In the battle of payment processors, there’s one that’s emerged above all the rest for us: Stripe.

Okay, so we’re a little biased, but we have good reason to be. Since 2015, Stripe has been our exclusive payment processor, meaning all credit card and ACH transactions through Goodshuffle Pro rely on Stripe to get deposited into your bank account.

If you’re fuzzy on the details of how Stripe works, we’ve got you covered here. We’ll also get into the security measures Stripe uses to protect sensitive information and the benefits of using Stripe.

Why is a Payment Processor Important?

You might be asking, “Do I even need a payment processor?”

The answer is yes. Technology is becoming a bigger and bigger part of business, and the truth is it’ll be hard for you to run your event business without a payment processor. Checks are fast becoming a thing of the past, and clients rely more and more on digital payment methods, from ACH payments to credit cards to even Venmo.

Think about it: When was the last time you paid for groceries or a new piece of furniture in cash? It’s just simpler for your customers (and you!) to keep track of payments when they’re online and instant. And if you’re not processing online payments, you could be leaving thousands of dollars on the table.

The increase in credit card usage also means that credit card fraud is on the rise. So having the additional protections of a secure payment processor is more important now than ever. But we’ll get to that later on.

What is Stripe Payments?

Stripe Payments is a powerful online payment processing platform that helps businesses send invoices and receive payments from customers. It’s known for its robust security and ability to accept a wide range of payment methods, making it a versatile choice for event businesses of all sizes.

With Stripe, you can handle everything from one-time payments to recurring billing, all while offering a seamless checkout experience for your customers.

How Does Stripe Work?

How does Stripe enable event businesses to accept and manage online payments? Here’s a quick breakdown of how it operates:

- Integration: Stripe integrates with Goodshuffle Pro and allows you to accept payments from customers — no separate Stripe account required.

- Customer interaction: When a customer makes a purchase, Stripe securely handles the payment information, ensuring compliance with industry standards.

- Payment processing: Stripe processes the payment, verifies the details, and transfers the funds from the customer’s bank or card to your business’s account.

- Payouts: The funds are then deposited into your business’s bank account daily. You’ll have all your funds within two business days, tops.

