Table of Contents

-

What Is General Liability Insurance?

-

What Is Inland Marine Insurance?

-

Coverage Comparison: General Liability vs. Inland Marine

-

Why the Distinction Matters

-

Coverage Considerations for Event Rental Businesses

-

A Layered Approach to Protection

-

The Value of Comprehensive Coverage

-

Easy-to-Get Insurance for Your Business and Clients

As an event rental business owner, you’ve invested significantly in your inventory. Each tent, table, speaker, and lighting fixture represents both financial value and your company’s reputation. But understanding how to properly protect these assets can be confusing, especially when insurance terminology isn’t always intuitive.

Let’s explore the differences between general liability and inland marine insurance, how they complement each other, and what event rental businesses should consider when evaluating their coverage needs.

What Is General Liability Insurance?

General liability insurance is a fundamental policy for most businesses. It primarily protects your company from third-party claims related to bodily injury, property damage, and personal injury claims that might occur during your business operations.

General liability typically addresses customer injuries at your warehouse, damage to venues during setup or breakdown, advertising injuries such as copyright infringement, legal defense costs for covered claims, and medical payments for injured third parties. For instance, if a client visits your showroom and trips over a cable, or if your team accidentally damages a venue’s wall during installation, general liability insurance would typically respond to these situations.

Event rental businesses face distinctive challenges that differ from traditional retail or service businesses. Your valuable inventory constantly moves between locations and is handled by multiple parties, including clients and their guests. Your items operate in diverse environments with varying risk factors, and your business model involves equipment being out of your direct supervision for extended periods. These factors create potential protection gaps that standard business insurance might not fully address.

What Is Inland Marine Insurance?

Despite its nautical-sounding name, inland marine insurance is highly relevant to event rental businesses. It was originally developed to protect goods being transported over water, but has evolved to cover valuable property that moves or is transported to different locations.

Traditional inland marine insurance generally covers equipment while in transit to and from events and your inventory while temporarily at event venues. It provides protection against theft, damage during transportation, and property that experiences significant damage due to misuse or neglect. This coverage is designed specifically for property that moves around regularly — making it particularly relevant for the event rental industry.

🔒 #1 way to protect inventory: Inland marine insurance

Coverage Comparison: General Liability vs. Inland Marine

Here’s a quick reference guide to help you understand the key differences between these two essential types of insurance:

| Coverage Aspect | General Liability | Inland Marine |

| Primary Purpose | Protects against third-party claims | Protects your business property/equipment |

| Location Coverage | Your business premises | Varies by policy (see note below) |

| Typical Claims | Bodily injury, property damage to others | Theft, damage to your equipment |

| Covers Equipment in Client Possession | No | Yes, with Goodshuffle Pro’s Event Insurance integration |

| Customer/Guest Injuries | Yes | No |

| Legal Defense Costs | Yes (for covered claims) | Sometimes (equipment-related disputes) |

| Vehicle Coverage | No (requires auto insurance) | Equipment in/on client’s vehicles |

| Filing Claims Impact | May affect business insurance rates | May affect business insurance rates |

Note: With Goodshuffle Pro’s Event Insurance integration, the inland marine coverage specifically protects your inventory after it has been handed off to your client, not during your company’s handling or transportation of the equipment.

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.

Why the Distinction Matters

Consider these scenarios that illustrate the complementary nature of these policies:

Scenario 1: A wedding guest is injured after tripping over your extension cord at a reception. Your general liability insurance would typically cover their medical expenses and potential legal claims.

Scenario 2: A client rents decor & serving trays for their outdoor festival, and a windstorm damages the equipment after you’ve handed it off to them, resulting in $10,000 of equipment damage. The inland marine coverage through Goodshuffle Pro’s integration would protect this equipment while in your client’s possession, and you’d be completely covered.

Scenario 3: Your client rents $25,000 worth of lighting equipment for a corporate event. After they take possession, an unexpected electrical surge damages most of the gear.

Fortunately, they had purchased $10,000 of inland marine coverage through Goodshuffle Pro’s Event Insurance integration. While this amount doesn’t meet the 90% coinsurance threshold (which would require at least $22,500 in coverage), it still provides a meaningful payout toward the loss — reducing the financial impact for both your client and your business.

Coverage Considerations for Event Rental Businesses

When evaluating your insurance protection, several key points deserve consideration. Location matters significantly — general liability primarily covers incidents at your fixed business location, while inland marine expands protection to locations where your clients are using your equipment. There’s also an important distinction between asset protection versus liability protection: general liability protects you from what happens to others, while inland marine protects what happens to your own valuable equipment while in your clients’ possession. These policies work together rather than replacing each other, each addressing different aspects of your business risk.

