First of all, what is a dispute? It’s a headache and a half, is what it is. A dispute is when a client contacts their bank (or vice versa, in the case of suspected fraud), and says that they shouldn’t have to pay a charge to your event company. The reasons can range from dissatisfaction to fraud, and everywhere in between. Some disputes are valid (a double charge) and some are not (if you’ve already given someone a refund and they file a dispute anyway) — but all of them will require your attention. If you’re wondering how to prevent disputes against your event company, you’ve come to the right place.

Not only are disputes a pain, high dispute activity can result in hefty fines — and even the inability to accept certain types of credit cards. They are also a sign of client dissatisfaction, so if you’re getting a lot of them it’s a sure sign that it’s time to take a second look at your methods and policies.

Unfortunately, it doesn’t actually matter to the banks if you win or lose a dispute, all they care about is that one was filed against you. That’s why it’s important to avoid them in the first place. While it’s unlikely that you’ll be able to completely prevent disputes, there are ways to help reduce them — and to make them easier to deal with when they do crop up. These changes are relatively simple to implement and are good business practices in general.

Collect enough information at purchase

Many disputes can be avoided by collecting a bit more information during purchase. If you’re using Goodshuffle Pro’s online payments, gathering the basic information below is automatically a part of the payment process.

Make sure you collect:

- Cardholder’s name

- Email address

- Full billing address

- The last 3-4 digits (CVC Number) on the back of the credit card

- Signed contract agreeing to terms and conditions (including your cancellation policy)

- Note: The person paying for the event should be the one signing the contract. Ensure that whoever is signing and paying the contract is listed as the client on the contract, even if it’s the end client and you’re first sending the quote to a planner for approval. This will avoid the client claiming that they never signed the contact for the reason that “it was under the name of the planner/company”.

Pretty standard stuff, right? Using a secure third party to accept payment will actually work in your favor, as you won’t have this sensitive information hanging out on your computers or in your desk. These companies have to undergo rigorous security checks; you do not. If you keep this sensitive financial information in an unsecured location, you’re opening yourself up to real theft and fraud claims, as you’ll have no way to prove that someone didn’t, in fact, steal the financial information from you.

Gather digital files to back up your claims

When you collect digital files like photos and signed documents as future evidence in case of a dispute, you never have to worry about digging these up later. Digital files allow you to stay more organized so you have this crucial information at your fingertips. Some of the files you should gather at every event include:

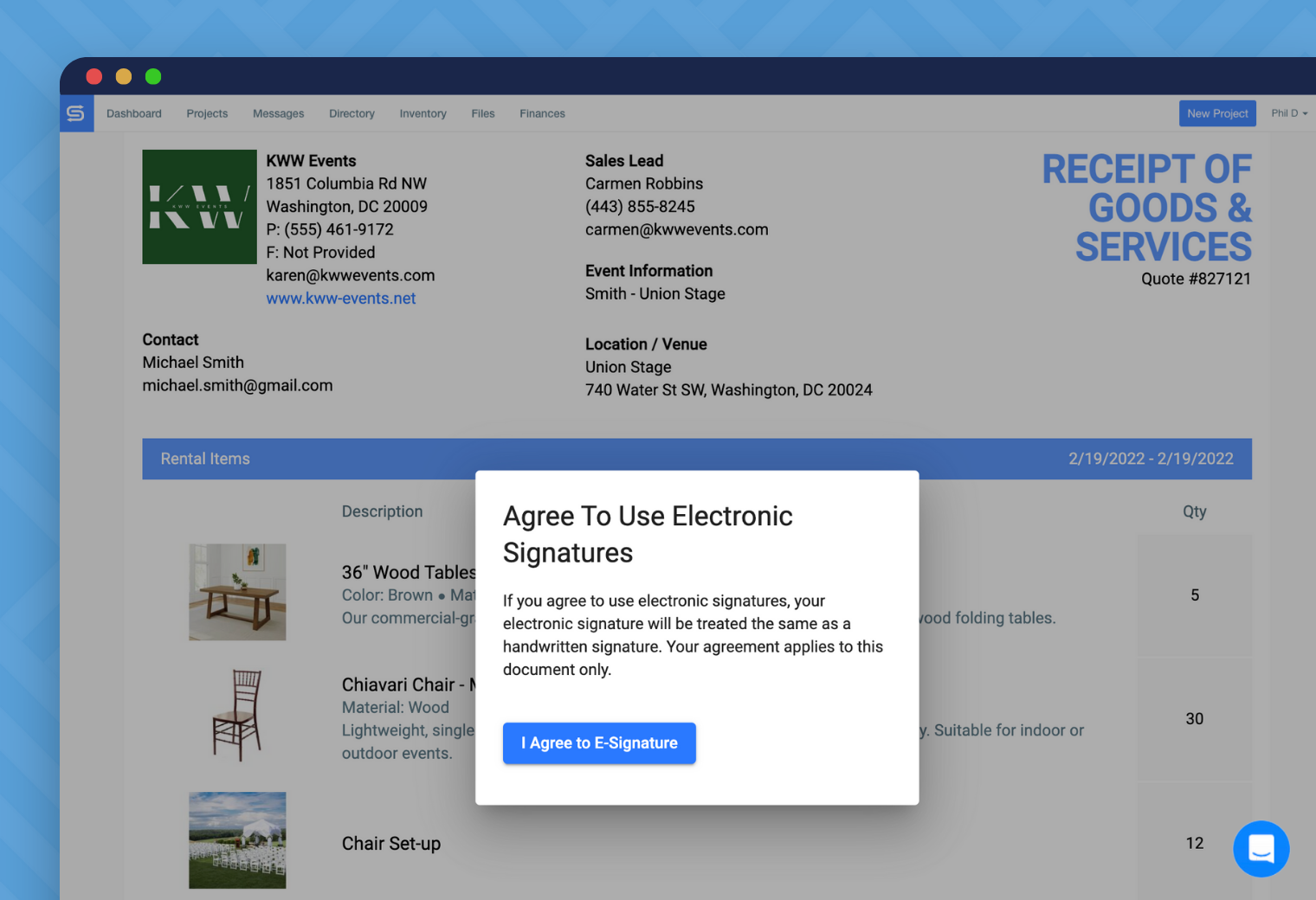

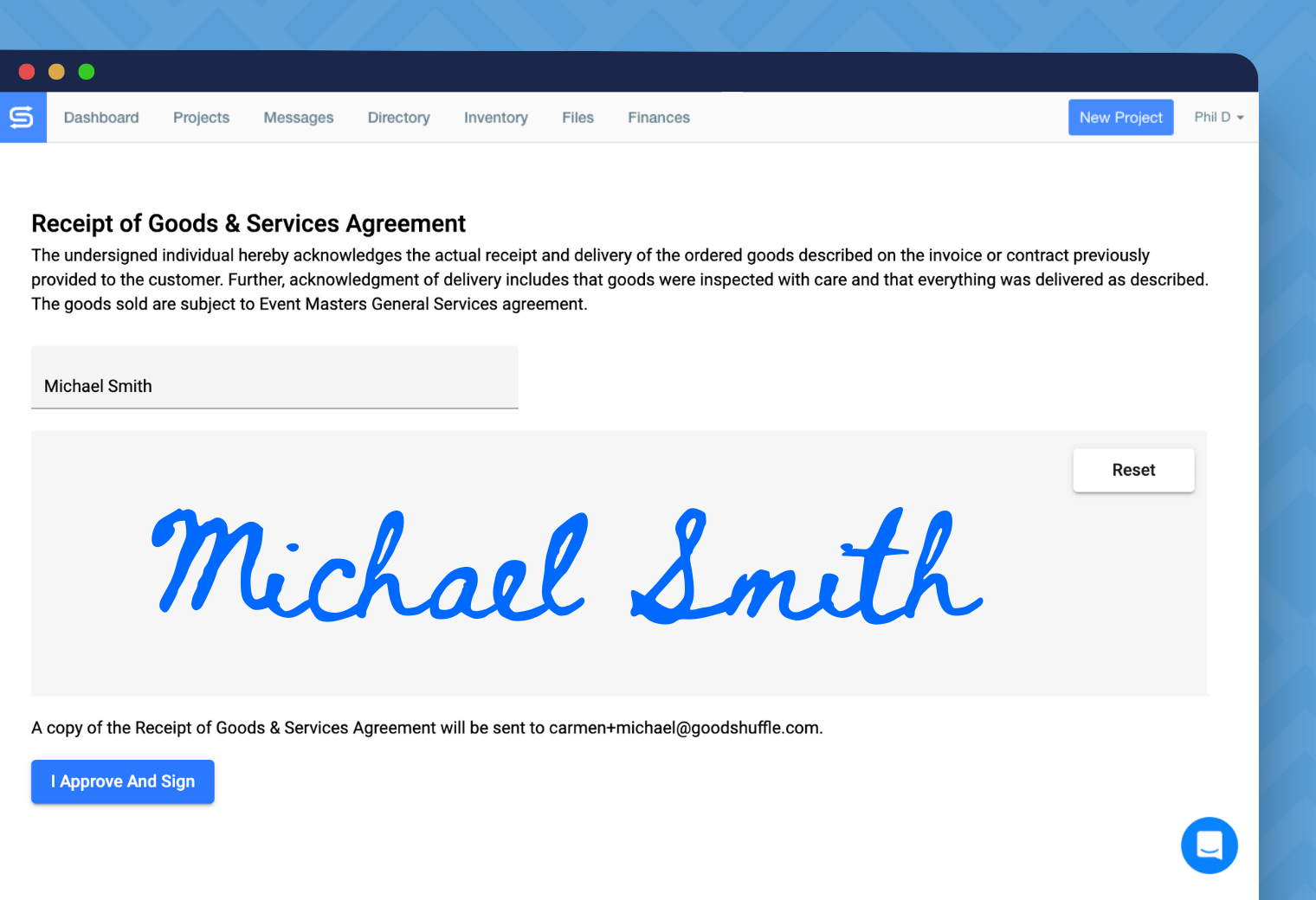

Receipt of Goods & Services

The electronic Receipt of Goods & Services within Goodshuffle Pro allows you and your team to easily capture a client’s signature on the day of the event. By signing this document, your client confirms they’ve received everything they expected. Your team can quickly pull up this digital document on a tablet or smartphone on site, or right on your computer for in-store pick-ups. Then, once the client signs, a PDF copy of the document is 1) automatically added to the files of your project in Goodshuffle Pro so you can stay organized, and 2) immediately emailed to the client for their records as well.

This e-document is dispute armor. Without it, your business is at a much higher risk of receiving disputes — and losing them.