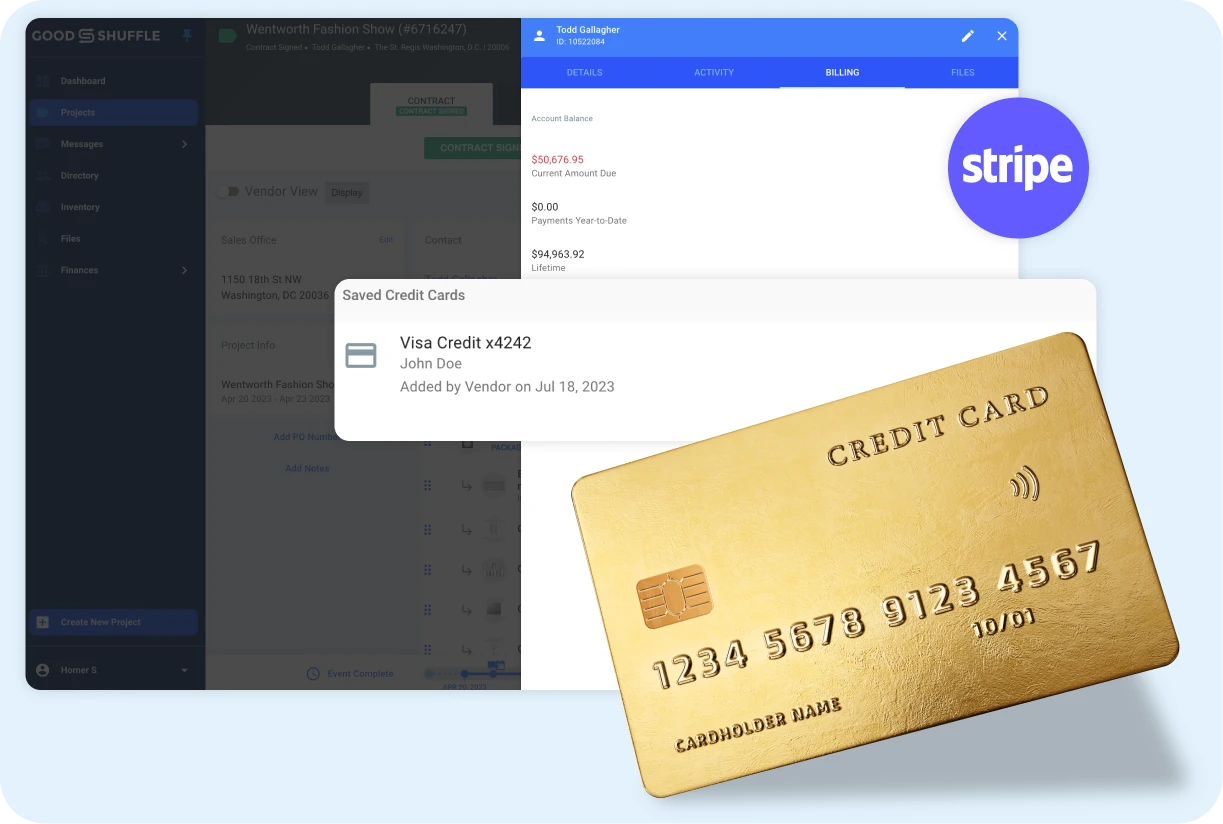

- Financial Hub: Businesses can manage Stripe transactions, handle refunds, and generate reports through Goodshuffle Pro’s Financial Hub.

- Security: Stripe ensures all transactions are secure and compliant, protecting both your business and your customers.

What Payment Types Does Stripe Accept?

With your Goodshuffle Pro account, you can use Stripe to accept nearly every payment method under the sun.

Here’s a quick list of the major payment methods Stripe supports:

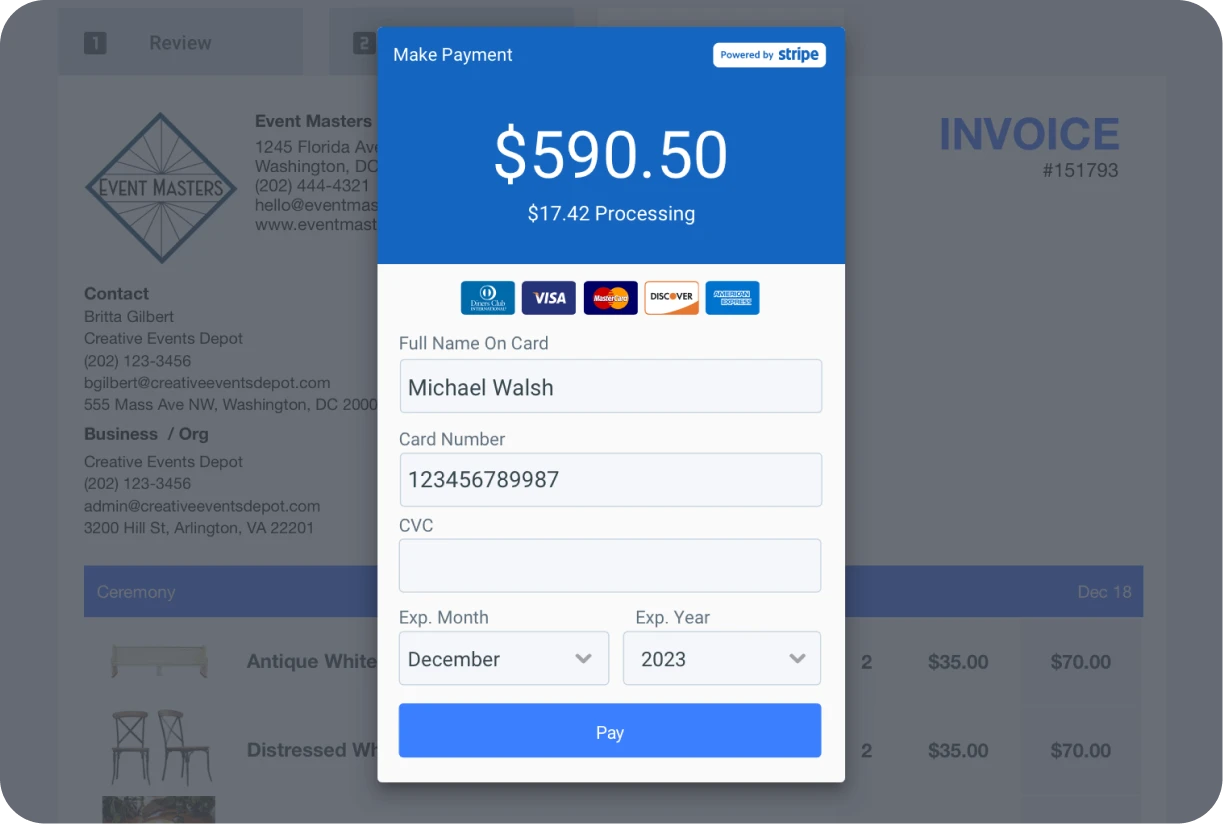

- Credit and debit cards: Visa, MasterCard, American Express, Discover, and more

- Digital wallets: Apple Pay, Google Pay, and Microsoft Pay

- Bank transfers: ACH

- Buy Now, Pay Later: Affirm

Is Stripe Safe to Use?

We wouldn’t choose Stripe if it wasn’t a safe option for you and your clients.

Stripe maintains a PCI DSS Level 1 standing, which is the highest security level a payment processor can hold. In less technical terms, Stripe offers bank-grade security and encryption when storing credit cards on their servers.

This also has some direct benefits for you as a user, including early warning fraud notifications, encryption for every payment, and 100% protection against liability for fraud.

To maintain these high security standards for you and your clients, Stripe is required by regulators and financial partners to verify the identity of its users.

Next time Stripe asks you to verify information like your ID, bank account, or address, you’ll get to see its security hard at work.

Stripe Pricing and Fees

When you use Stripe and Goodshuffle Pro, you can get up and running in a jiffy — no need for a separate Stripe account, and no hidden hosts. And you won’t pay anything for having a Stripe account on file.

That means no setup costs, no monthly fees, and all-inclusive customer service.

And if you’re wondering what Stripe’s processing fees are, we’ve laid them out here:

- 2.9% + $0.30 for all credit card payments (including American Express)*

- 1% with a maximum fee of $60 per charge for ACH (eCheck) payments

- 0.25% transfer fee per payment

- $0.25 deposit fee per payout

*+2% for international cards

If your local regulations permit, you may have the option of passing these fees onto your clients or footing them yourself. But be sure to do research on your local rules beforehand to avoid landing in legal hot water.

Learn more about billing with Stripe in these Help Center articles.

Benefits of Using Stripe With Goodshuffle Pro

In this world of infinite choices, we’ve searched high and low for the best payment processor. Stripe stands out above the pack, and here’s why we use it at Goodshuffle Pro.

