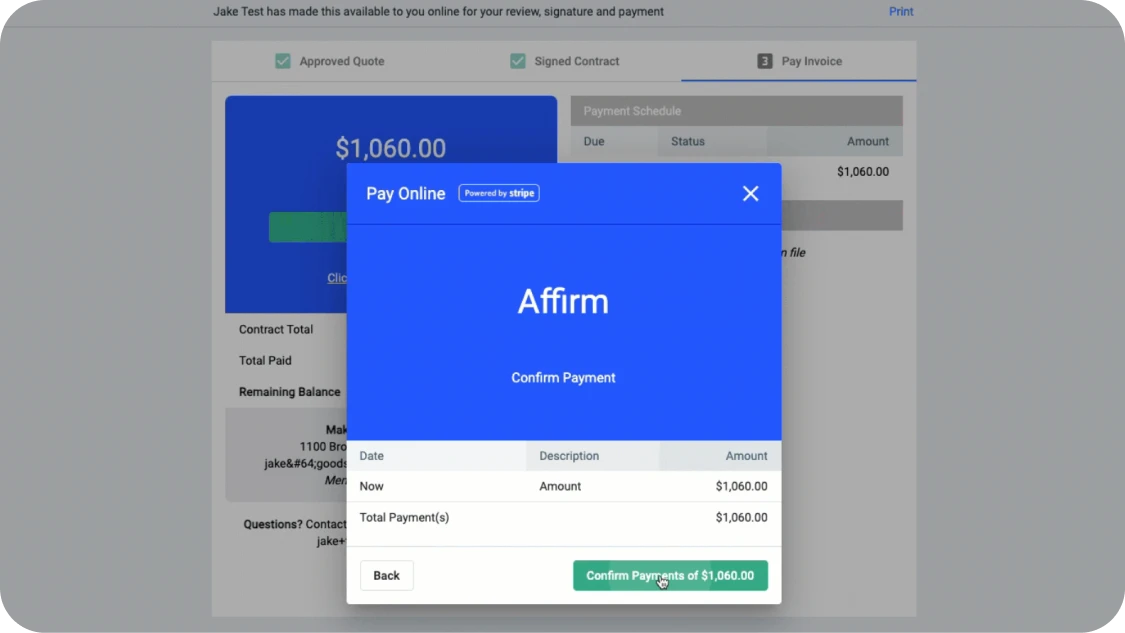

After your clients sign your contract, they’ll be directed to the Pay Invoice tab of their live quote link. When they click “Pay Online,” they have the option of selecting “Buy Now, Pay Later (Affirm).”

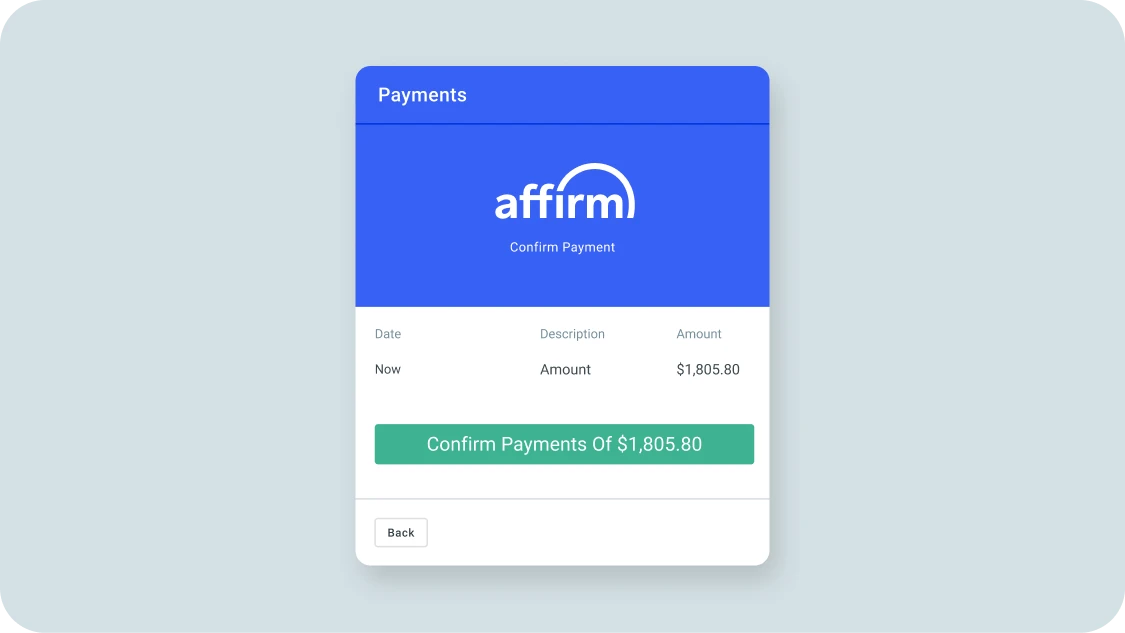

From there, they can enter their Full Name and Billing Address, click “Pay with Affirm,” and then click “Confirm Confirm Payments of X Amount.” This will direct them to the next page to confirm the payment total and then set up an account with Affirm.

Once they’ve done that, Affirm will walk them through choosing a payment plan. When their purchase is successful, they’ll be redirected back to Goodshuffle Pro’s live invoice link. They’ll see a Payment Successful pop-up window and their invoice will reflect the Total Paid through Buy Now, Pay Later, along with the Remaining Balance.

Your client will also receive a notification via email that they can keep for their records.

💡 Learn more in our Help Center

4 Examples of How to Use Buy Now, Pay Later

There are tons of creative ways to boost your business with Buy Now, Pay Later. Some of the possibilities include:

- You give your sales team aggressive goals to hit for total contract value. Your salespeople use Buy Now, Pay Later as a powerful upsell tool.

- You want to improve success with millennials, who are used to the Buy Now, Pay Later models in other industries. You use the feature to position your business as more modern and accessible than your competitors.

- You’ve historically had price-conscious customers. In the past, they’ve sometimes been scared off by the total price and haven’t followed through with quotes. Now, you’re more likely to close this business.

- A bride you’re working with wants to wait to pay until she gets her commission check. With Buy Now, Pay Later, she gets flexible payments and you get paid immediately.

What’s Next?

We can’t wait to see how you use Buy Now, Pay Later. But the features don’t stop here. We’re always adding exciting new features to Goodshuffle Pro. If you’d like to stay in the loop on what’s new, subscribe to our newsletter.

And if you’re not already a Goodshuffle Pro user, check out what the platform has to offer by scheduling a demo below.