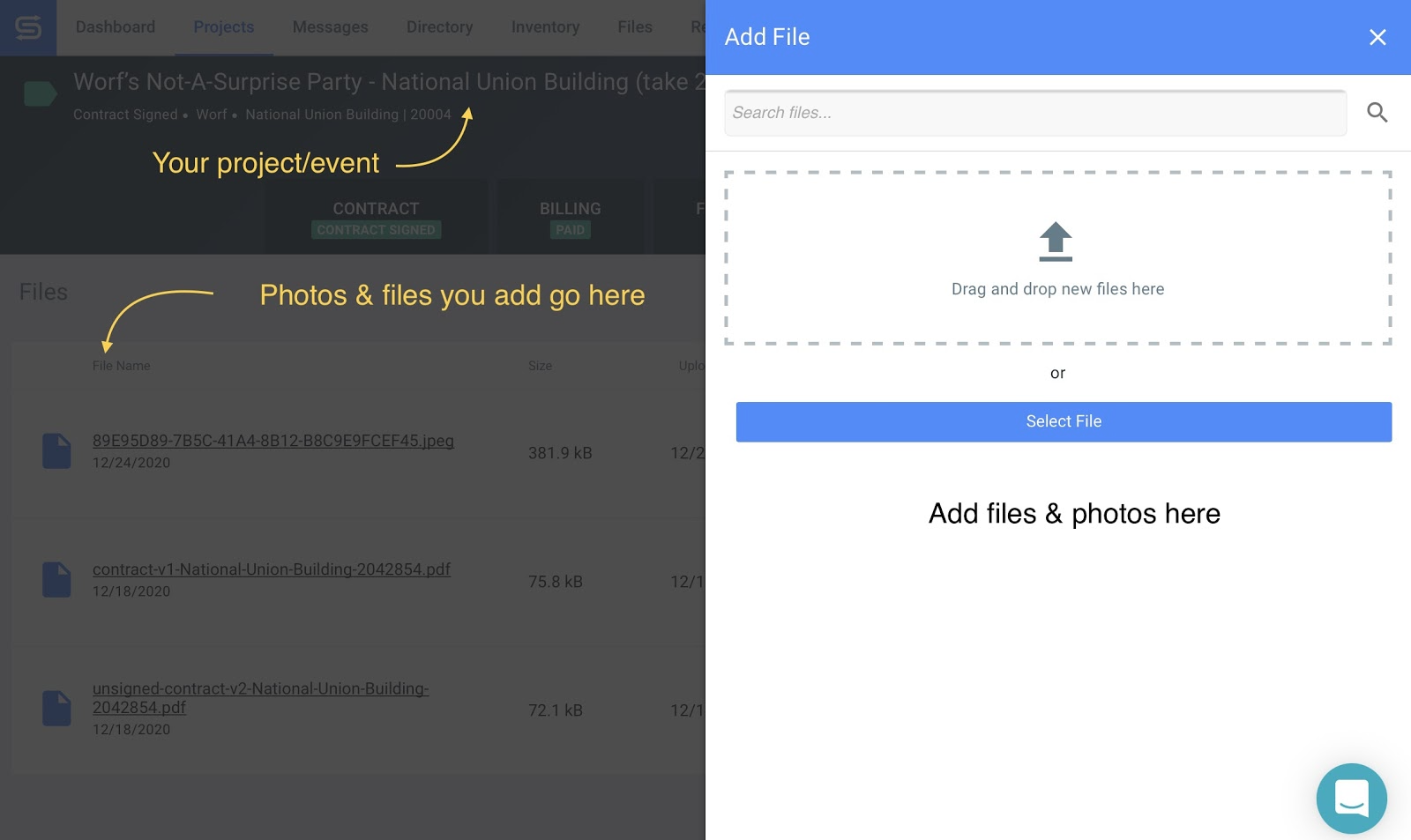

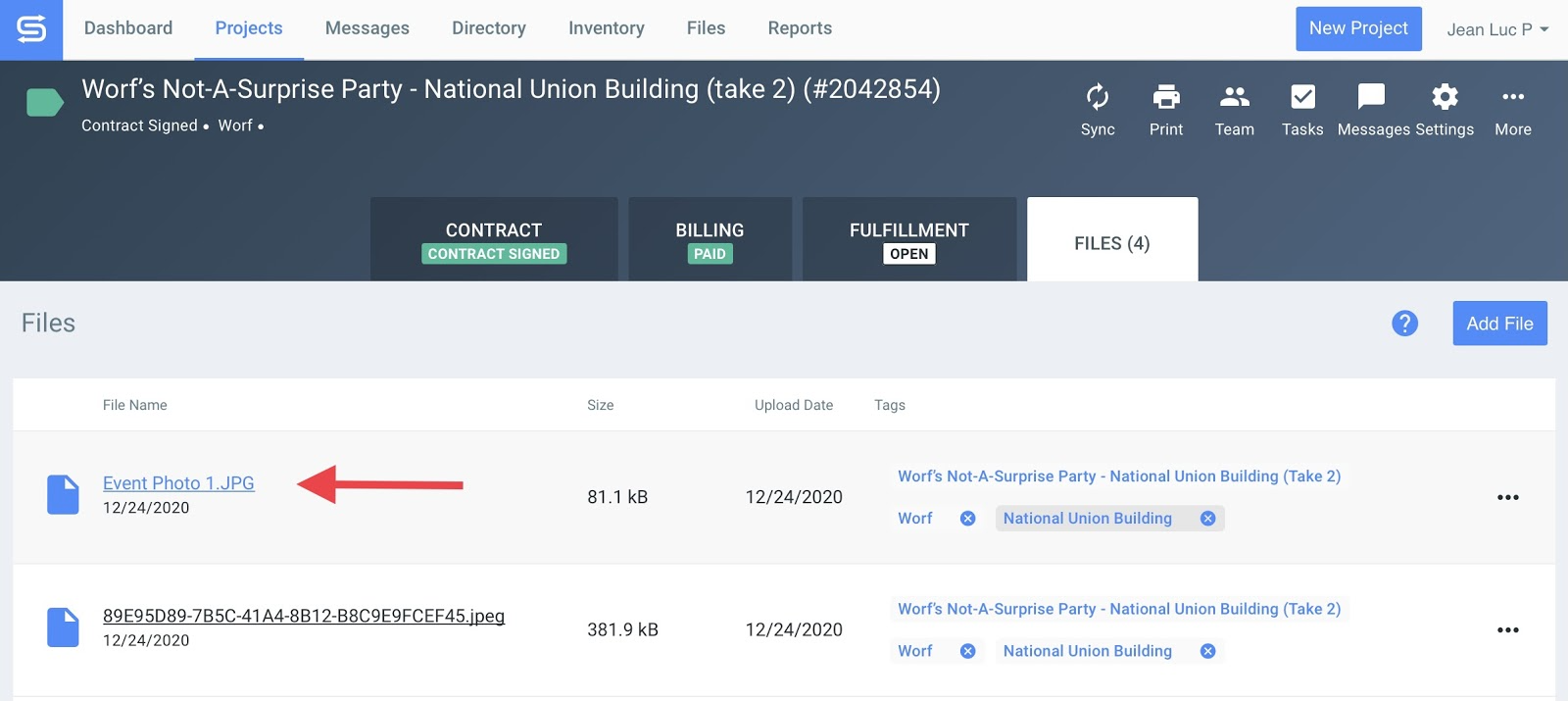

Photo evidence of the event

You can easily drag and drop photos from your event right into the project in Goodshuffle Pro. It keeps everything together so it’s easy to find later.

All of this information is very helpful to have on hand if a dispute does happen. Because disputes can take around 2-3 months to resolve, having these documents organized and on hand can help move the process forward at a faster rate than if you have to search for them — or risk not having them at all. You also only get one shot to submit all of your documents for the dispute, so it really works in your favor to have everything you need on hand ahead of time.

Make sure your policies are crystal clear

If you haven’t already met with your attorney to create clear refund and cancellation policies, you should do so ASAP! Creating these with an attorney is the best way to protect your event company — we do NOT recommend trying to DIY anything involving the legal process. It’s also important to make sure your clients read and agree to these policies; requiring signatures is a great solution. People tend to not read terms and policies, but if you require a signature they’re much more likely to read what they’re signing. This should go a long way in preventing disputes where a client cancels too late (per the cancellation policy) and wants a full refund. And if that type of dispute does happen, you have the evidence on hand to back up your case. It’s important to note that you need to collect these signatures before the client pays.

Tell your clients how the charges will show up on their statements

