Whether you’re renting out linens, tables, tents, bounce houses, or something in between, all party rental businesses have one thing in common: They need insurance.

In the off chance someone gets injured at an event or one of your employees accidentally damages property, having the right coverage can save you from costly legal headaches.

You don’t want to be like the 3 in 4 small businesses in the U.S. that are underinsured. It could leave you and your business vulnerable to unexpected lawsuits, repair bills, lost income, and damage to their reputation — all of which can be avoided with proper insurance.

We’re not here to give you financial or legal advice, but we are here to help you get your bearings when it comes to event rental insurance, along with the help of a couple of event pros. So let’s get to it.

Do You Need Party Rental Insurance?

A 2023 survey found that 70% of small businesses don’t understand what business insurance covers. We get it — policies are confusing, it can be hard to trust brokers who are after commissions, and when insurance isn’t legally required, you’re not sure if you really need it.

Especially when first starting an event company, it’s tempting not to deal with the cost of insurance. You might feel like you can’t afford the time and money that goes into getting several policies. But the truth is you can’t afford not to have it.

“Many people wait too long to get event insurance, and by then it’s too late,” said Sharla Cartzdafner, Director of Operations at insurance provider The Event Helper. “You want to make sure you’re prepared.”

Often, you may not even be able to provide your services to a venue without coverage, as venues typically require at least a general liability policy. Besides losing out on those contracts, you should be aware of the risks of running a party rental business, like:

- Customer injuries: A guest tripping over a tent rope or slipping on a dance floor could lead to hefty medical bills and potential lawsuits.

- Employee injuries: Setting up heavy equipment or inflatables comes with the risk of sprains, strains, or more serious injuries for your team.

- Rental equipment injuries: Whether it’s chairs breaking to bounce houses tearing, damaged gear can result in unexpected repair or replacement costs.

- Car accidents: Transporting rental items can lead to fender benders or more severe accidents.

- Sudden loss of business: Unexpected events like weather disasters or supply chain issues can halt operations, putting a significant dent in your revenue.

You‘ll want party rental insurance to mitigate the effects of these damages. Let’s take a look at what kinds of insurance you should consider.

Types of Party Rental Insurance You Should Have

The kinds of event rental insurance coverage you need will vary, but here’s a look at the main options:

General Liability Insurance

General liability insurance is a must for all event rental companies. This policy covers things like medical payments, legal fees, and property damage in case of an accident. Additionally, some policies cover legal fees and damages in cases of slander, error, and personal and advertising injury, so if someone claims your Facebook ad misled them or your contract negotiation went south, you’ll be covered up to the amount of your plan’s coverage.

A common misconception is that once you get a general liability policy, you’re protected against anything, which isn’t the case.

This doesn’t mean that you need to purchase every type of event insurance. But it does mean there are some other coverages other than general liability insurance that your company should consider, which we’ll go over now.

Business Owner’s Policy

While general liability insurance covers you for bodily injury caused by your operations, property damage caused by your business, or advertising injury, a Business Owner’s Policy (BOP) does a lot more. A BOP combines business property and business liability insurance into one package. This means you’re not only covered for accidents and legal claims but also for damage or loss of your inventory and equipment from events like theft, fire, and natural disasters. BOPs are only available for businesses with fewer than 100 employees and below $1 million in revenue

Commercial Property Insurance

In the case of burglary, theft, or fire, commercial property insurance will protect any buildings or structures on your property, plus everything within them. Note that flooding is generally not covered by standard insurance policies. You’ll most likely need to purchase additional flood insurance if you live in a flood zone.

Commercial Auto Insurance

If you have an event rental company, you probably have trucks or other company vehicles for delivering rental items. As you’ll probably have employees driving some of these vehicles, it would be wise to get coverage under a commercial auto insurance plan. That way, if an accident does happen, you’ll be covered — and it also won’t impact your personal auto insurance rates and records.

Inland Marine Insurance or Equipment Insurance

Confusing as it may be, in-transit items may not be covered under other insurance policies. If that’s the case for you, inland marine insurance will cover your rental items while they’re in transit.