A Layered Approach to Protection

The most comprehensive protection strategy combines multiple elements working in tandem. General liability insurance covers third-party claims involving bodily injury or property damage. Inland marine insurance protects your inventory while in client possession. Damage waivers address minor damages that might occur during client use. Being added as an “additional insured” on event policies provides an extra layer of protection. With each layer, you’re building a more robust shield around your business assets and operations.

The Value of Comprehensive Coverage

For perspective, consider the math: If your average event includes $10,000 worth of equipment and you run 50 events annually where clients take possession of your inventory, that’s $500,000 worth of inventory that could potentially benefit from inland marine coverage during these events.

Without proper protection, a single significant loss could impact your immediate financial stability, your ability to fulfill upcoming contracts, your insurance premiums if claims are filed, and your long-term business growth potential. The right coverage ensures business continuity even when unexpected incidents occur.

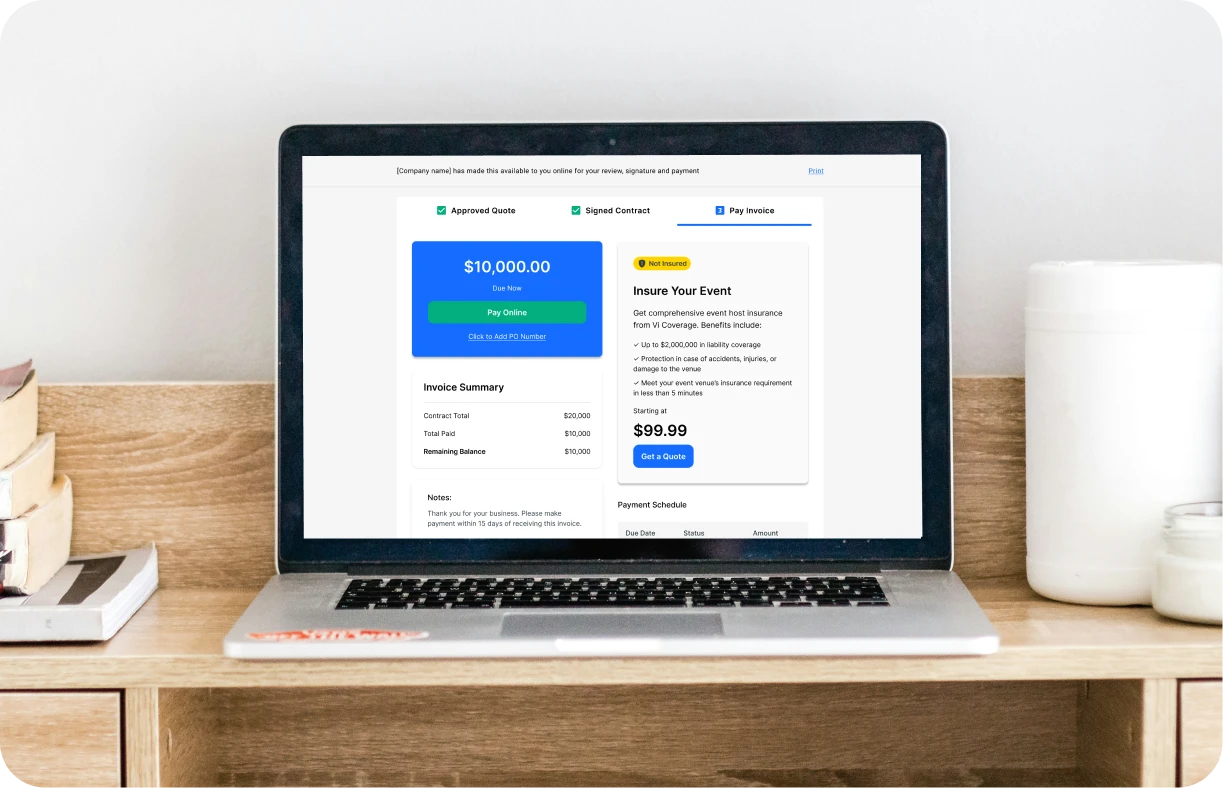

Easy-to-Get Insurance for Your Business and Clients

Insurance doesn’t have to be complicated. Modern solutions are making it easier for both rental businesses and their clients to obtain appropriate coverage without administrative headaches.

Goodshuffle Pro’s new Event Insurance integration is revolutionizing how event rental businesses approach protection. This innovative feature allows clients to obtain event host insurance with just a few clicks. As part of this integration, rental businesses receive inland marine coverage for their inventory specifically during client possession, and event companies are automatically added as “additionally insured” parties on the event host policy.

This means all parties have appropriate protection without filing claims against their primary business policies — which not only enhances protection but potentially helps keep insurance rates stable by reducing claims against your primary policies. It’s a win-win.

Get Insured For Free

Benefit from up to $15,000 free coverage with every insurance policy your clients purchase.