Getting paid shouldn’t be your biggest challenge. Yet too many event professionals still struggle with rigid payment systems that don’t match their business needs, clunky signature processes, and outdated payment methods that frustrate clients.

That’s why we’re excited to announce three powerful new features designed to streamline your financial operations and enhance your client experience.

To sum it up quickly:

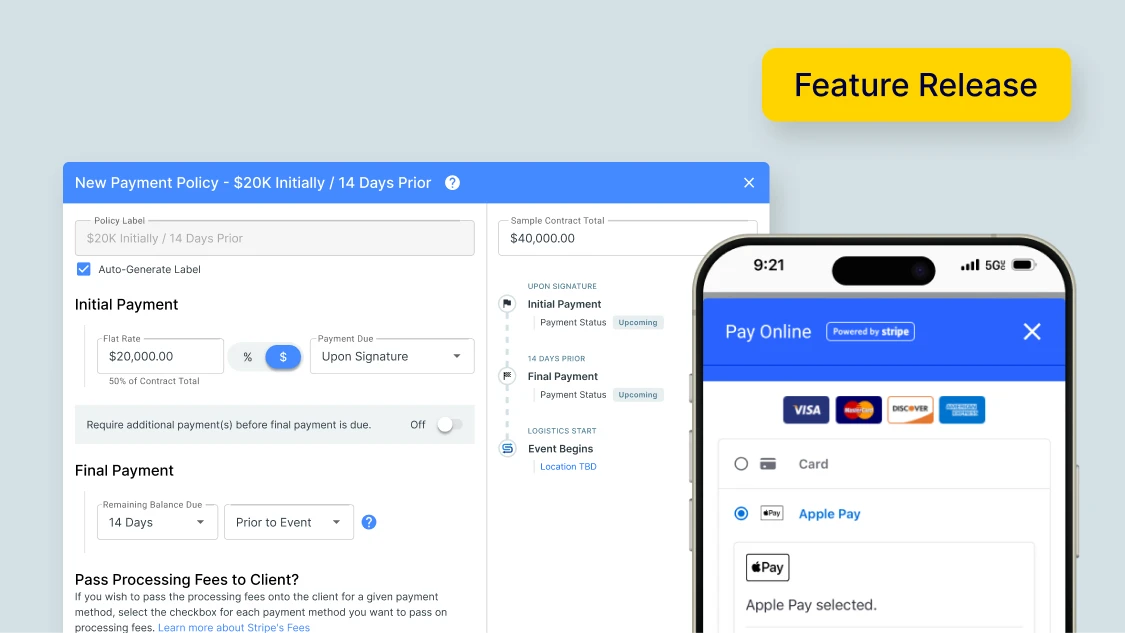

- Flexible Payment Policies let you create custom payment schedules that work for your business and your clients’ budgets.

- In-Person Contract Signatures eliminate email delays and allow you to close deals on the spot with a simple touchscreen signature.

- Apple Pay & Google Pay Integrations offers your clients the modern, secure payment options they expect.

These features work together to create a seamless payment experience that will help you close more deals, get paid faster, and delight your clients along the way.