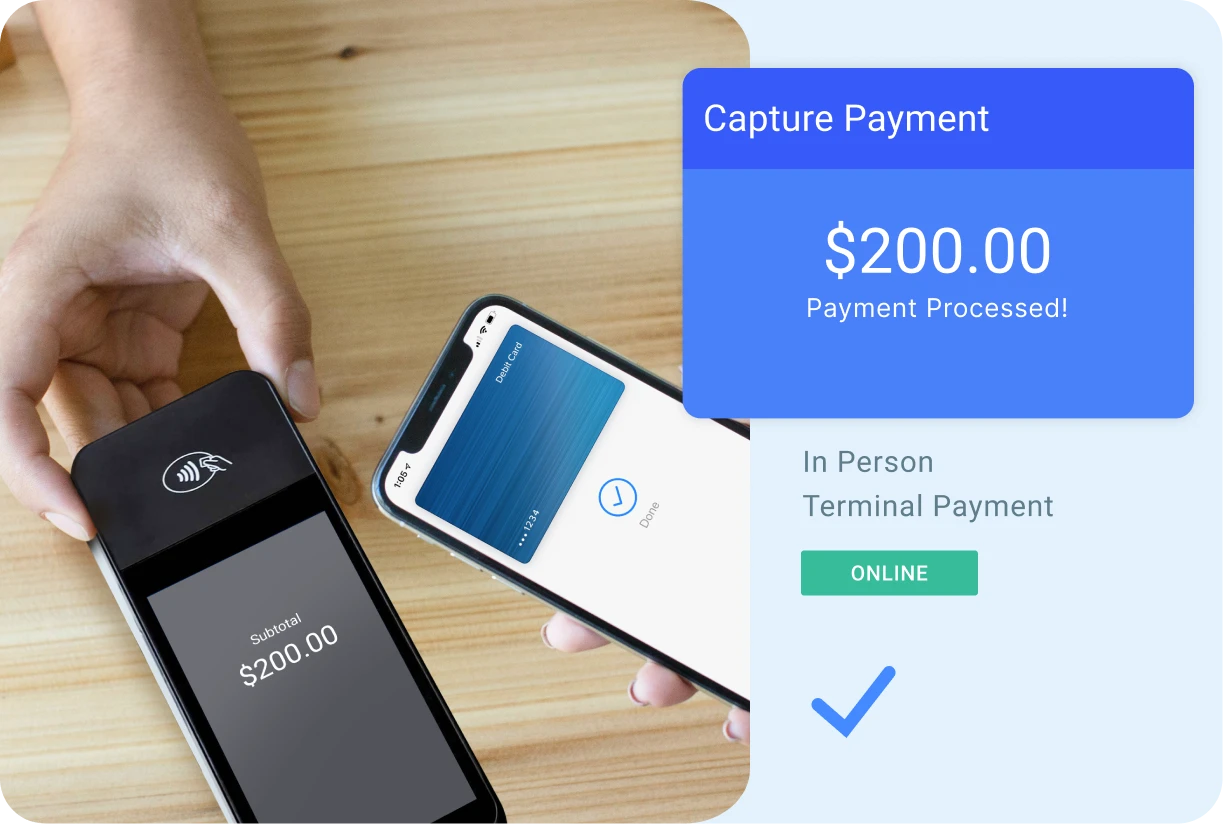

1. Stripe is an easy way to get paid

Goodshuffle Pro users get paid faster with Stripe, not just because funds get deposited directly into your bank account as soon as they are available, but also because the payment process itself is so smooth, flexible, and easy — no matter how small or big your business is. Goodshuffle Pro and Stripe work well across all payment types and devices, from desktops to mobile phones, so you can accept payments from wherever you are.