If you’re looking for coverage that covers your items even when they’re not in transit, equipment insurance is a good option. It provides replacement or repair for your party and events supplies if they are lost, damaged, vandalized, or hit by extreme weather.

Business Interruption Insurance

Some event rental companies may find business interruption insurance to be a worthwhile investment. This type of policy will provide you with coverage in the event of a disaster, in the form of lost income, employee wages, bill payments, and temporary relocation. The specifics of this type of policy’s coverage do vary, so make sure to discuss the coverage and limits with your insurance agent.

Workers’ Compensation

Because your warehouse employees may be moving furniture and other heavy objects on a daily basis, their risk of injury is higher than that of an average office worker. While you should implement safety SOPs for your warehouse team members to help prevent injury, you’ll still want coverage in the event of an accident. Workers’ compensation insurance generally covers things like employee medical bills, rehabilitation expenses, disability income, and lost income.

Commercial Umbrella Insurance

Commercial umbrella insurance, also known as excess liability insurance, is vital for event rental companies who rent bounce houses, climbing walls, or any other items that have an elevated risk of injury. It provides an extra layer of coverage in addition to your general liability insurance. Legal fees, medical bills, fines, and legal judgements add up fast, and commercial umbrella insurance gives you that extra peace of mind.

How Much Does Party Rental Insurance Cost?

The answer to how much party rental insurance costs is “it depends.” But if you’re looking for a general idea of how much you can expect to pay, here are some rough estimates from Insurance Business Magazine and Insureon.