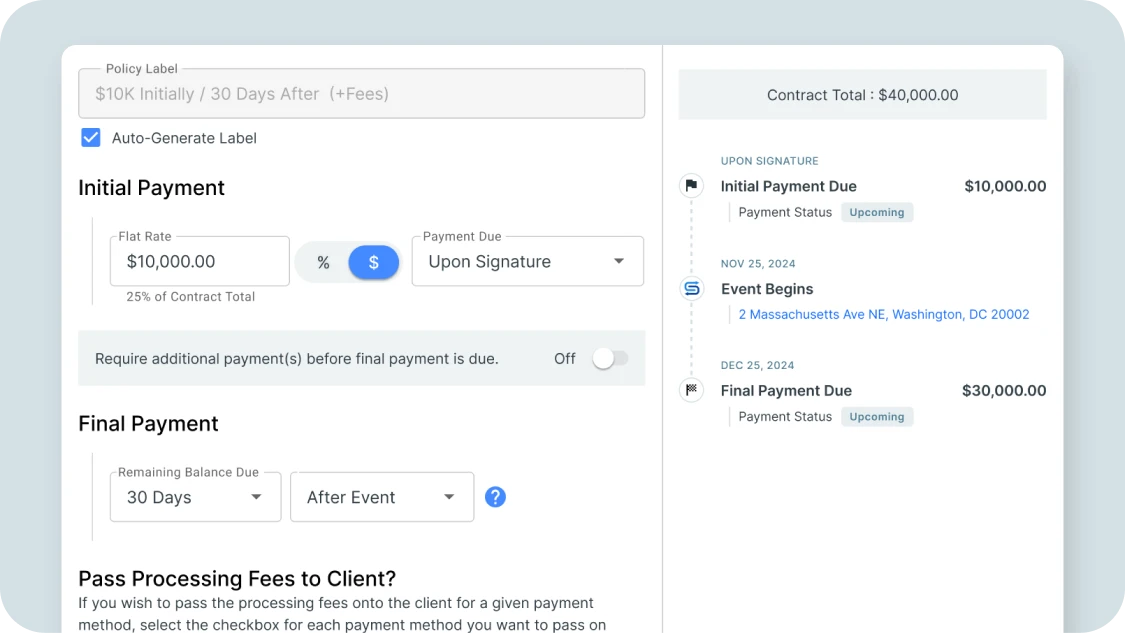

Flexible Payment Policies: Take Control of Your Cash Flow

Picture this: You’ve just landed a major corporate event contract worth $20,000, but the client wants to split payments into manageable installments rather than making two large payments. With our new flexible payment policies, you can now create a custom payment schedule that works for both of you — without leaving the Goodshuffle Pro platform.

Our expanded payment policy options include:

- Multiple payment intervals in a flexible schedule (e.g., deposit + 4 payments leading up to the event)

- Equal installments (e.g., 6 monthly payments)

- Combined upfront and net payments (e.g., 50% deposit with final payment 7 days after the event)

Plus, the intuitive payment timeline gives both you and your clients a clear visual representation of when payments are due, eliminating confusion and reducing those awkward “where’s my payment?” conversations.

💰 Here’s how flexible payment policies work

How Do Payment Policies Work in Real Life?

Example 1: The Large Corporate Event

If you’re working on a $25,000 corporate gala, you can create a payment policy with 5 equal monthly installments of $5,000. This makes the contract more appealing to your client while ensuring steady cash flow throughout the planning process.

Example 2: The Post-Event Final Payment

If you work with corporate clients who require net-30 payment terms, you can set up a payment policy with 50% due at booking and 50% due 30 days after the event, all tracked automatically in Goodshuffle Pro.

Example 3: The Wedding Payment Plan

For wedding clients who appreciate smaller, more manageable payments, you might offer a payment plan with 25% due at booking, followed by four equal quarterly payments, with the final 25% due two weeks before the wedding.

Payment Policies in the Vendor Setup Flow

New to Goodshuffle Pro? As part of our streamlined Vendor Setup Flow, you’ll now be able to select a default payment policy during onboarding. This removes potential blockers for your sales team and gets you sending quotes faster than ever.

In-Person Contract Signatures: Close Deals on the Spot

We’ve all experienced this frustrating scenario: A client is in your showroom, ready to book, but then you have to send them the quote or contract via email. Even if they’re standing right in front of you, they need to check their email, open the client view, and complete the signature process — often fumbling with their phone or promising to do it later when they’re at a computer. Days might pass with no signature.

With our new In-Person Contract Signatures feature, those awkward moments and delays are a thing of the past. And the process works seamlessly with Goodshuffle Pro’s Card Readers as well.

This feature allows your clients to sign contracts directly on your device — whether it’s a tablet, smartphone, or touchscreen computer — while they’re still excited about your services. No more waiting for emails or follow-ups. The digital signed contract is automatically uploaded to the project, just like other electronic signatures.

✍️ How can I access digital signatures?

Real-World Applications for In-Person Signatures

Example 1: The On-Site Adjustment

Imagine you’re delivering audio equipment for a corporate event when the client requests additional speakers. Instead of creating a separate contract later, your delivery team could adjust the order on their tablet, calculate the new total, and have the client sign the updated contract right then and there. The additional speakers could be delivered within the hour.

Example 2: The Showroom Close

If you have a showroom where clients come to see different rental options, your clients could now complete the entire booking process — including digital signature — before they leave. This could significantly reduce the number of “lost” contracts that happen when clients leave without signing.

Example Scenario 3: The Festival Vendor

Consider a situation where you’re managing multiple vendors at a large event. If a vendor needs to modify their booth requirements during setup, you can simply update the contract on your phone and collect a new signature immediately, avoiding confusion and ensuring proper documentation.