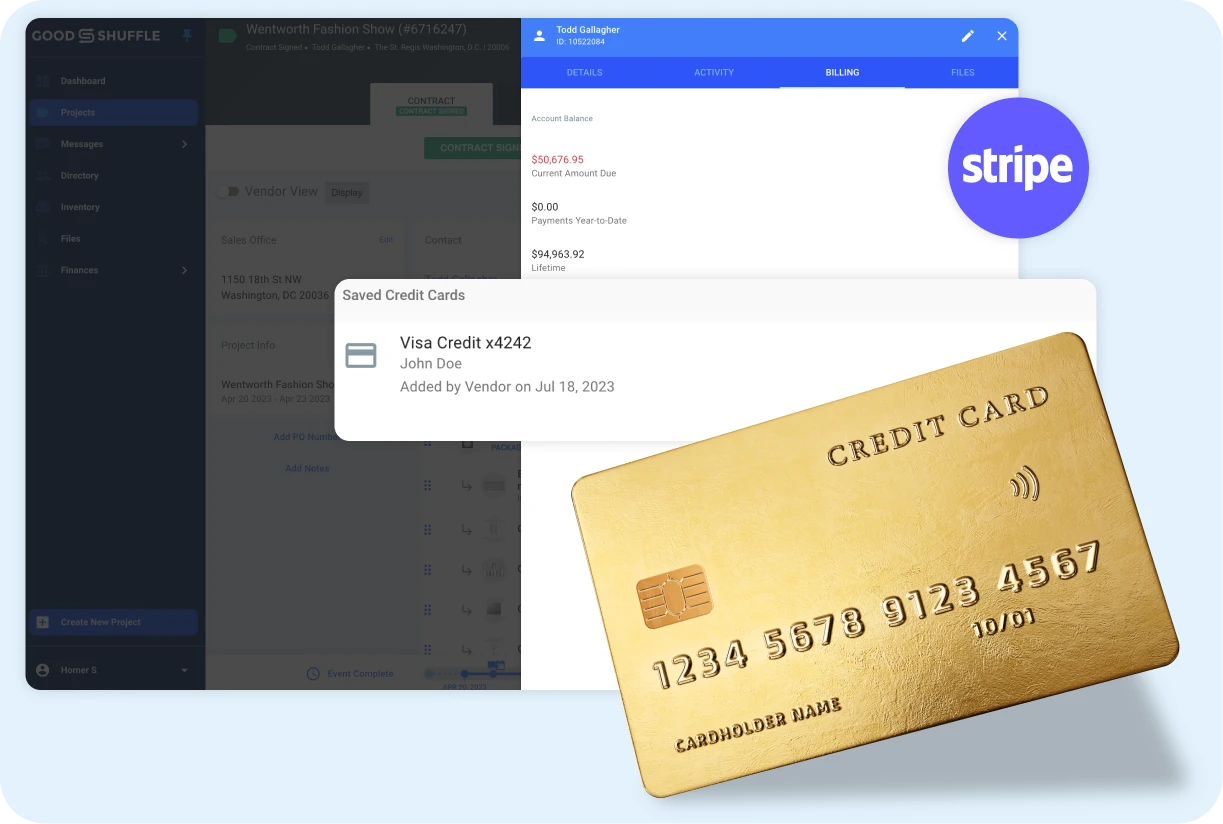

2. Stripe keeps clients’ cards on file

The ability to keep client cards on file through Stripe is incredibly handy. You never know when a bride might need 30 last-minute chairs for her big day or when damage might occur at an all-too-rowdy birthday party.

This feature is fully integrated into Goodshuffle Pro, so you won’t have to navigate between multiple sites just to get things done. As an added bonus, because your client’s payment information is secured through Stripe (instead of in a filing cabinet somewhere) it reduces your company’s liability for protecting that information.

3. Stripe helps automate payment collection

Goodshuffle Pro’s Stripe integration also helps you out when it comes time to collect payment. You can set up client payment reminders and automated payments right in Goodshuffle Pro, so there’s no need to track down clients to collect payments. There may not be much need for that, however, as we’ve noticed that about half of all clients pay within 5 minutes, and 70% of clients pay within 3 days.

4. Stripe doesn’t have hidden costs

We’ve seen all the gimmicks, and it’s refreshing to see a transparent pricing structure without any surprises. With Goodshuffle Pro and Stripe, what you see is what you get — a reliable payment processing solution that simplifies your workflow and helps you get paid faster.

5. Stripe is secure

Oh yeah, have we mentioned that Stripe is secure? Your and your clients’ payment information is essentially locked away in a safety deposit box. Updating your information every so often is a small price to pay for the unrivaled security and fraud protections Stripe offers.

Now That You Know the Benefits of Using Stripe…

If you’re already processing online payments, we hope you understand more about the benefits of using Stripe and why it’s the exclusive payment processor of Goodshuffle Pro. And if you’re not yet a Stripe user, taking five minutes to set it up in Goodshuffle Pro could lead to thousands more in revenue.