| Type of policy | Average monthly premiums | Average annual premiums |

| General liability insurance | $40 to $55 | $480 to $660 |

| Business owner’s policy

(General liability + commercial property) |

$55 to $65 | $660 to $780 |

| Commercial property insurance | $65 to $70 | $780 to $840 |

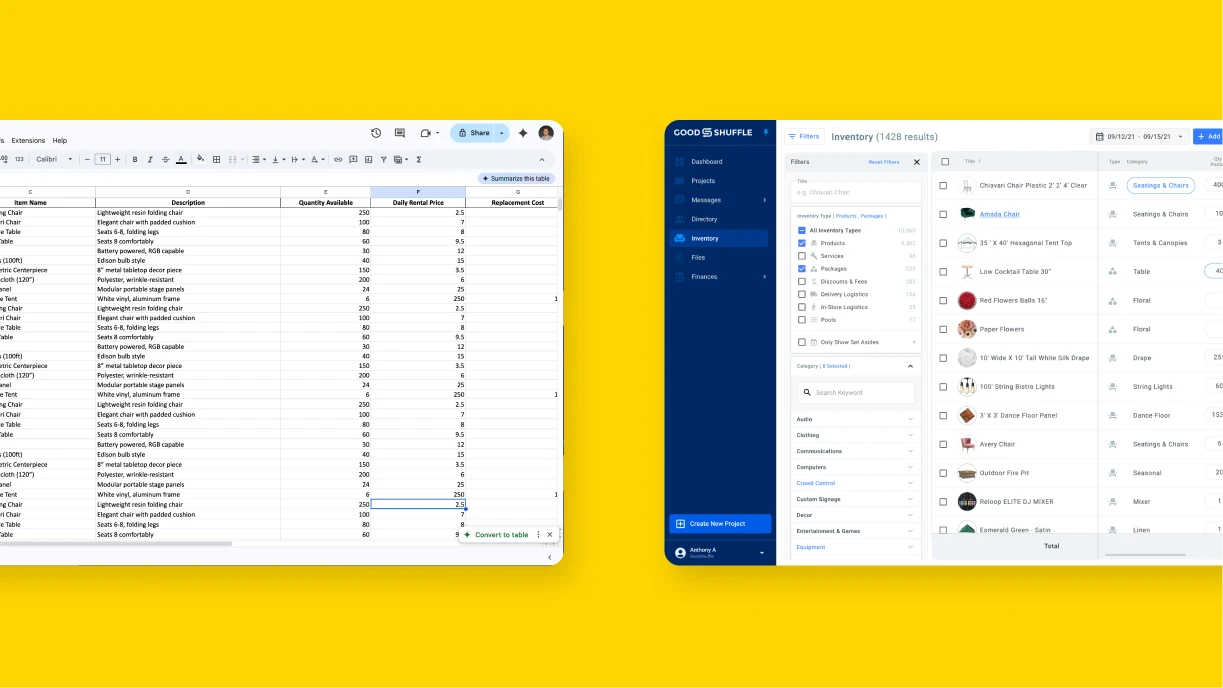

| Inland marine insurance | $29 to $39 or

FREE with Goodshuffle Pro’s Event Insurance integration |

$350 to $470

FREE with Goodshuffle Pro’s Event Insurance integration |

| Equipment insurance

($10,000 coverage limit) |

$15 to $38 | $175 to $450 |

| Workers’ compensation insurance

(Small business with 3 to 5 staff) |

$30 to $60 | $360 to $720 |

| Rental property insurance | $65 to $70 | $780 to $840 |

| Commercial umbrella insurance

($1 million umbrella coverage) |

$60 to $75 | $720 to $900 |

While you can use these numbers as a general benchmark, insurance costs will vary widely depending on things like:

- Types of equipment, inventory, and services: Higher-risk items like inflatables can increase premiums compared to standard tables and chairs. Additionally, higher-value or rare items will require more coverage.

- Business size and revenue: Larger businesses with more inventory, higher annual revenue, and more employees usually face higher insurance costs.

- Coverage area: Operating in areas with higher crime rates or severe weather risks can raise insurance costs. Offering service to multiple locations or states may increase the premium.

- Policy limits and deductibles: Higher coverage limits typically result in higher premiums. Opting for lower deductibles will also increase the insurance cost.

- Coverage type and add-ons: Adding specialized coverages, like business interruption insurance, will increase costs. Comprehensive Business Owner’s Policies will usually cost more than standalone policies.

- Claims history: A history of frequent or significant claims can make premiums higher because insurance companies consider past claims as an indicator of future risk.

When you talk to insurance companies, we encourage you to quote shop for the best price and coverage. A fair price depends on so many factors, and you’ll discuss these factors and your coverage needs before getting quotes.

But the best way to know if you’re getting a good price is to gather multiple quotes and choose the best. We’ll talk about how to do that next.

How to Find Good Party Rental Business Insurance

Now it’s time to shop around for party rental insurance. You’ll want to take your time here to find an honest, ethical broker you trust to find the best price and coverage for you.

Consider tapping into your local network of event professionals for recommendations. You can also get started with online party rental insurance comparison sites like Insureon and Tivly. But you’ll need to do your due diligence to ensure you’re signing up for a policy that meets your needs with a provider you trust. That means hand-picking a few established companies to do in-depth research on, including reading online reviews.

💡Pro Tip: You can tick inland marine insurance off your coverage list for many projects just by signing up for Goodshuffle Pro.

Once you have your short list, you can compare several different quotes and bundle options, so you can find the best fit for your party rental business. Be sure to also keep an eye out for overlapping liability policies.

Along the way, don’t be shy to ask questions on any policy points that are unclear or vague. You should have a clear understanding of how your provider handles claims, what their policy flexibility is like, and what their coverage limits and excludes.

Read all of the terms and conditions so you know exactly what you’re getting, and be aware if you’ve signed up to auto-renew or not. (Some providers will sneakily insert an auto-renew clause in your contract, but you may be able to find a better rate elsewhere over time.)

Remember, even with multiple policies, insurance does have its limitations. It’s virtually impossible to cover every single risk, especially when multiple vendors and venues are involved. But you can get as close as possible with a good insurance policy.

Time to Get Insured

Party rental insurance isn’t just a good investment for event professionals — it’s a necessary one that can save you thousands or even millions of dollars in claims. Just be sure to reevaluate your policy on a regular basis.

Cartzendafner explains, “As your business grows, you’ll need more and more complex insurance. This is a good thing! It means your company is scaling. Don’t be scared of this; there are people and providers out there who are more than happy to help.”