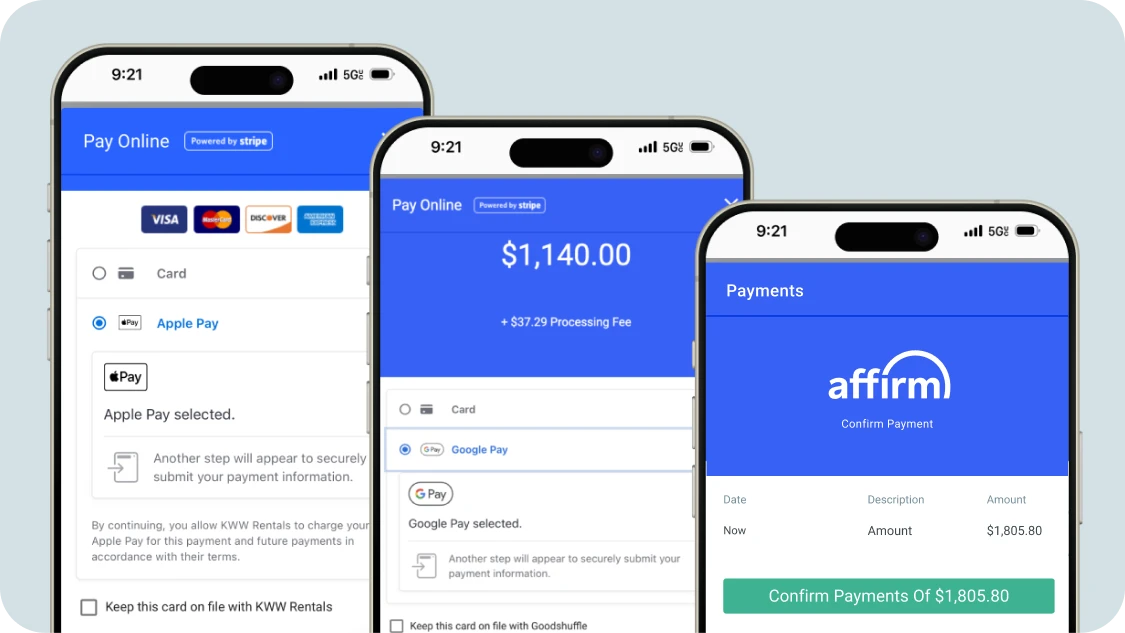

Apple Pay & Google Pay: Seamless Payments Made Simple

Consumers don’t just like convenient payment options, they expect them. A 2021 survey revealed that 48% of consumers are likely or very likely to use Apple Pay and Google Pay for bill payments if available, with 40% considering these options important or very important.

That’s why we’re thrilled to introduce Apple Pay and Google Pay integrations to Goodshuffle Pro, in addition to ACH, card, and Buy Now, Pay Later. Now your clients can pay with just a tap or a face scan — no more manually entering credit card information.

This seamless payment experience not only impresses clients with its modern approach but also helps you get paid faster by removing payment friction. And don’t worry — you’ll still be able to keep the card on file for future payments, even when clients use Apple Pay or Google Pay.

The Power of Modern Payment Methods

Example Scenario 1: The Last-Minute Booking

Consider receiving a next-day booking request for a pop-up corporate event. With Apple Pay, your client could review the contract and complete payment in less than 2 minutes. The speed and convenience could help seal the deal for this last-minute opportunity.

Example Scenario 2: The Remote Client

If you work with clients from across the country, such as for destination events, your clients could quickly approve and pay for additional items via Google Pay while on site visits, all from their smartphone without needing to access a computer.

Example Scenario 3: The Tech-Savvy Client

For younger, tech-savvy clients who expect digital payment options, offering Apple Pay and Google Pay could position your business as a forward-thinking choice in your market, potentially attracting clients who value innovation and convenience.

Ready to Elevate Your Client Experience?

These three new features — Flexible Payment Policies, In-Person Contract Signatures, and Apple Pay & Google Pay integration — work together to create a payment experience that’s as exceptional as your events. By offering more flexible payment options, convenient signature methods, and modern payment solutions, you’ll:

- Close more deals by accommodating clients’ financial needs

- Get paid faster with less payment friction

- Reduce administrative work by keeping everything in one system

- Enhance your professional image with cutting-edge tools

- Improve client satisfaction by making it easier to do business with you

If you’re already a Goodshuffle Pro user, you can start exploring these features today. Not a user yet? Schedule a demo to see how our modern event software can help you streamline your payment processes and deliver an exceptional client experience.