If a client doesn’t recognize a charge on their statement (or forgot about a charge), they will often file a dispute mistakenly thinking that fraud was involved. The only real way to get ahead of this type of dispute is to let them know how the charge will appear on their statement and to send a confirmation/receipt after the charge is submitted. Unfortunately, there’s not a lot you can do about them forgetting a charge!

The good news is that a client can withdraw this type of dispute from their bank. You’ll still need to submit some evidence (such as receipts), but it’s relatively easy to wrap up as there’s not about you winning a case.

Talk to your clients regularly

This is the most important factor in preventing disputes. Why? Because if there’s a problem, you have an opportunity to fix it before the client escalates it to a dispute, especially in the cases of duplicate charges, client dissatisfaction, bank issues, etc. You can always issue a partial/full refund or issue a credit before a dispute begins, but once a dispute is filed that option disappears and you are at the mercy of the dispute process and the client’s card issuer.

The best offense is a good defense — and good business practice, too

While disputes cannot be completely avoided, by implementing these suggestions your event company should be able to get ahead of some of the more common reasons for disputes. When a dispute does happen, you’ll also be more prepared to provide any necessary evidence to the card issuer and, hopefully, win the dispute. Remember: the only way to win a dispute is to provide sufficient and compelling evidence. While no one wants to do business expecting disputes around every corner, it’s better to be prepared. Plus, we think these tips are just good business records practices!